However the object, i.e. the first argument has been evaluated. function is being evaluated the actual expression used as an argument is stored in the promise together with a pointer to the environment the function was called from….

Bookkeeping 101

Operating Expenses vs. SG&A

Posted on Posted on: 14.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Operating Expenses vs. SG&AResearch and development (R&D) expenses are associated with the research and development of a company’s goods or services. A company generally incurs R&D expenses in the process of finding and creating new products or services. As a type of o…

Learn common accounting terms

Posted on Posted on: 14.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Learn common accounting termsAnother category of income is Other Income, or income generated from the sale of a product or service not normal to your operations. Interest Income is an example of an Other Income account type….

Earnings Per Share – EPS Definition

Posted on Posted on: 14.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Earnings Per Share – EPS DefinitionYou report your revenues, expenses and earnings on your income statement. If your total revenues are more than your total expenses for the quarter, you will have a quarterly profit, or net income. If your total expenses are greater than your total re…

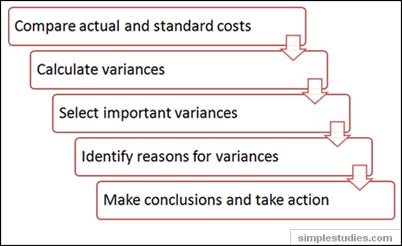

Difference between Cost Variance and Schedule Variance

Posted on Posted on: 14.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference between Cost Variance and Schedule VarianceSales Quantity Variance The variance is calculated by taking the difference between the actual sales volume at the budgeted mix and the budgeted sales volume and multiplying this by the budgeted price to give a monetary amount….

The Benefits of Conducting a Quality of Earnings Study

Posted on Posted on: 13.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Benefits of Conducting a Quality of Earnings StudyAccounting decisions can in turn affect earnings because they can influence the timing of transactions and the estimates used in financial reporting. Working down the income statement, analysts then might look for variations between operating cash fl…

The four principal qualitative characteristics of financial reporting.

Posted on Posted on: 13.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The four principal qualitative characteristics of financial reporting.“Acceptance From Foreign Private Issuers of Financial Statements Prepared in Accordance With International Financial Reporting Standards Without Reconciliation to U.S. GAAP,” Page 7. GAAP may be contrasted with pro forma accounting, which is a non-GA…

PV vs NPV

Posted on Posted on: 13.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on PV vs NPVThe first practical application of photovoltaics was to power orbiting satellites and other spacecraft, but today the majority of photovoltaic modules are used for grid-connected systems for power generation. There is still a smaller market for stand…

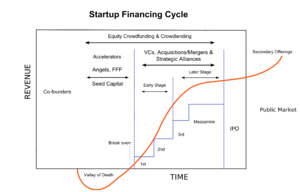

Purchase of Business

Posted on Posted on: 13.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Purchase of BusinessEngineering would also inspect sample products to determine if the company or organisation can produce products they need. If the bidder passes both of these stages engineering may decide to do some testing on the materials to further verify quality …

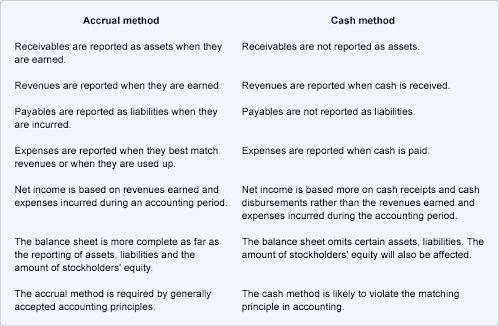

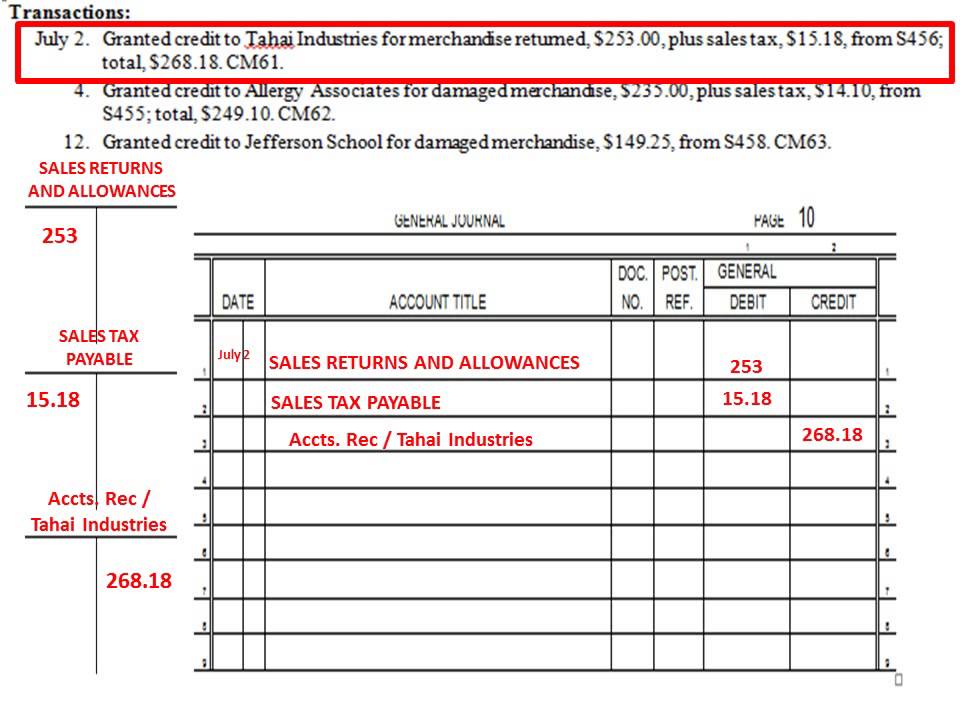

How to Record a Sales Return for Accounting

Posted on Posted on: 13.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Record a Sales Return for AccountingWhen merchandise is returned, the sales returns and allowances account is debited to reduce sales, and accounts receivable or cash is credited to refund cash or reduce what is owed by the customer. A second entry must also be made debiting inventory …