We are now starting to evaluate the extent to which investors are recognizing improvement in the reliability of financial reporting by U.S. public companies. That is, today we are in a better position to reflect on the impact of the Act and whether w…

Bookkeeping 101

Sarbanes-Oxley Act of 2002: Definition, Summary

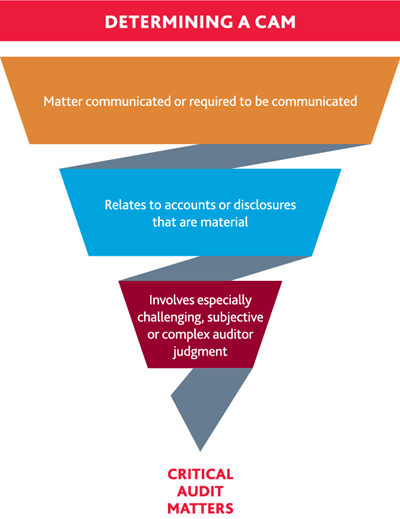

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Sarbanes-Oxley Act of 2002: Definition, SummaryAccordingly, upon adoption of this standard, a reference to generally accepted auditing standards in auditors’ reports is no longer appropriate or necessary. The Public Company Accounting Oversight Board (PCAOB) was established with the passage of th…

Payroll Taxes in 2020: The Dos and Don’ts

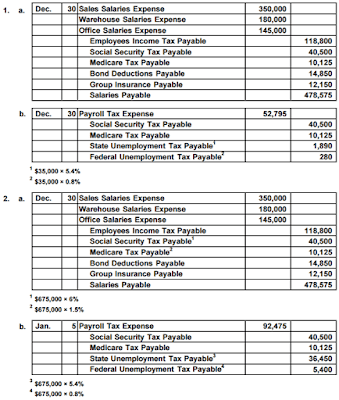

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Payroll Taxes in 2020: The Dos and Don’tsThe Medicare tax rate is 1.45 percent, with no maximum income limit. These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers….

How to Change Your Social Security Disability Payee

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Change Your Social Security Disability PayeeWhen making a payment, customers should always stop and undertake further checks if they do not receive a ‘Confirmation of Payee’ match against the details they have been given. Customers should take particular care if a payee advises or coerces them…

Payback Pay

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Payback PayAlternatively, shop for rewards from the Rewards Catalogue, buy instant e-Vouchers with PAYBACK Points; increase the redemption choices. It not only lets you redeem your Points for products but also rewards you with exciting offers on each transactio…

What is Money Cost in Economics?

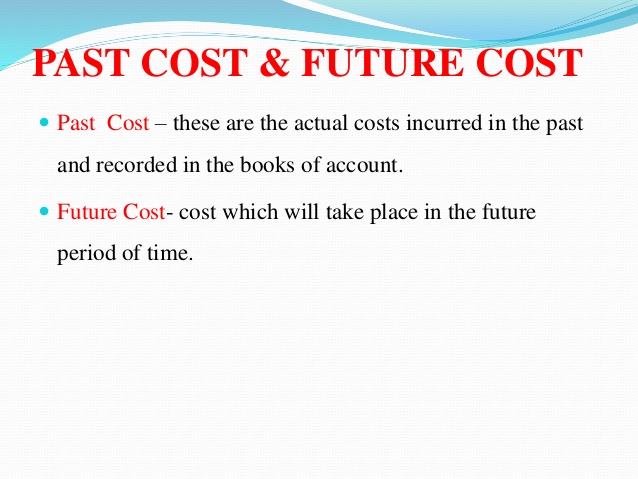

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is Money Cost in Economics?Sunk cost dilemma describes the decision of whether to stick with a project you’ve invested in that has not yet achieved desired results. In a financial sense, a line can be drawn between sunk costs and other costs you incur that have no immediate be…

Disadvantages of Partnership: Everything You Need to Know

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Disadvantages of Partnership: Everything You Need to KnowWithin a partnership, members are vulnerable to unlimited liability for their overall actions. Every partner is personally liable for any company debts and responsibilities. If the company lacks the assets to cover an organizational debt, then credit…

What Happens to a Preferred Stock in a Buyout?

