These four strategies each leverage new or existing products or markets in order to help the company grow. In this case, they will need to determine if the new market fits their target market, or the population in which they want to sell their produc…

Bookkeeping 101

Year-to-date

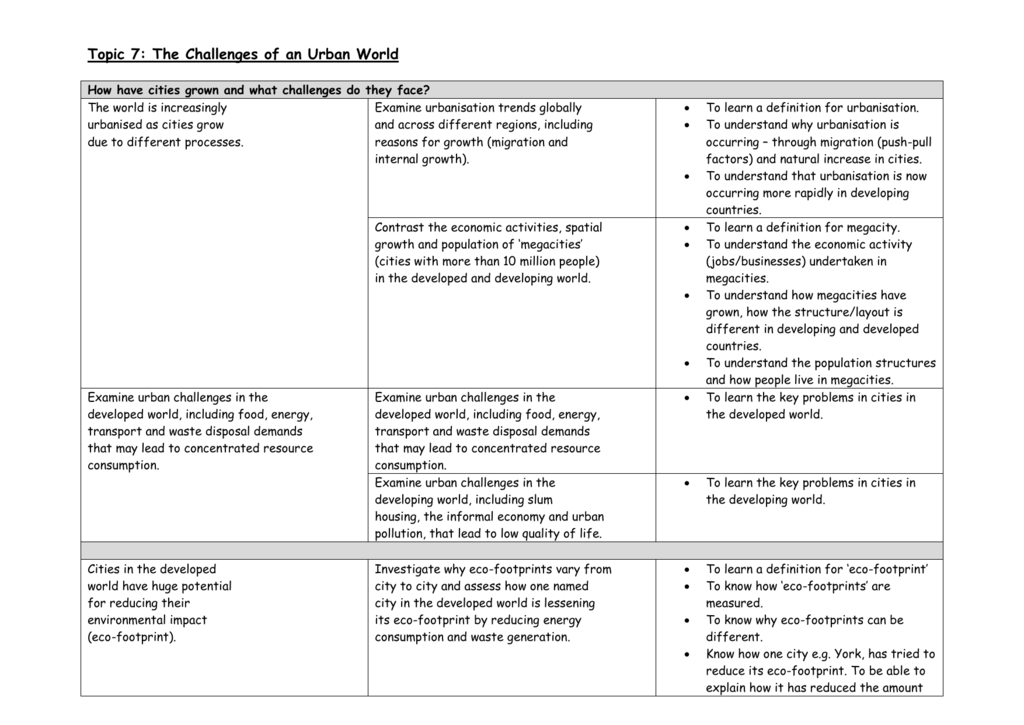

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Year-to-dateUnlike annual statements, interim statements do not have to be audited. Interim statements increase communication between companies and the public and provide investors with up-to-date information between annual reporting periods. A financial stateme…

interest revenues definition and meaning

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on interest revenues definition and meaningIt is a line item and is generally recorded separately from interest expense in the income statement. This income is taxable as per IRS and the ordinary tax rate is applicable for this income. Under the accrual basis of accounting, the Interest Reven…

