Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal….

Bookkeeping 101

What kind of salary can I expect to earn with a Bachelor's degree in Accounting?

Posted on Posted on: 28.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What kind of salary can I expect to earn with a Bachelor's degree in Accounting?Every accountant, at whatever level, should have a general understanding of basic bookkeeping, in addition to more complex understanding of areas like auditing, payroll, financial reporting, and (of course) taxes. Even if you’ve worked your way to th…

Key Differences Between Salary Account and Savings Account

Posted on Posted on: 28.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Key Differences Between Salary Account and Savings AccountThe organization is required to have a minimum of 20 employees and a payout of Rs 36 lakhs with an average salary per account of Rs per month. It is a zero balance salary account so that you don’t need to maintain minimum balance in the account. Empl…

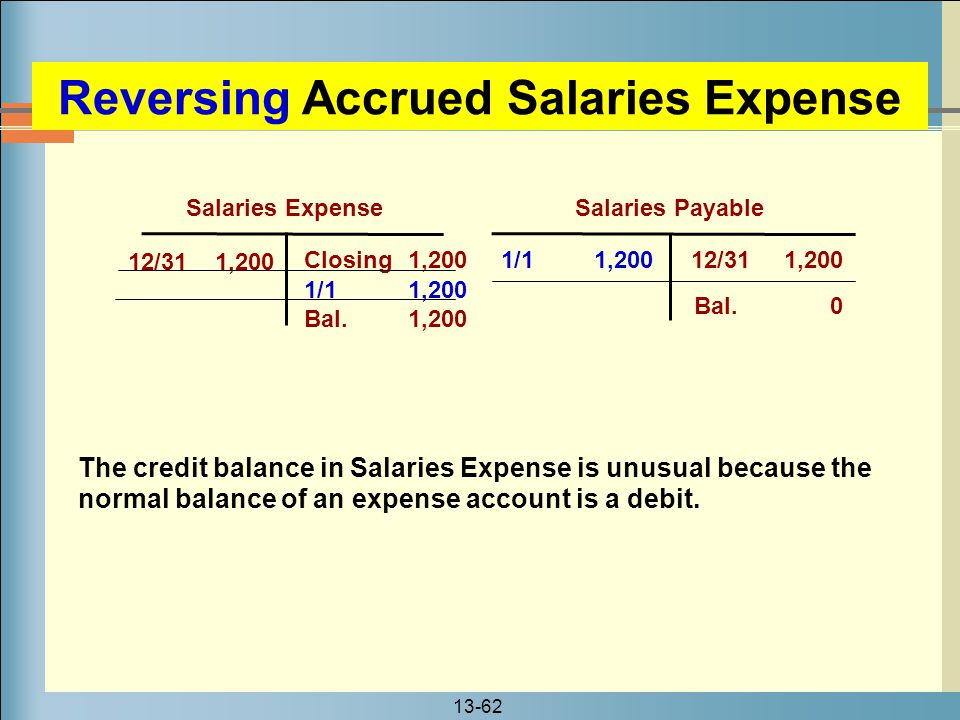

The Differences in Wages Payable & Wages Expense

Posted on Posted on: 28.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Differences in Wages Payable & Wages ExpenseThe cost of labor is the sum of each employee’s gross wages, in addition to all other expenses paid per employee. Other expenses include payroll taxes, benefits, insurance, paid time off, meals, and equipment or supplies. Once the total overhead is a…

