This might give you an edge if you’ve since bounced back from your economic woes – you might not be insolvent in your current financial condition, but you were back when the debt was canceled. A taxpayer is insolvent when his or her total liabilities…

Bookkeeping 101

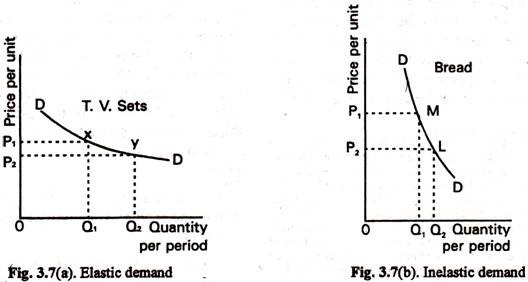

Do luxury goods have elastic demand?

Posted on Posted on: 03.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do luxury goods have elastic demand?This is because there are very few good substitutes for gasoline and consumers are still willing to buy it even at relatively high prices. Price elasticity of demand (Epd), or elasticity, is the degree to which the effective desire for something chan…

What is another word for ‘best practice’?

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is another word for ‘best practice’?They can vary from something as simple as making several sets of plans for a construction project to a software project using an iterative development process, quality control, requirements management and change control. Each of those items would als…

The difference between direct costs and indirect costs

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The difference between direct costs and indirect costsDirect material are those material which are easily identified, conveniently measured and directly charged to the cost of production. Indirect Material are those materials which cannot be conveniently identified & allocated to the cost centre or…

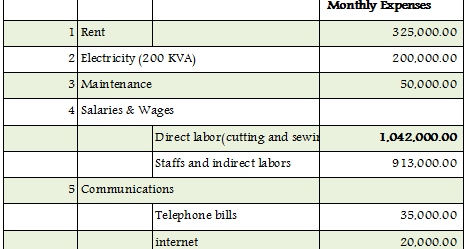

How to Calculate Direct Labor and Indirect Labor for a Factory Payroll

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Direct Labor and Indirect Labor for a Factory PayrollIndirect costs are those for activities or services that benefit more than one project. Their precise benefits to a specific project are often difficult or impossible to trace. For example, it may be difficult to determine precisely how the activitie…

Independent and Dependent Variables: Which Is Which?

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Independent and Dependent Variables: Which Is Which?Therefore, the aim of the tutor’s investigation is to examine whether these independent variables – revision time and IQ – result in a change in the dependent variable, the students’ test scores. However, it is also worth noting that whilst this is t…

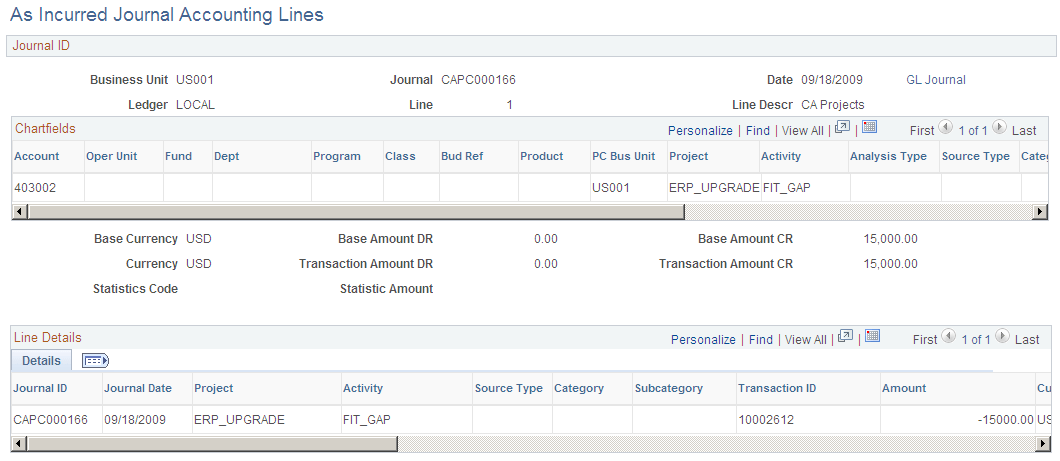

What are the meanings between 'incur' and 'occur' in accounting?

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are the meanings between 'incur' and 'occur' in accounting?It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. Incurred Losses — the total amount of paid claims and loss reserves associated with a particular time pe…

Why do single people have to pay more taxes? : NoStupidQuestions

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Why do single people have to pay more taxes? : NoStupidQuestionsThe rate on the first $9,700 of taxable income would be 10%, then 12% on the next $29,775, then 22% on the final $10,525 falling in the third tax bracket. This is because marginal tax rates only apply to income that falls within that specific bracket…

Incremental Synonyms & Antonyms

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Incremental Synonyms & AntonymsBoth the revenue and direct costs are therefore relevant for the incremental analysis. A sunk cost is a cost which a business has already incurred and which cannot be recovered in the future. As these historical costs cannot change, they should not b…

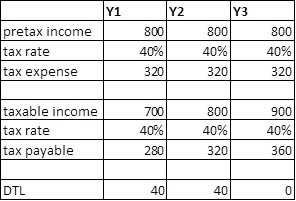

Income Taxes Payable

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Income Taxes PayableA temporary difference is the difference between the asset or liability provided on the tax return (tax basis) and its carrying (book) amount in the financial statements. This difference will result in a taxable or deductible amount in the future….