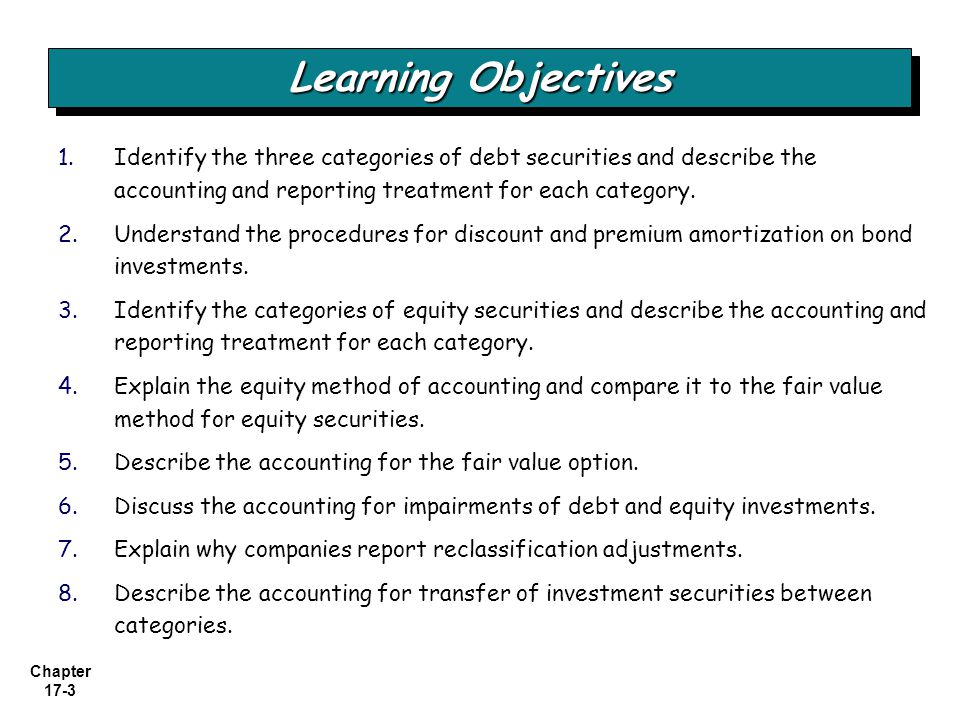

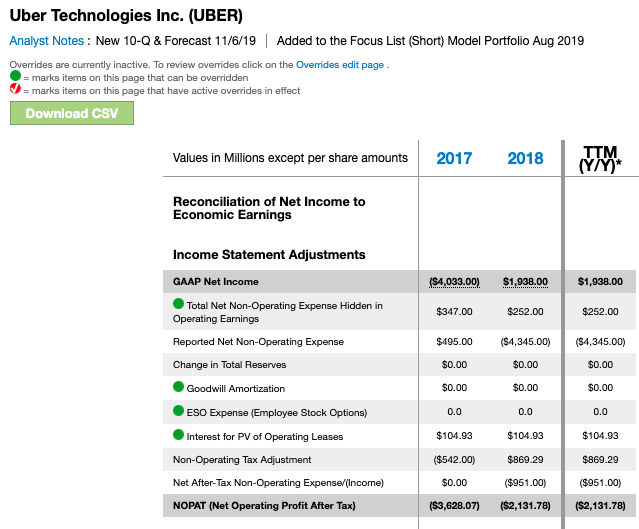

So, the accounting choices made by investing companies when making investments in financial assets can have a major effect on its financial statements. The more your assets outweigh your liabilities, the larger your investors’ equity. It’s easy to in…

Bookkeeping 101

Cost Center Definition

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cost Center DefinitionIf you want to identify your cost centers and know how they fit within your economics, then download your free guide here. When you divide your company into profit centers, it allows you to delegate responsibility to decentralized units and treat the…

11 Types of Inventory / Stock

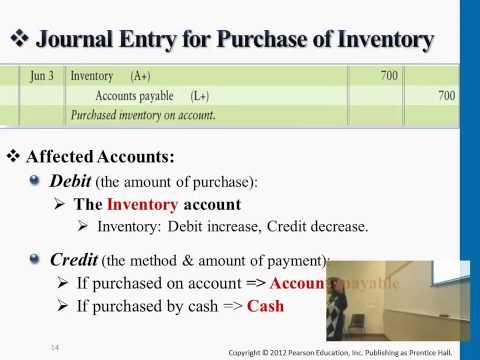

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 11 Types of Inventory / StockInventory is needed to calculate cost of goods sold on a business tax form. Inventory costs reduce business income and business taxes. This is the end-of-year inventory done by many retailers….

