Paid-in capital excess of par is the amount a company receives from investors in excess of its stated par value. For example, if a company issues 100 shares at $10 par value for $15, the $500 difference is credited under stockholders’ equity as paid-…

Bookkeeping 101

Does Selling Stocks Increase the Net Income on the Balance Statement?

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Does Selling Stocks Increase the Net Income on the Balance Statement?Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholder’s equity by the amount paid for the stock. You can also issue a repurchase tender offer to buy up shares at a stated price. Some companies…

Who is the mother of accounting?

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Who is the mother of accounting?In 1494, the first book on double-entry accounting was published by Luca Pacioli. Since Pacioli was a Franciscan friar, he might be referred to simply as Friar Luca. While Friar Luca is regarded as the “Father of Accounting,” he did not invent the sy…

Profit and Loss Statement

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Profit and Loss StatementThe income statement tells how you are doing financially regarding operating profit. It is how you keep score relative to the budget (the promise) and last year….

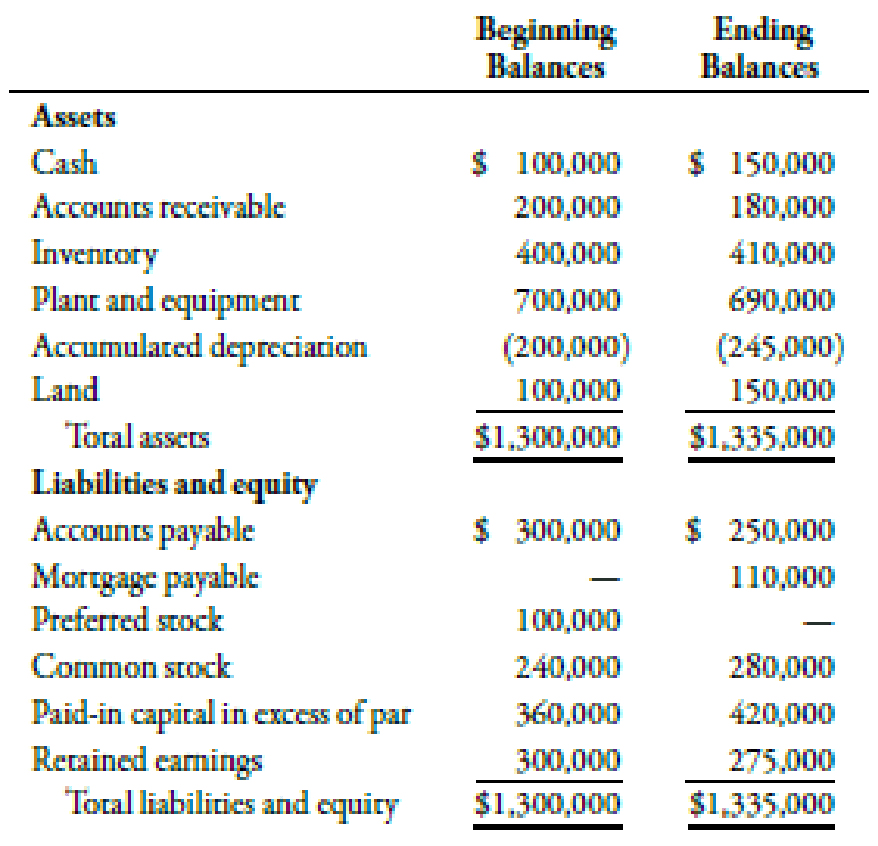

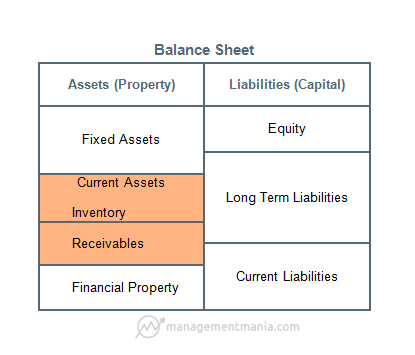

What is owners’ equity? definition and meaning

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is owners’ equity? definition and meaningOwner’s equity can be calculated by taking the total assets and subtracting the liabilities. Owner’s equity can be reported as a negative on a balance sheet; however, if the owner’s equity is negative, the company owes more than it is worth at that p…

