That price is paid after all production costs, whether they are joint costs or separable costs incurred after splitoff. Joint products are multiple products generated by a single production process at the same time. These products incur undifferentia…

Bookkeeping 101

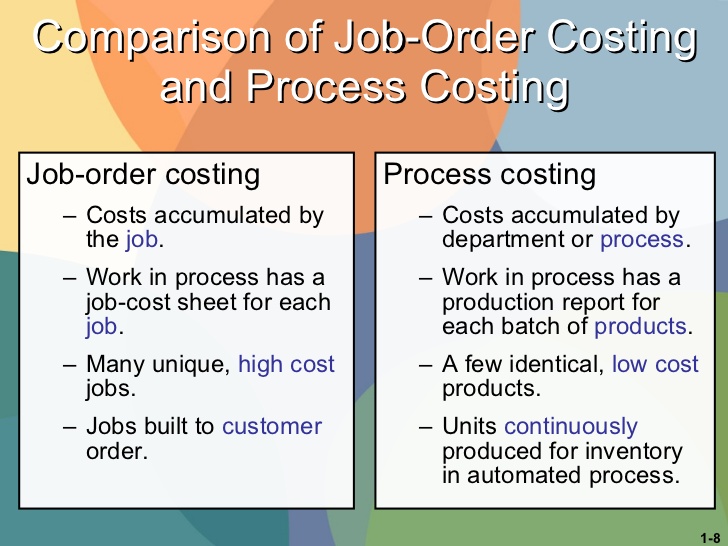

3.1 Process Costing Vs. Job Order Costing

Posted on Posted on: 11.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 3.1 Process Costing Vs. Job Order CostingIt makes fewer assumptions than other costing methods. Manufacturing companies incorporate job order costing as a means of controlling usage of raw materials, production equipment and labor hours. These businesses consider each customer order a separ…

Job cost sheet

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Job cost sheetIt can help to get an estimate from each of these contractors. Job costing involves the detailed accumulation of production costs attributable to specific units or groups of units. For example, the construction of a custom-designed piece of furniture…

Frederick J Ott — Pollock-Randall Funeral Home

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Frederick J Ott — Pollock-Randall Funeral HomeBiologically, gene control factors represent compelling therapeutic targets for these cancers, as they are master regulators of cell identity. Yet despite this clear rationale, most are perceived as intractable drug targets owing to their large size,…

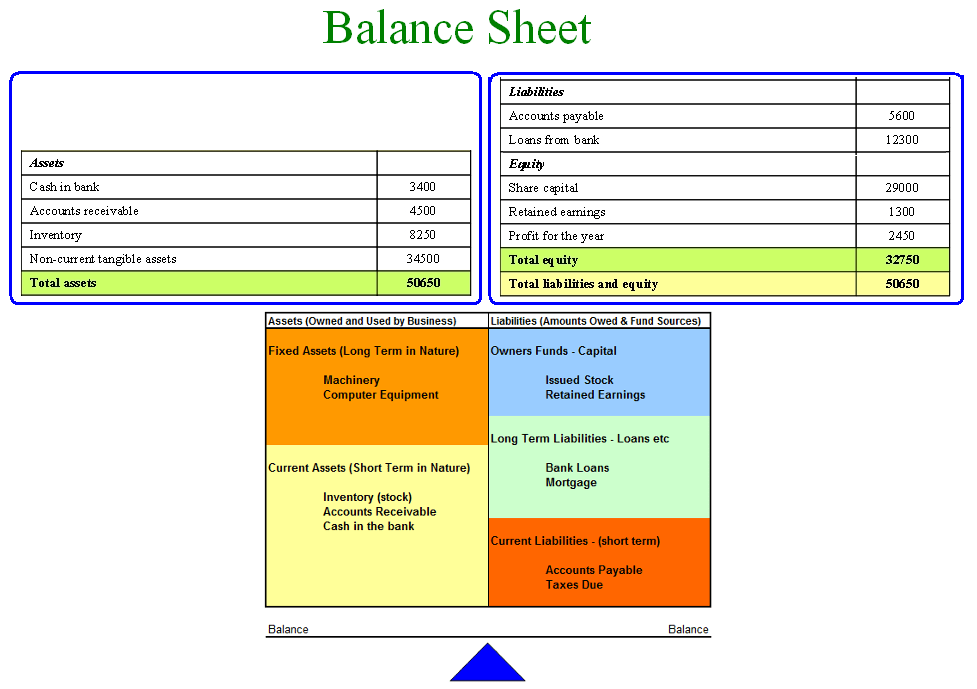

Why are prepaid expenses considered an asset?