How to Account for the Value of Finished Goods Inventory

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Account for the Value of Finished Goods InventoryUnder FIFO/LIFO cost systems, the unit cost of an item is the value of one receipt in one layer, selected by the FIFO or the LIFO rule. Each receipt or assembly completion creates either a new layer for each organization. For a specified job number, …

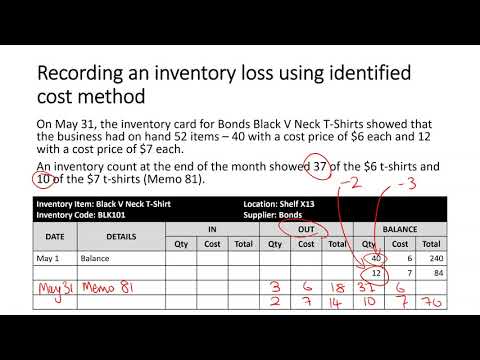

Inventory Shrinkage in Retail: 4 Tips to Prevent It

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Inventory Shrinkage in Retail: 4 Tips to Prevent ItIt’s done by charging it to the cost of goods sold or by balancing the obsolete inventory allowance in the books. If you lose inventory to theft, or because a fire, flood or other disaster damaged your business, you can claim your loss as a tax deduc…

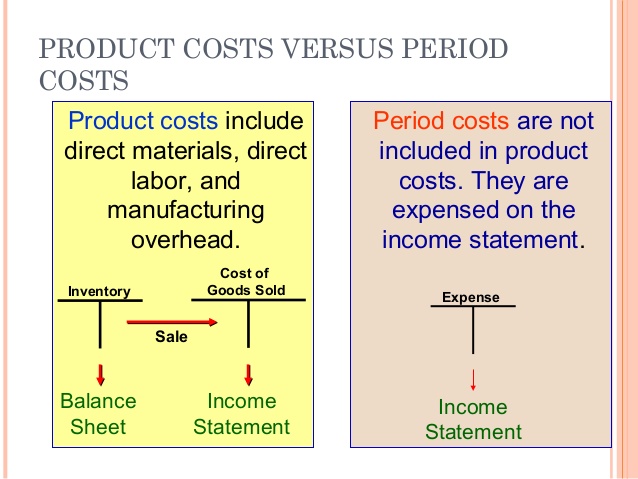

Is rent expense a period cost or a product cost?

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is rent expense a period cost or a product cost?If a product is unsold, the product costs will be reported as inventory on the balance sheet. When the product is sold, its cost is removed from inventory and will be included on the income statement as the cost of goods sold. Prime costs are the cos…

Discontinued Operations: Its Impact on Financial Reporting

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Discontinued Operations: Its Impact on Financial ReportingIn financial accounting, discontinued operations refer to parts of a company’s core business or product line that have been divested or shut down and that are reported separately from continuing operations on the income statement. Each of the above i…

Heritage interpretation

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Heritage interpretationThe remaining part of the Roman Empire, in the eastern Mediterranean, continued as what came to be called the Byzantine Empire. Centuries later, a limited unity would be restored to western Europe through the establishment in 962 of a revived “Roman …

Gross Income Allocation Sample Clauses

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Gross Income Allocation Sample ClausesIf the tax return preparer is not consulted during the drafting phase, the tax return preparer should consult with the drafter(s) of a partnership agreement when necessary to clarify any ambiguities therein, including the issues raised in this articl…

IFRS vs. U.S. GAAP: What’s the Difference?

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on IFRS vs. U.S. GAAP: What’s the Difference?The basic purpose of the IASB Framework is to provide assistance and guidance to the IASB in developing new or revised standards in addition to assisting the preparers of financial statements in applying the standards and dealing with issues which ar…