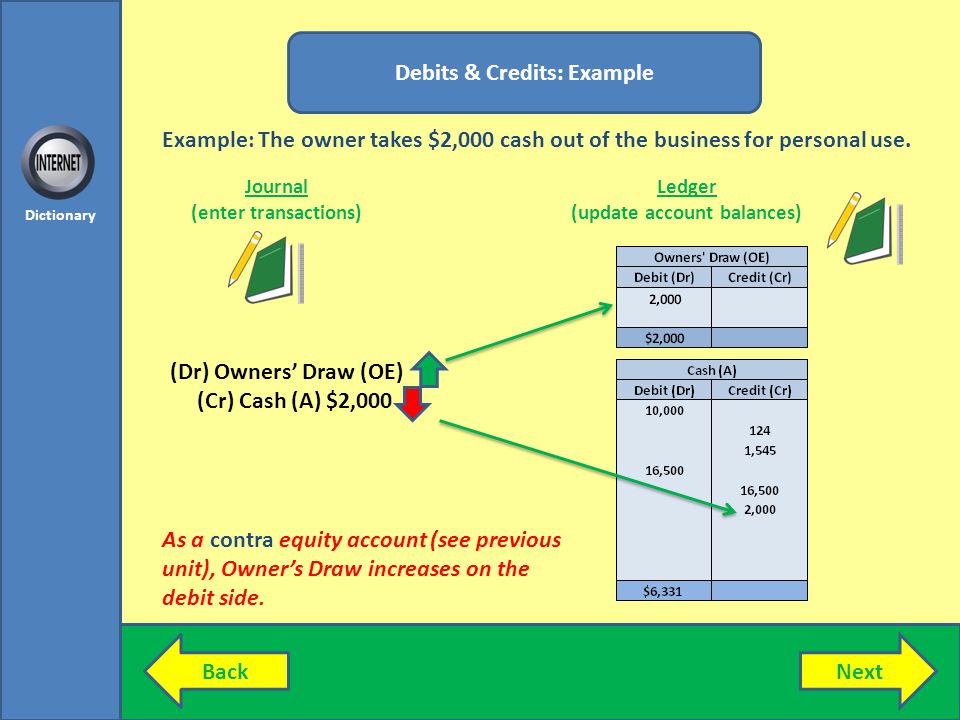

owner’s drawing account definition and meaning

Posted on Posted on: 22.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on owner’s drawing account definition and meaningOtt, Drawing for $500 and will credit Cash for $500. After this transaction, the business will have assets of $2,500 and will have owner’s equity of $2,500. The contra owner’s equity account used to record the current year’s withdrawals of business a…

What Are the Differences Between Assets and Revenue?

Posted on Posted on: 22.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are the Differences Between Assets and Revenue?In accounting terms, a company’s equity balance represents its net worth and may be calculated as a company’s total assets minus its total liabilities. The owner’s equity is recorded on the balance sheet at the end of the accounting period of the bus…

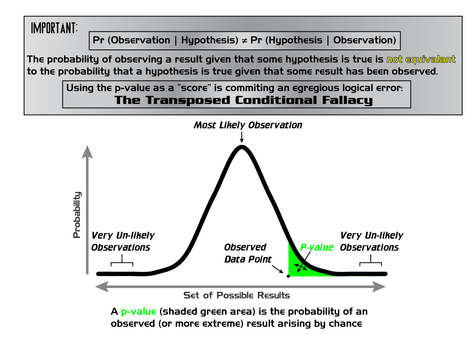

What is the Meaning of Understated and Overstated in Accounting?

Posted on Posted on: 22.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is the Meaning of Understated and Overstated in Accounting?An overstated balance is an account balance that is reported as having a greater balance than it actually does, while an understated balance is one that is reported as having a lesser balance than it actually does. In this scenario, a character is se…

Overhead

Posted on Posted on: 22.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OverheadFixed expenses are those that must be paid each month. These can include rent or mortgage payments, depreciation of assets, salaries and payroll, membership and subscription dues, legal fees and accounting costs….

Accidentally Charged Closed Bank Account : personalfinance

Posted on Posted on: 22.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Accidentally Charged Closed Bank Account : personalfinanceElectronic withdrawals at ATMs are instantaneous, meaning your bank debits the amount of the withdrawal from your account at the time of the transaction. Nevertheless, ATM withdrawals, like check withdrawals, can lead to overdrafts and fees. While yo…