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Why are prepaid expenses considered an asset?Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of…

withdrawals by owner definition and meaning

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on withdrawals by owner definition and meaningNoncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property…

The “New” IRS Independent Contractor Test – The More Things Change The More They Stay The Same

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The “New” IRS Independent Contractor Test – The More Things Change The More They Stay The SameWithholding of tax on wages includes income tax, social security and medicare, and a few taxes in some states. Certain minimum amounts of wage income are not subject to income tax withholding. Wage withholding is based on wages actually paid and empl…

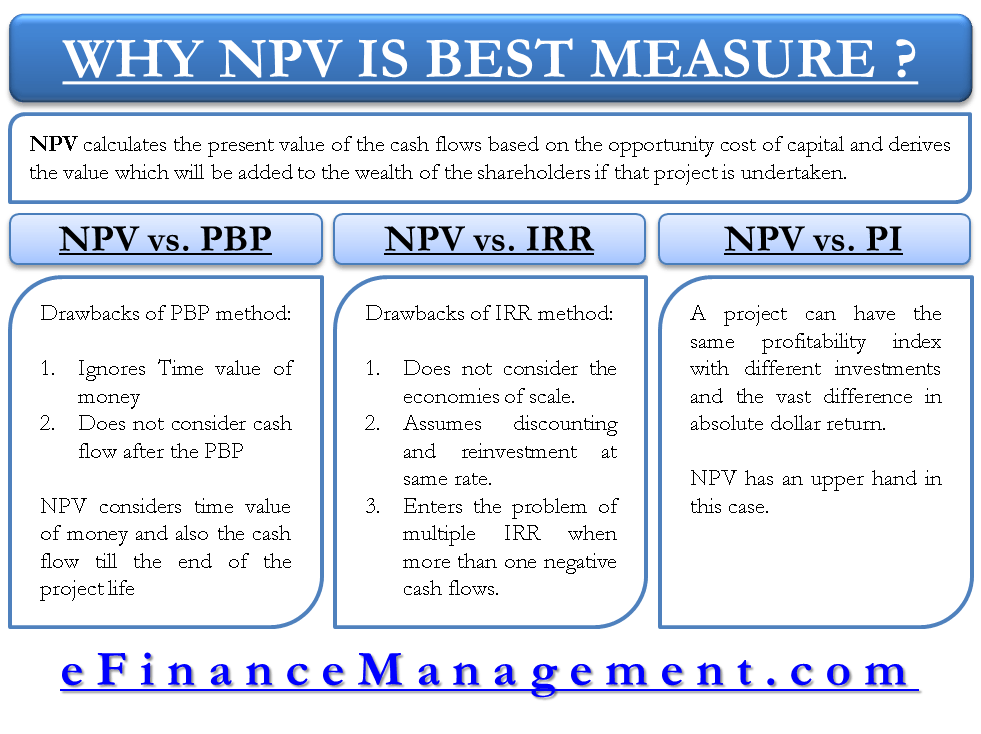

What condition makes the value of IRR greater than 100%?

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What condition makes the value of IRR greater than 100%?Further information about potential problems with the IRR method (compared to NPV) may be obtained from most finance textbooks. One major problem with IRR is the possibility of obtaining multiple rates of return (multiple “roots”) when solving for th…

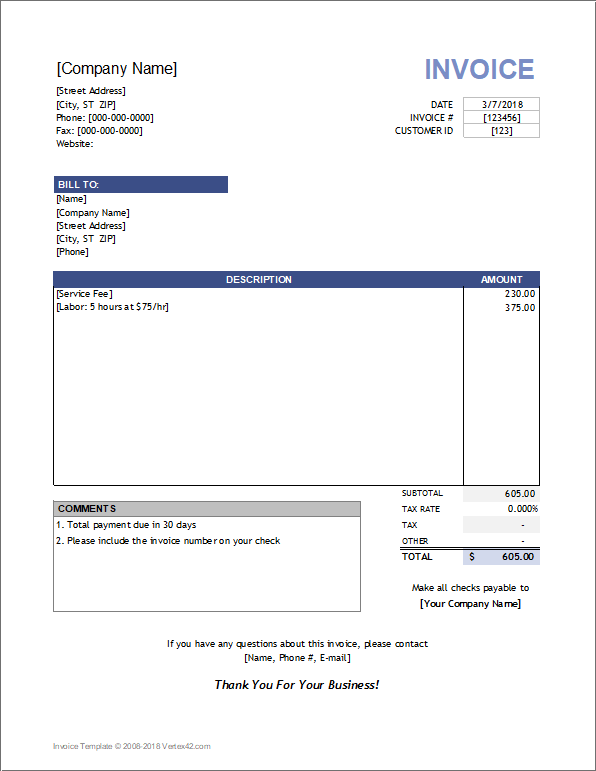

Invoice Examples for Every Kind of Business

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Invoice Examples for Every Kind of BusinessOn the other hand, when a company makes a payment for items purchased on credit, this results in a debit to accounts payable (decrease). A report that lists the accounts and amounts that are debited for a group of invoices entered into the accounting…

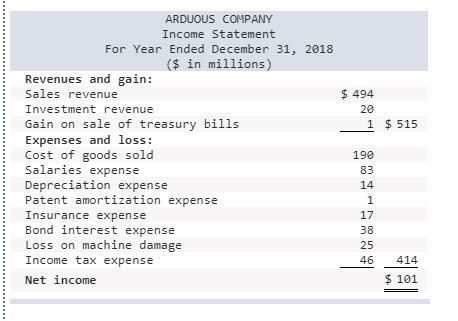

Understanding the Difference Between Revenue vs. Profit

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding the Difference Between Revenue vs. ProfitBalance sheet is prepared based on transactions and transactions can take place only between two entities. For this purpose, promoter/s are considered as entity/ies separate from business. Having shown business as a separate entity in the balance she…