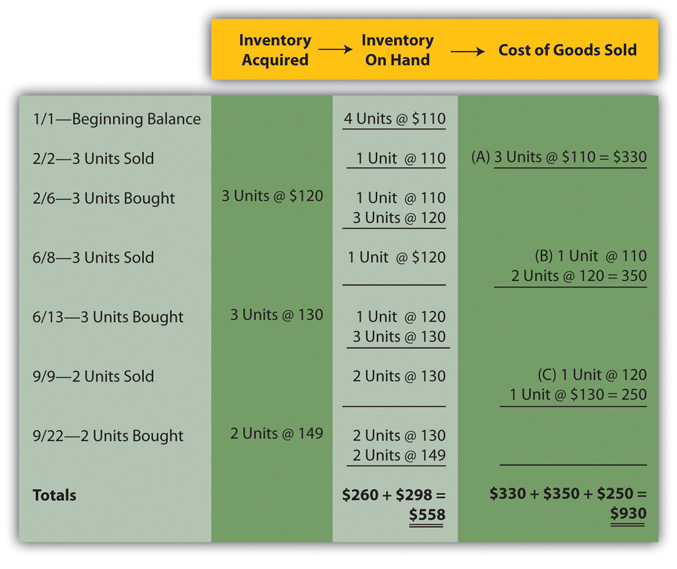

The LIFO reserve is a contra-asset or asset reduction account that companies use to adjust downward the cost of inventory carried at FIFO to LIFO. Many companies use dollarvalue LIFO, since this method applies inflation factors to “inventory pools” r…

Bookkeeping 101

Limited liability

Posted on Posted on: 17.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Limited liabilityThe accounting equation is a representation of how these three important components are associated with each other. The accounting equation is also called the basic accounting equation or the balance sheet equation. The accounting equation shows on a…

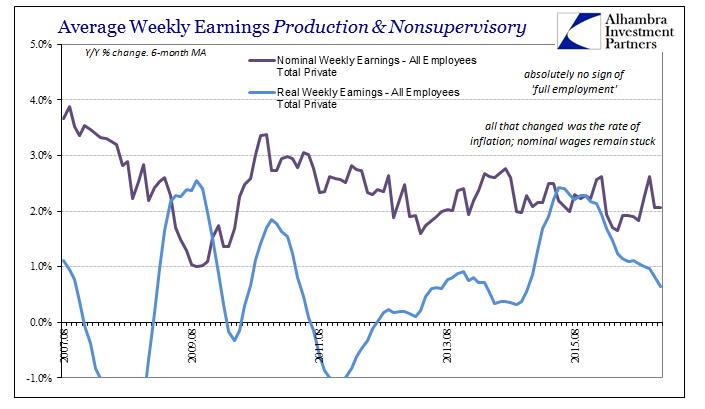

What is bank leverage?

Posted on Posted on: 17.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is bank leverage?Employment of fixed cost bearing assets in the company’s operations is known as Operating Leverage. Employment of fixed financial charges bearing funds in a company’s capital structure is known as Financial Leverage. The impact of leverage is measure…

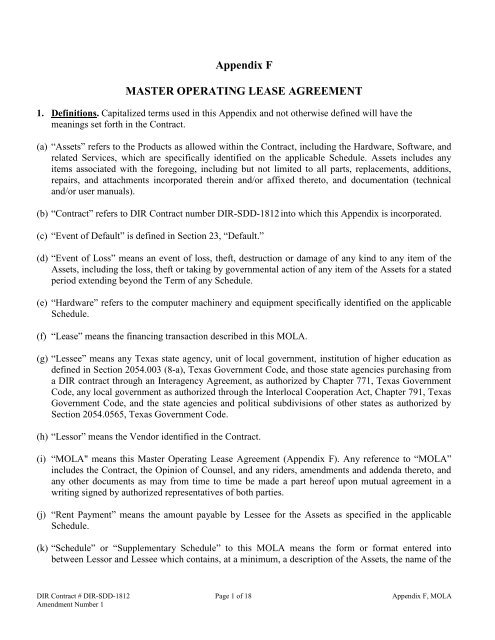

Lessor Definition

Posted on Posted on: 17.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Lessor DefinitionThe lease agreement is a contract between the lessor vs lessee for the use of the asset or property. It outlines the terms of the contract and sets the legal obligations associated with the use of the asset. Both parties are signatories to the agreem…

Operating Lease Definition

Posted on Posted on: 17.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Operating Lease DefinitionIn addition, the lessor receives payment from the lessee in exchange for the usage of the asset or property. Essentially, a finance lease is one where the lessor purchases the asset for a lessee and rents it to them over a defined period. The lessee …

Which institutes is called a borrower as well as a lender

Posted on Posted on: 17.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Which institutes is called a borrower as well as a lenderMortgage bankers are lenders that are large enough to originate loans and create pools of loans. Some companies do not sell directly to those major investors but sell their loans to the mortgage bankers. It’s always good to browse different lenders’ …

Difference Between Journal and Ledger

Posted on Posted on: 16.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Journal and LedgerReporting requirements, for example, that require a different accounting representation to comply with international or country-specific regulations, create the need for a secondary ledger. Reporting currencies maintain and report accounting transact…

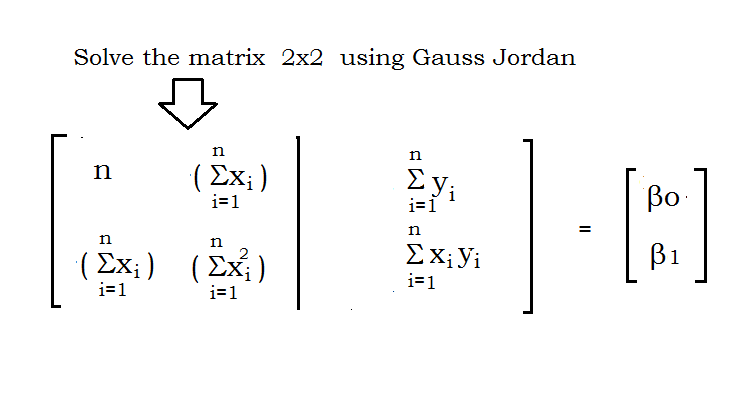

‘Least Squares’ and ‘Linear Regression’, are they synonyms?

Posted on Posted on: 16.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on ‘Least Squares’ and ‘Linear Regression’, are they synonyms?There is a close connection between correlation and the slope of the least square line. It is interesting that the least squares regression line always passes through the point (`x , `y ). The correlation (r) describes the strength of a straight line…

Capital Lease Definition

Posted on Posted on: 16.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Capital Lease DefinitionA buyer-lessor has significant economic incentive when the repurchase price is expected to significantly exceed the fair value of the asset at the time of purchase. The classification of the leaseback matters in determining whether sale and leaseback…

Lease vs. Rent: What is the Difference?

Posted on Posted on: 16.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Lease vs. Rent: What is the Difference?The regular lease payments are operating expenses, and thus, come under the income statement. Since the lessee does not get any ownership rights, the asset does not appear in the balance sheet. The sublessor remains liable to the original lessor in a…