Your account books don’t always reflect the real-world value of your business assets. The carrying value of an asset is the figure you record in your ledger and on your company’s balance sheet. The carrying amount is the original cost adjusted for fa…

Bookkeeping 101

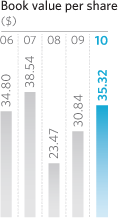

Book Value Per Share Financial Ratio

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Book Value Per Share Financial RatioNet book value is the amount at which an organization records an asset in its accounting records. Net book value is calculated as the original cost of an asset, minus any accumulated depreciation, accumulated depletion, accumulated amortization, and …

How to Calculate Net Income From Retained Earnings

Posted on Posted on: 07.07.2020 Modified on: 03.03.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Net Income From Retained EarningsThe net income applicable to common shares figure on an income statement is the bottom-line profit belonging to the common stockholders, who are the ultimate owners, a company reported during the period being measured. (To get the basic earnings per …

How Much Less Do Nonprofit CEOs Get Paid Than For-Profit CEOs?

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Much Less Do Nonprofit CEOs Get Paid Than For-Profit CEOs?Which of the following statements is not correct with respect to contributions to a private not-for-profit? A) Contributions to a not-for-profit are recorded at fair market value at the date of receipt….

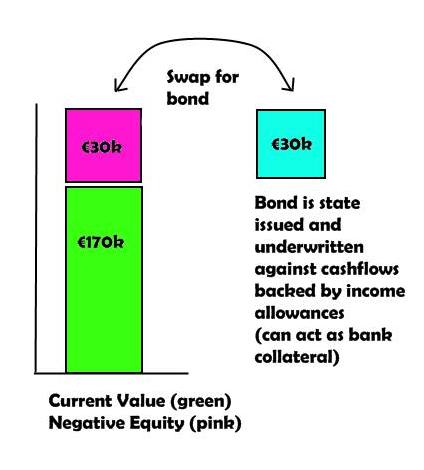

Negative Shareholders Equity

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Negative Shareholders EquityIt’s debit balance will reduce the owner’s capital account balance and the owner’s equity. The drawing account’s purpose is to report separately the owner’s draws during each accounting year. Since the capital account and owner’s equity accounts are …

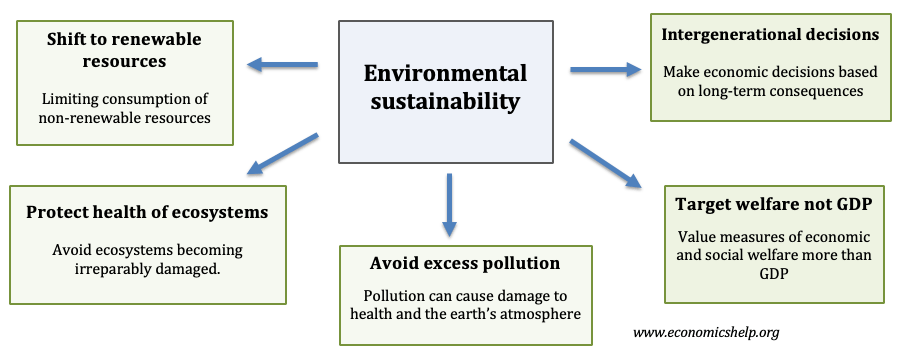

natural resources definition and meaning

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on natural resources definition and meaningNaturally, this means that we are utilizing more and more natural resources. These resources are called exhaustible or non-renewable resources. Ever since the earth was inhabited, humans and other life forms have depended on things that exist freely …

Calendar year

Posted on Posted on: 06.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Calendar yearAt any time, these businesses may elect to change to a calendar year. However, companies that want to change from a calendar year to a fiscal year must get special permission from the IRS or meet one of the criteria outlined on Form 1128, Application…

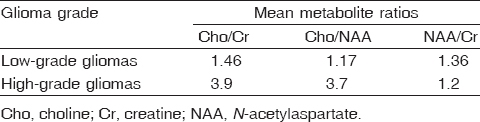

What does naa mean?

Posted on Posted on: 06.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What does naa mean?Ever wondered what NAA means? Or any of the other 1,050,000 slang words, abbreviations and acronyms listed here at Sayitshort.com? Your resource for web acronyms, web abbreviations and netspeak….

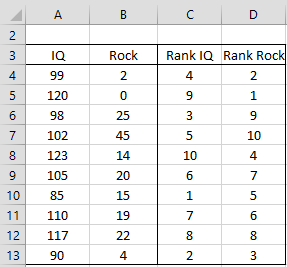

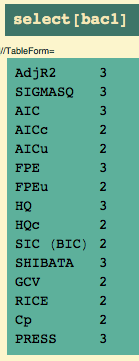

Difference Between Correlation and Regression in Statistics

Posted on Posted on: 06.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Correlation and Regression in StatisticsIn other terms, MLR examines how multiple independent variables are related to one dependent variable. Once each of the independent factors has been determined to predict the dependent variable, the information on the multiple variables can be used t…

Correlation meaning in Accounting

Posted on Posted on: 06.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Correlation meaning in AccountingMulticollinearity refers to a situation in which two or more explanatory variables in a multiple regression model are highly linearly related. We have perfect multicollinearity if, for example as in the equation above, the correlation between two ind…