The methods are not actually linked to the tracking of physical inventory, just inventory totals. This does mean a company using the FIFO method could be offloading more recently acquired inventory first, or vice-versa with LIFO. However, in order fo…

Bookkeeping 101

Difference Between Fair Value & Net Realizable Value

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Fair Value & Net Realizable ValueEvery business has to keep a close on its inventory and periodically access its value. The reason for that is there are several negative impacts like damage of inventory, obsolescence, spoilage etc. which can affect the inventory value in a negative …

Recording a Cost of Goods Sold Journal Entry

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Recording a Cost of Goods Sold Journal EntryThis means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current ma…

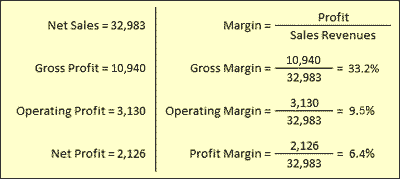

$27,500 (Income Tax Calculator) California

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on $27,500 (Income Tax Calculator) CaliforniaFor every exemption claimed on your W-4 form, you will subtract the current rate from your gross income. The concepts of gross and net income have different meanings, depending on whether a business or a wage earner is being discussed. For a company,…

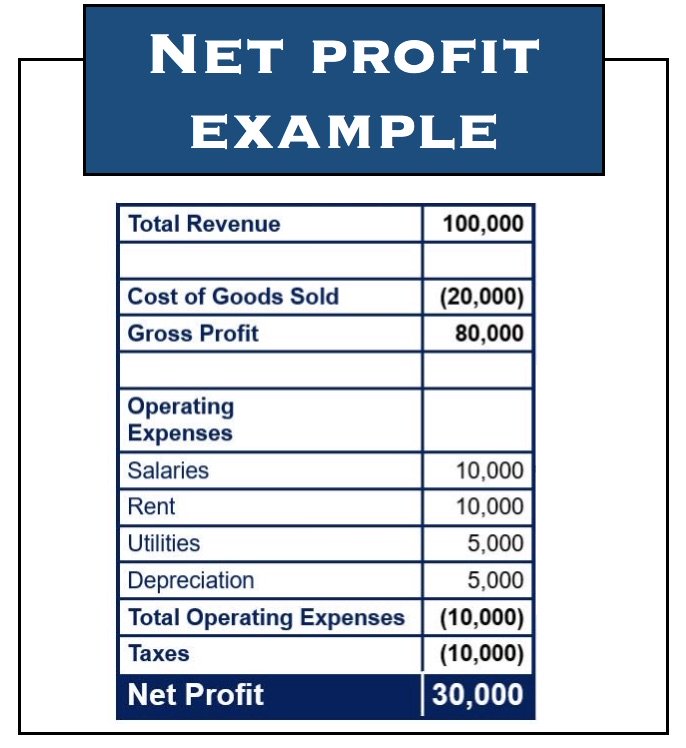

P&L — Profit & Loss Statement — Definition & Example

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on P&L — Profit & Loss Statement — Definition & ExampleThe top line of the P&L statement isrevenue, or the total amount of income from the sale of goods or services associated with the company’s primary operations. Deducting expenses for the running of the business, such as rent, cost of goods, freig…

What is net income?

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is net income?Net income is the portion of a company’s revenues that remains after it pays all expenses. Owner’s equity is the difference between the company’s assets and liabilities. It is the owner’s share of the proceeds if you were to liquidate the company tod…

The difference between income and assets

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The difference between income and assetsBoth the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities. Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as i…

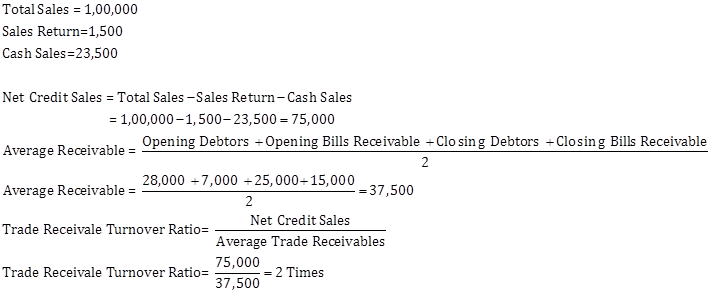

How to Figure Out Cash Sales From Financial Statements

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Figure Out Cash Sales From Financial StatementsAlso, there may be production-related expenses (such as facility rent) even when there is no production at all, as would be the case when there is a union walkout. In these cases, it is possible for there to be a cost of goods sold expense even in th…

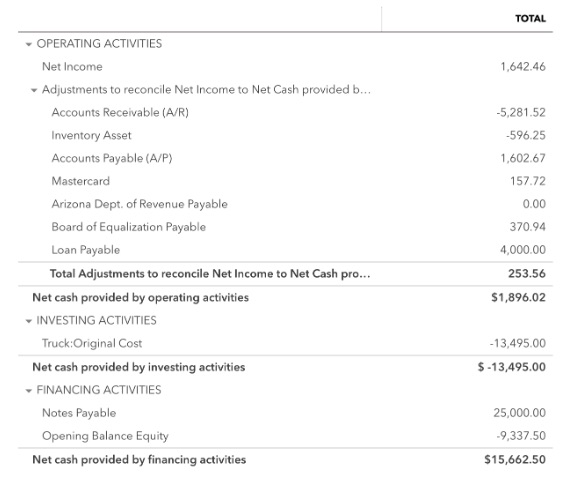

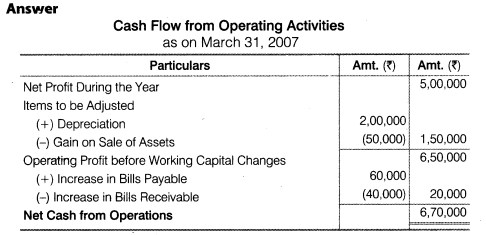

What Are Investing Activities? How to Report Investment Activities on the Cash Flow Statement

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are Investing Activities? How to Report Investment Activities on the Cash Flow StatementIf it’s coming from normal business operations, that’s a sign of a good investment. If the company is consistently issuing new stock or taking out debt, it might be an unattractive investment opportunity. The company engaged in a number of financing …

Cash Flow From Financing Activities – CFF Definition

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow From Financing Activities – CFF DefinitionCash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends….