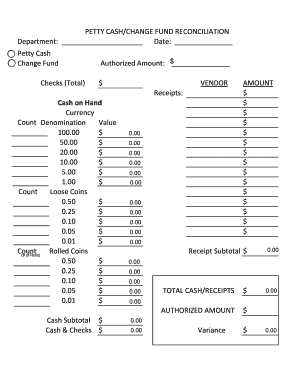

To control the petty cash fund properly and record it correctly for tax purposes, the fund should be stored in a secure location and reconciled frequently. Petty cash is a highly liquid asset, which means that it’s easily stolen….

Bookkeeping 101

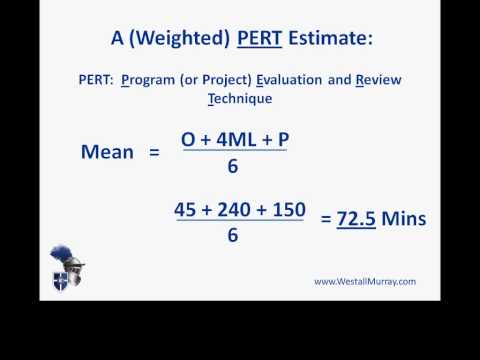

What are PERT Advantages And Disadvantage?

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are PERT Advantages And Disadvantage?PERT charts depend on the ability to predict precise time frames for multitudes of tasks. Complicated projects involving many activities and suppliers can make this prediction difficult, as explained by U.S. Unexpected events occur, and sometimes the…

Understanding Periodic vs. Perpetual Inventory

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding Periodic vs. Perpetual InventoryA more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor. If a company has several locations, a perpetual inventory system centralizes this management. It amalgamates al…

3 Types of Inventory

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 3 Types of InventoryAs expected, the extent to which resources generated by sales can be used to pay operating expenses and provide net income is dependent on both revenue and the cost of goods sold. Amid the ongoing LIFO vs. FIFO debate in accounting, deciding which me…

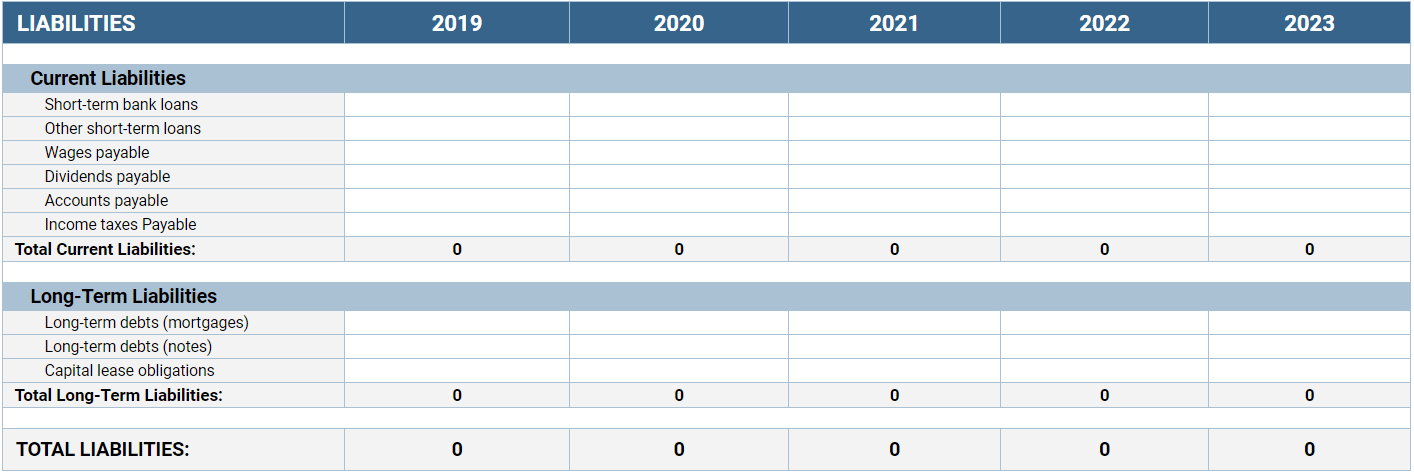

Statement of Net Position- Reporting Requirements for Annual Financial Reports

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Statement of Net Position- Reporting Requirements for Annual Financial ReportsFor this reason, it is strongly recommended to report restricted dollars separately, and to pay particular attention to the unrestricted amounts when planning and making operational decisions. In addition, directors and managers need adequate trainin…

What Are Retained Earnings in Accounting?