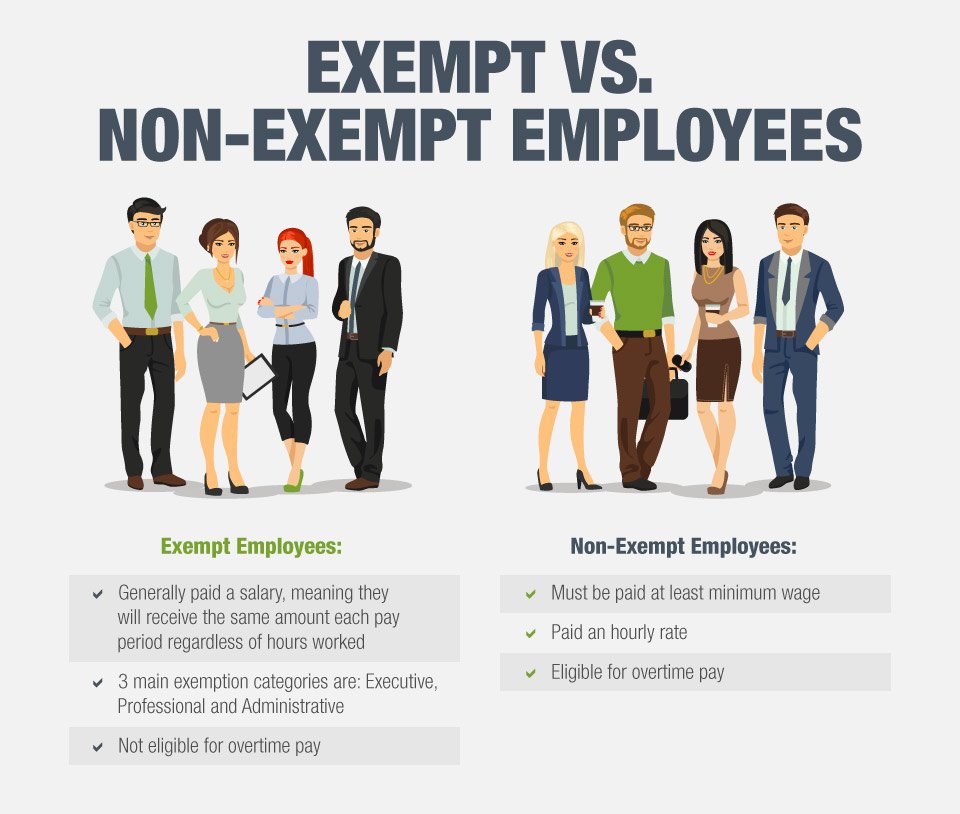

4 reasons why companies can ask exempt employees to work for ‘free’

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 4 reasons why companies can ask exempt employees to work for ‘free’A non-exempt employee is not exempt from FLSA regulations, rules and requirements. Non-exempt employees need to receive the state or federal minimum wage (whichever rate is higher) and overtime pay at not less than one-and-a-half times their hourly p…

How the Rule of 72 Can Help Double Your Money

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How the Rule of 72 Can Help Double Your MoneyThe rule of 72 teaches you how to double your money, but it’s up to you to take action. Invest in the broad market, stay patient through volatile upward and downward swings, and reinvest your gains. The 25-year average annualized return for the S&…

A rolling horizon rescheduling strategy for flexible energy in a microgrid

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on A rolling horizon rescheduling strategy for flexible energy in a microgridSince the modeling is a crucial step in solving the ALP, we are concerned in this research with modeling the landing procedure of aircrafts for single and multiple runway system. The model solution for the static case using an exact method is present…

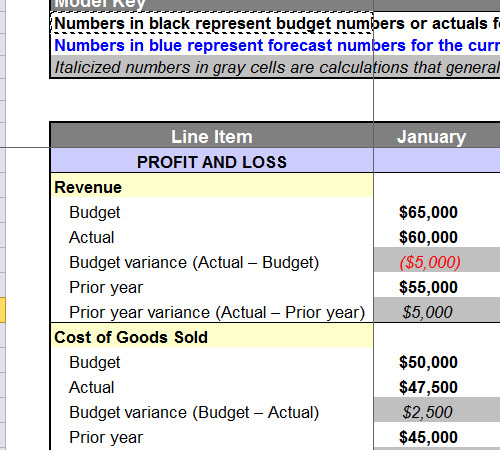

Should You Use Rolling Forecasts? Weighing the Pros & Cons

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Should You Use Rolling Forecasts? Weighing the Pros & ConsThis is usually achieved with support of a computer system that enables the process of planning and budgeting to be managed. Imposed budgeting is a top-down process where executives adhere to a goal that they set for the company….

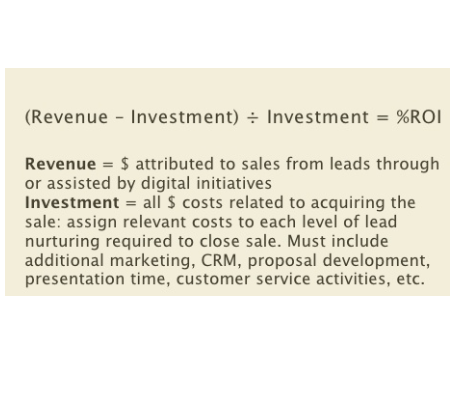

What is a Good Return on Investment

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a Good Return on InvestmentFor instance, with the purchase of capital equipment, it is expected that equipment will provide a benefit to the company for several years. As such, the net income will need to be estimated for future time periods to determine the overall ROI. Addit…

Is ROCE useful as an indicator of a company’s performance?

Posted on Posted on: 27.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is ROCE useful as an indicator of a company’s performance?For starters, ROCE is a useful measurement for comparing the relative profitability of companies. But ROCE is also an efficiency measure of sorts — it doesn’t just gauge profitability as profit margin ratios do. ROCE measures profitability after fact…