This can be done with the help of accounting standards like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standard (IFRS). In this method, the deferred income tax amount is based on tax rates in effect when the…

Bookkeeping 101

What’s the difference between operating income and gross income?

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What’s the difference between operating income and gross income?Also known as gross profit, gross income doesn’t include expenses such as salaries, income taxes and office supplies. Gross profit is used to figure out a company’s gross margin, which measures how efficiently your company is producing and distributi…

What does the status “In Transit” mean?

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What does the status “In Transit” mean?I am a Canadian citizen and I will be travelling from Calgary to Delhi via London and will have a 19 hour layover in London. During this time I would like to visit my cousin in London. I would like your advise if I can go out during this time. If so …

The Difference Between Cash Transfers & In-Kind Benefits

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Difference Between Cash Transfers & In-Kind Benefitsadjective. paid or given in goods, commodities, or services instead of money: in-kind welfare programs. paying or returning something of the same kind as that received or offered….

How to Calculate Loan Payments with Excel PMT Function

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Loan Payments with Excel PMT FunctionThough personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year. If you pay money …

Imprest Account

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Imprest AccountThe balance in the petty cash account should now be the same as the amount at which it started. When the cash balance in the petty cash fund drops to a sufficiently minimal level, the petty cash custodian applies for more cash from the cashier. This …

Reading: Explicit and Implicit Costs

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Reading: Explicit and Implicit CostsWell, in every lease, whether it be a $3,000,000 piece of manufacturing equipment or a $20,000 car, there is an implicit interest rate that lessees pay to lessors. The interest rate implicit in a lease often incorporates an ‘asset risk premium’ refle…

Is Accumulated Depreciation a Current Asset?

Posted on Posted on: 28.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is Accumulated Depreciation a Current Asset?For physical assets, such as machinery or computer hardware, carrying cost is calculated as (original cost – accumulated depreciation). If a company purchases a patent or some other intellectual property item, then the formula for carrying value is (…

What is the eligibility criteria to apply for IMA

Posted on Posted on: 28.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is the eligibility criteria to apply for IMAIMA provides a forum for members by promoting forward-thinking research and industry best practices and offering newsletters and journals. For years now, the Institute of Management Accountants salary survey has noted that accountants with both the C…

[Updated] List of IFRS and IAS 2019

Posted on Posted on: 28.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on [Updated] List of IFRS and IAS 2019However, it is the Board that issues Interpretations and narrow scope amendments and the Board that considers and votes on each Interpretation and narrow scope amendment before it is issued. As well as IFRS Standards, the Board has issued an IFRS Sta…

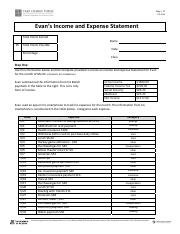

![[Updated] List of IFRS and IAS 2019](https://www.business-accounting.net/wp-content/uploads/2021/07/image-uLxMotw47XaQbqkG.jpg)