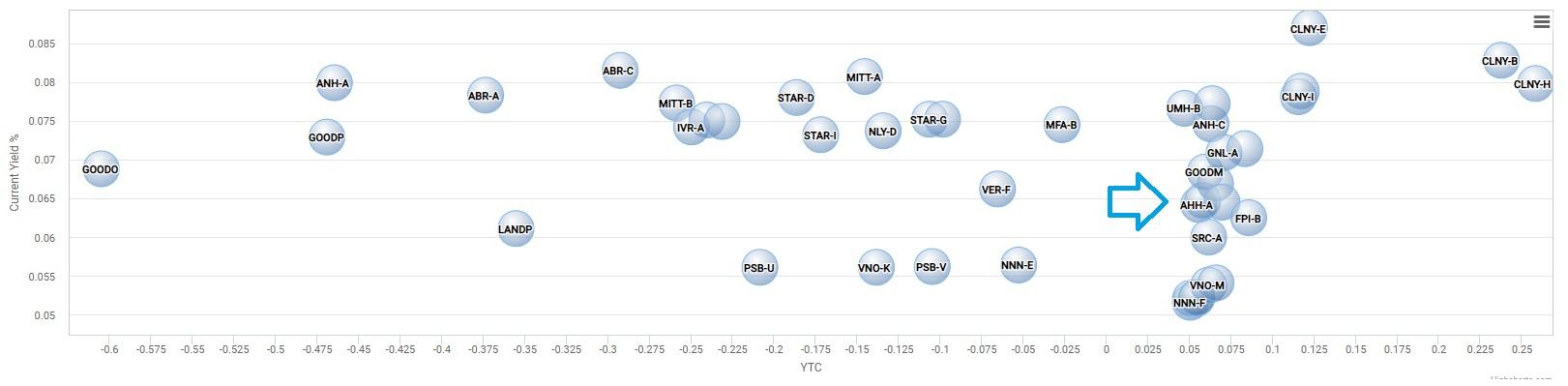

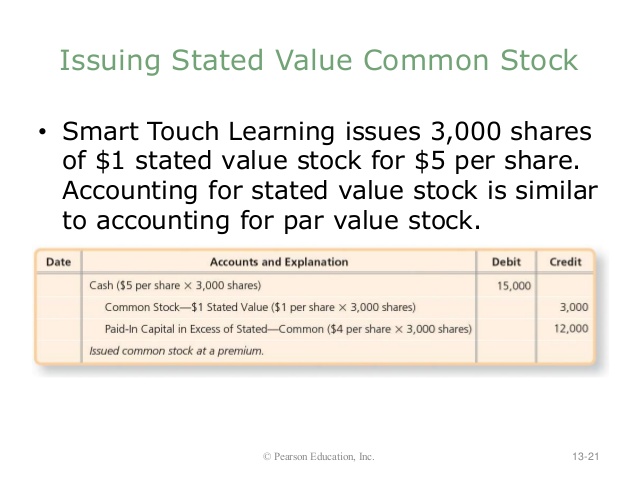

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Happens to a Preferred Stock in a Buyout?For example, a bond with a par value of $1,000 can be redeemed at maturity for $1,000. This is also important for fixed-income securities such as bonds or preferred shares because interest payments are based on a percentage of par. So, an 8% bond wit…

The difference between paid in capital and retained earnings?

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The difference between paid in capital and retained earnings?A company’s working capital is a core part of funding its daily operations. However, it’s important to analyze both the working capital and cash flow of a company to determine whether the financial activity is a short-term or long-term event….

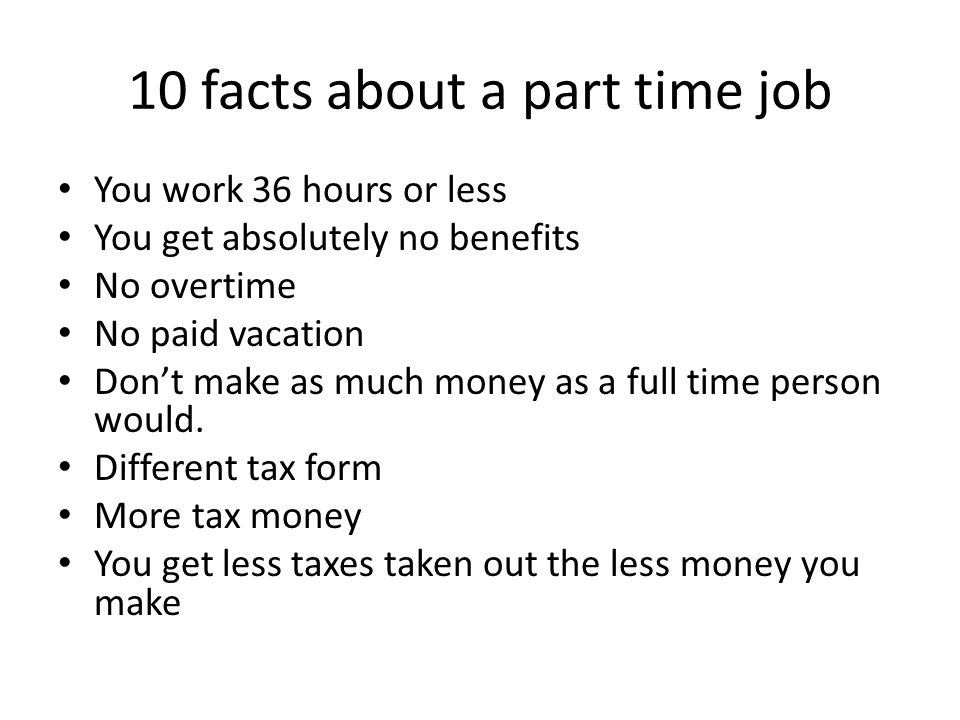

Paid vacation

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Paid vacationThe extra pay may come in the form of a bonus, flat sum, straight-time or time-and-a-half pay or additional time off. For example, your employer could have a policy stating that weekly hours over 50 are paid at a salaried exempt employee’s straight-t…