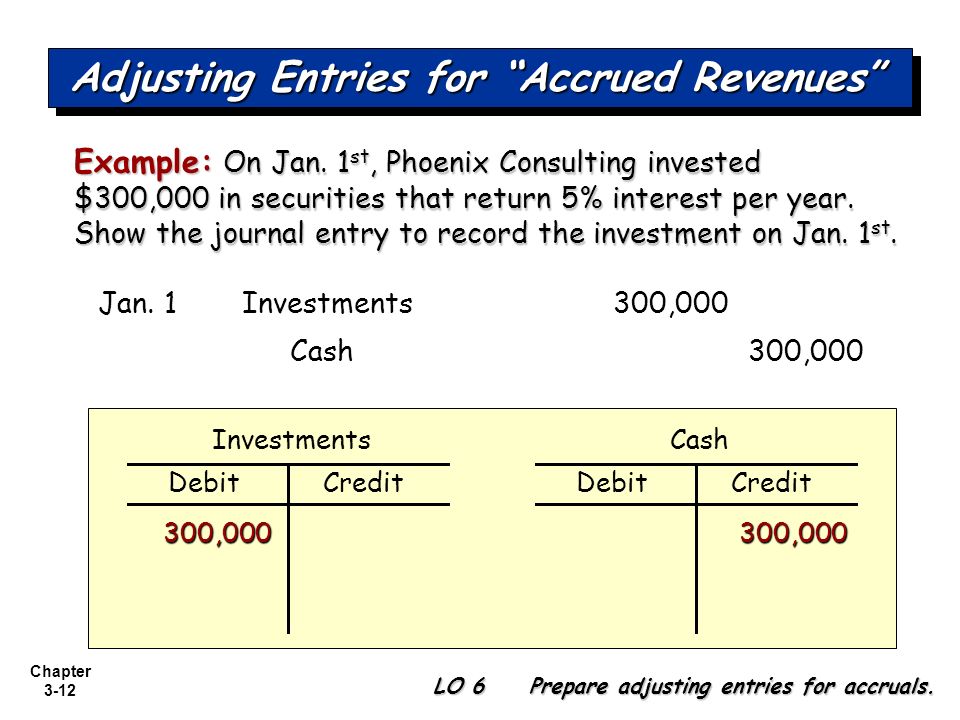

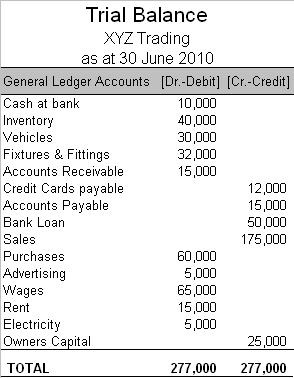

The Five Types of Accounts in Accounting

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Five Types of Accounts in AccountingAn interest expense is the cost incurred by an entity for borrowed funds. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings – bonds, loans, convertible debt or lines of credit….

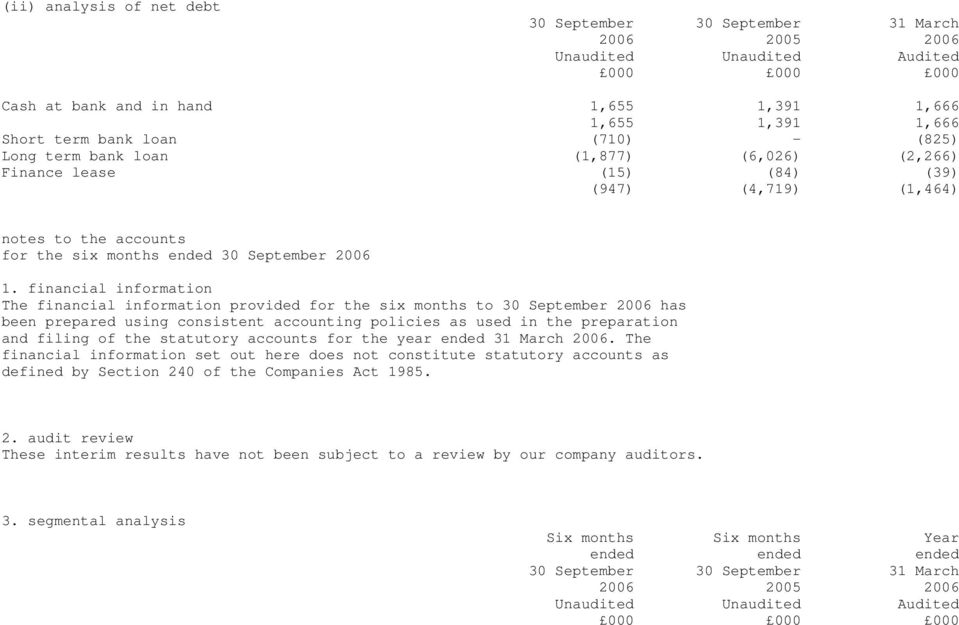

Adjusting Entries: Does Your Small Business Need Them?

