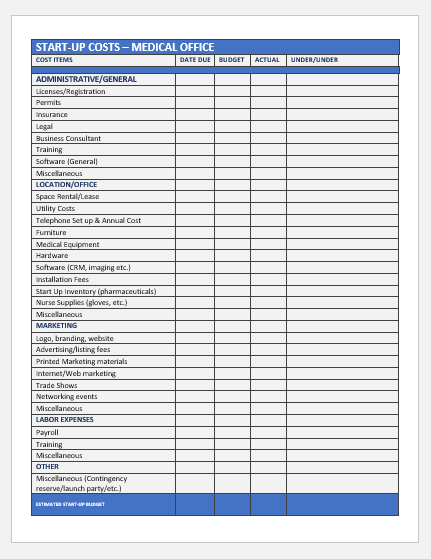

Assume the same facts, but she incurred $23,000 of start-up costs. She can claim $5,000 off the top as a current deduction. The remaining $18,000 must be amortized over the 180-month period, which is a monthly amount of $100….

Bookkeeping 101

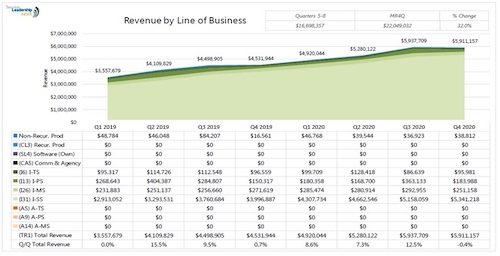

revenues definition and meaning

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on revenues definition and meaningIf a company does not pay cash immediately, you cannot credit Cash. But because the company owes someone the money for its purchase, we say it has an obligation or liability to pay. Most accounts involved with obligations have the word “payable” in t…

Trademark Examples

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Trademark ExamplesA well-known example of a service mark is “Geek Squad‚” which identifies a national computer repair and troubleshooting company. Though service marks are technically distinct from trademarks‚ they receive the same protection and have similar requirem…

List These Monthly Expenses in Your Budget

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on List These Monthly Expenses in Your Budgetsupporting services expenses definition. One of two broad functional categories for sorting and reporting a nonprofit organization’s expenses. (The other is program expenses.) Supporting services expenses consists of 1) management and general expense…

Personal expense

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Personal expense50/20/30 rule to create your budget, especially if you’re a young adult. The 50/20/30 guideline offers a basic financial strategy for your spending and saving….

When Should I Service My Car?

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on When Should I Service My Car?Customer support is a series of customer services to support the customers in making the correct use of a product. Excellent customer service means making each and every aspect of the customer’s experience an absolutely positive one. I believe that e…

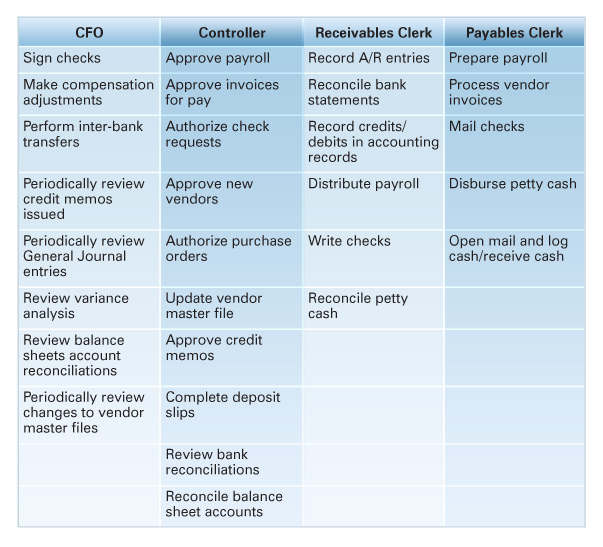

Office of Internal Audit

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Office of Internal AuditThe second is the detection of control failures that include security breaches, information theft and circumvention of security controls. Correct SoD is designed to ensure that individuals don’t have conflicting responsibilities or are not responsibl…

How Are Selling Expenses Figured Out Monthly?

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Are Selling Expenses Figured Out Monthly?A company’s master budget profit and loss statement include these expenses along with sales revenue, cost of goods sold, and other expenses, such as interest and depreciation. The selling and administrative expense budget makes up part of a company’s…

What Qualifies as General & Administrative Expenses in Sales?

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Qualifies as General & Administrative Expenses in Sales?An entity may utilize the sales-to-administrative ratio to gauge the portion of sales revenue attributable to covering administrative costs. A portion of administrative expenses are typically fixed in nature as they are incurred as part of the founda…

Self-employed and unemployment

Posted on Posted on: 01.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Self-employed and unemploymentIf you’re a sole proprietor, a partner, or an LLC that’s a disregarded entity, you’ll pay Medicare and Social Security taxes on your percentage of your company’s net income or profits. If your business is an S corporation or an LLC that’s considered …