Return on Assets (ROA) is a type of return on investment (ROI) metric that measures the profitability of a business in relation to its total assets. This ratio indicates how well a company is performing by comparing the profit (net income) it’s gener…

Bookkeeping 101

Do You Write Off Fully Depreciated Assets?

Posted on Posted on: 26.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do You Write Off Fully Depreciated Assets?The sale price would find its way back to cash and cash equivalents. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet. As an…

What are Reversals in Accounting?

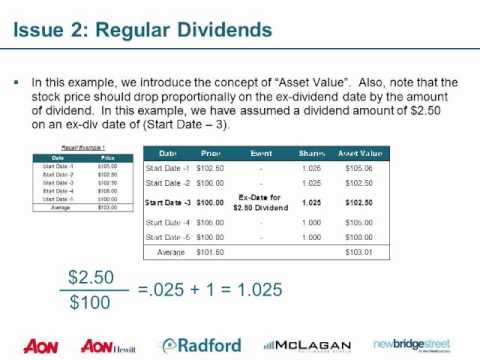

Posted on Posted on: 26.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are Reversals in Accounting?Under the accrual method of accounting, a business is to report all of the revenues (and related receivables) that it has earned during an accounting period. A business may have earned fees from having provided services to clients, but the accounting…

Percentage of completion method

Posted on Posted on: 26.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Percentage of completion methodThe Financial Accounting Standards Board (FASB), which dictates accounting standards for most companies—especially publicly traded companies—discourages businesses from using the cash model because revenues and expenses are not properly matched. The …

Steps to Building Equity in Your Home

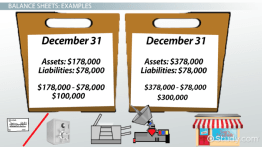

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Steps to Building Equity in Your HomeROE reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet. Shareholder equity is equal to total assets minus total liabilities. Shareholder equity is a creation of accounting that …

Importance of ROI: Why it matters for all businesses

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Importance of ROI: Why it matters for all businessesReturn on investment (ROI) is a ratio between net profit (over a period) and cost of investment (resulting from an investment of some resources at a point in time). A high ROI means the investment’s gains compare favorably to its cost….

Ratio Analysis: Return on Capital Employed

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Ratio Analysis: Return on Capital EmployedReturn of capital (and here I differ with some definitions) is when an investor receives a portion of his original investment back – including dividends or income – from the investment. The ROIC formula is calculated by assessing the value in the den…

Is it better to have cash on hand or assets? : personalfinance

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is it better to have cash on hand or assets? : personalfinanceTo illustrate this, let’s assume that a machine with a cost of $100,000 was expected to have a useful life of five years and no salvage value. The company depreciated the asset at the rate of $20,000 per year for five years….

Long-Term Debt Definition

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Long-Term Debt DefinitionMGP had previously used a combination of cash flow generation and borrowings under its bank credit line (‘revolver’) to fund a warehouse expansion project and to build up aged whiskey inventory. In 2017, MGP elected to borrow long-term, fixed-rate se…

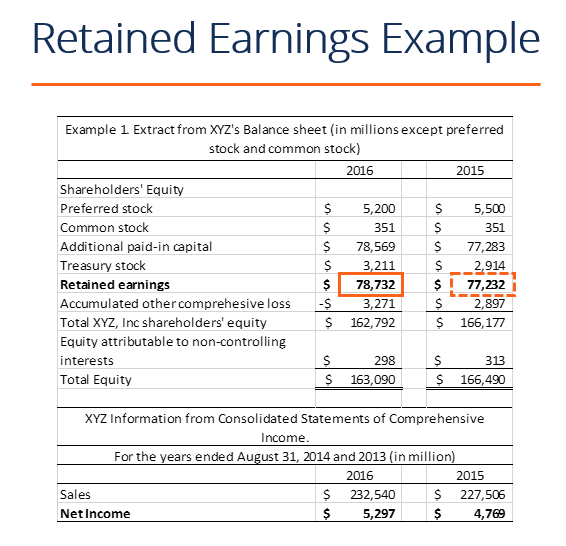

How to Calculate the Retained Earnings of a Start-Up Company

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate the Retained Earnings of a Start-Up CompanyThis statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement. The statement is a financial document that includes information regarding a firm’s retained earnings, along wi…