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Adjusting Entries: Does Your Small Business Need Them?To illustrate the difference between interest expense and interest payable, let’s assume that a company borrows $200,000 on November 1 at an annual interest rate of 6%. The company is required to pay each month’s interest on the 15th day of the follo…

Interest receivable

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Interest receivableType of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products…

SparkNotes: Money: Interest Rates

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on SparkNotes: Money: Interest RatesEBT is calculated by taking net income and adding taxes back in to calculate a company’s profit. EBITDA is essentially net income (or earnings) with interest, taxes, depreciation, and amortization added back….

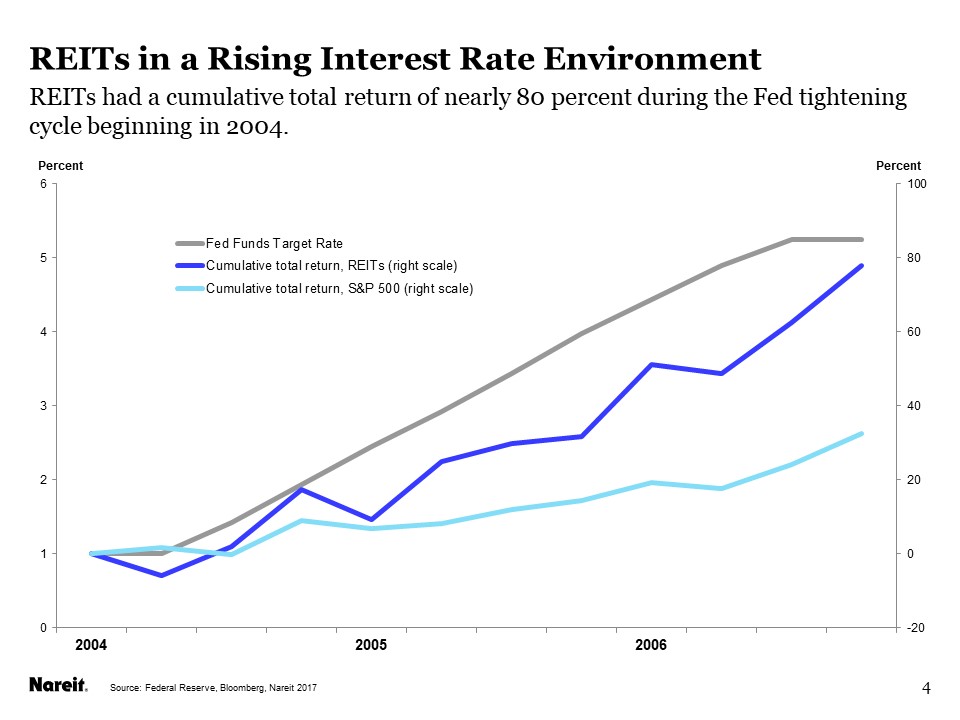

Interest-Only Retirement: Can It Be Done?

Posted on Posted on: 03.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Interest-Only Retirement: Can It Be Done?Avoiding investing mistakes will make you more money in the long run than trying to pick the hottest sector/stock/fund/investment over the years. For a full list of the best investing apps for 2019, check out LearnBonds app investing guide for more i…

Intangible Assets

Posted on Posted on: 03.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Intangible AssetsGoodwill, brand recognition and intellectual property, such as patents, trademarks, and copyrights, are all intangible assets. Intangible assets exist in opposition to tangible assets, which include land, vehicles, equipment, and inventory….

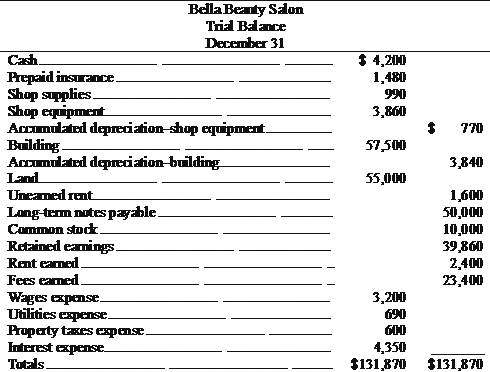

Is insurance in accounting recognized as an expense or an asset?

Posted on Posted on: 03.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is insurance in accounting recognized as an expense or an asset?A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over ti…