Purchase Return Journal Entry is the journal entry passed by the company in order to record the transaction of return of the merchandises which were purchased from the supplier where the cash account will be debited in case of the cash purchases or t…

Bookkeeping 101

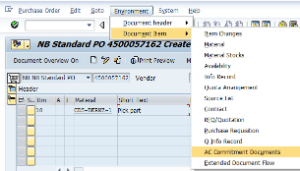

How to create a Purchase Order in SAP

Posted on Posted on: 12.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to create a Purchase Order in SAPNotwithstanding the foregoing, Buyer agrees to pay the balance of the undisputed amounts on any invoice that is the subject of any dispute within the time periods specified herein. Yet despite the nature of the purchase order as a contract, it is com…

Relationship Between Sales & Purchase Discount

Posted on Posted on: 12.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Relationship Between Sales & Purchase DiscountA cash discount is a type of sales discount, sometimes called an early settlement discount, and is recorded in the accounting records using two journals. The first journal is to record the cash being received from the customer. The second journal rec…

Commitment: Its Purpose and Power

Posted on Posted on: 12.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Commitment: Its Purpose and PowerIt is commitment that transforms the vision of success into actual success. Commitment stands first on the list of values and priorities of successful people. Being committed thus requires that a person is fully engaged in his endeavours and remains …

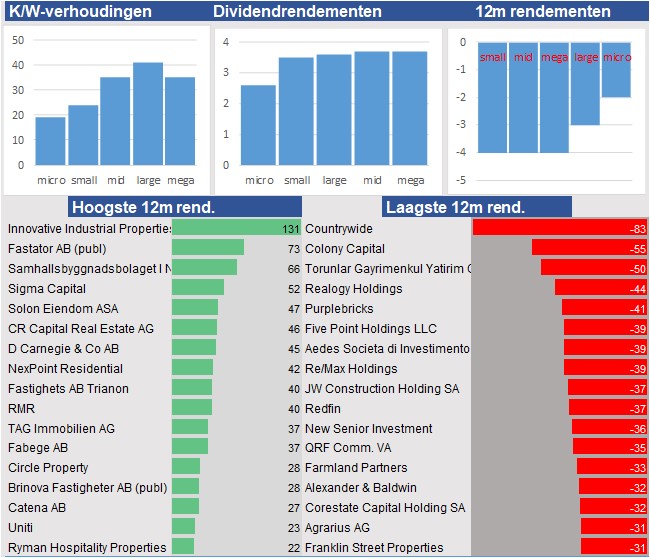

How Many Shares Should I Buy of a Stock?

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Many Shares Should I Buy of a Stock?This is calculated as the number of shares outstanding (as opposed to authorized but not necessarily issued) times the price per share. For example, a company with two million shares outstanding and a price per share of US$40 has a market capitalizat…

Provision

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on ProvisionA provision is an amount that is put aside to cover a future liability. The purpose of a provision is to make the balance of current year more accurate, as there may be costs which could be accounted for in either the current or previous financial ye…

What is a sole proprietorship?

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a sole proprietorship?Furthermore, operating as either type of business structure means that you will need to pay taxes on the company’s profits. A partnership operates as a pass-through tax entity, meaning that the profits and losses pass through to the owners who report…

A Sole Proprietorship or a Limited Partnership?

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on A Sole Proprietorship or a Limited Partnership?An LLP has at least one general partner and one limited partner. The general partner is like a sole proprietor — she has full control over business activities and may be held liable for business obligations. The limited partner is a silent partner, …

Dividend Per Share

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Dividend Per ShareA company’s EPS, equal to net income divided by the number of outstanding shares, is often easily accessible via the firm’s income statement. The retention ratio, meanwhile, refers to the opposite of the payout ratio, as it instead measures the propo…

Bad debt expense

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Bad debt expenseMore than half of the organizations treat less than 15 percent of their advertising as overhead. For those organizations, if advertising were their only expense, their program spending ratios would be greater than 85 percent—an excellent figure by an…