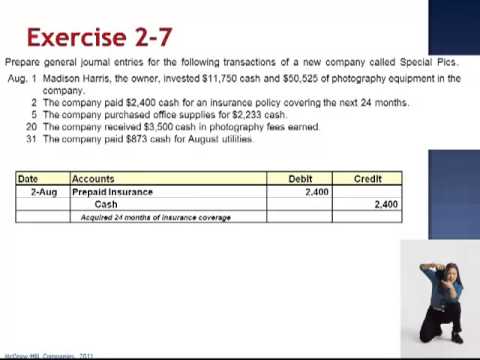

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are Retained Earnings in Accounting?Generally, the accounts payable GL is for money owed that hasn’t been paid yet, whereas expenses are costs which have already been incurred. Accounts payable is also a permanent account that appears on the balance sheet, whereas expenses is a tempora…

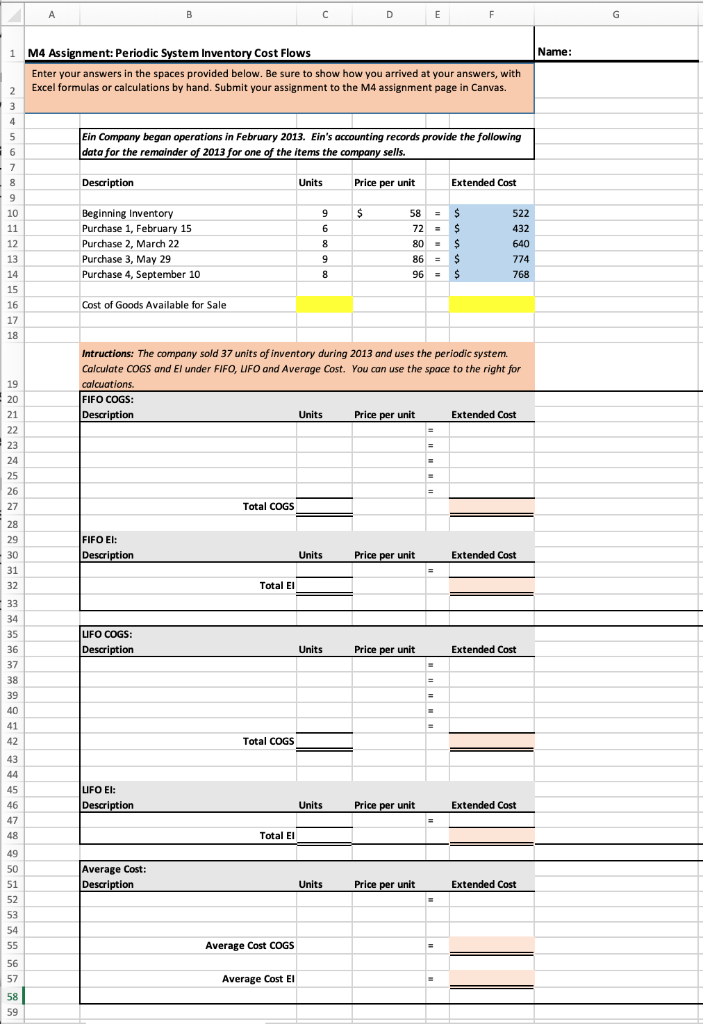

Periodic Inventory System

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Periodic Inventory SystemThe bad news is the periodic method does do things just a little differently. Business types using the periodic inventory system include companies that sell relatively few inventory units each month such as art galleries and car dealerships….

Periodic Sentence

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Periodic SentenceThe largest family of elements consists of transition metals. The center of the periodic table contains the transition metals, plus the two rows below the body of the table (lanthanides and actinides) are special transition metals….

Pension vs 401

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Pension vs 401That means Maria is entitled to receive a specific amount of benefits each month until she dies based on her pay rate and years of service. It’s up to ConSoft to make sure there are enough funds set aside to pay all of the pensioners what they have b…

Pension contributions and tax relief for limited company owners

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Pension contributions and tax relief for limited company ownersPension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined…