Rule 102 of the Accountancy Rules also provides that a Notice to Schedule (“NTS”) for the CPA examination is valid for six months after it is issued. Pursuant to the Proclamation, the Board Staff shall be entitled, in its discretion, to extend any un…

Bookkeeping 101

Basic Concepts of Measurement

Posted on Posted on: 09.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Basic Concepts of MeasurementSystems of Measurement: there are two main systems of measurement in the world: the Metric (or decimal) system and the US standard system. The US Standard system uses units that have no predictable relationship to each other. For example, there are …

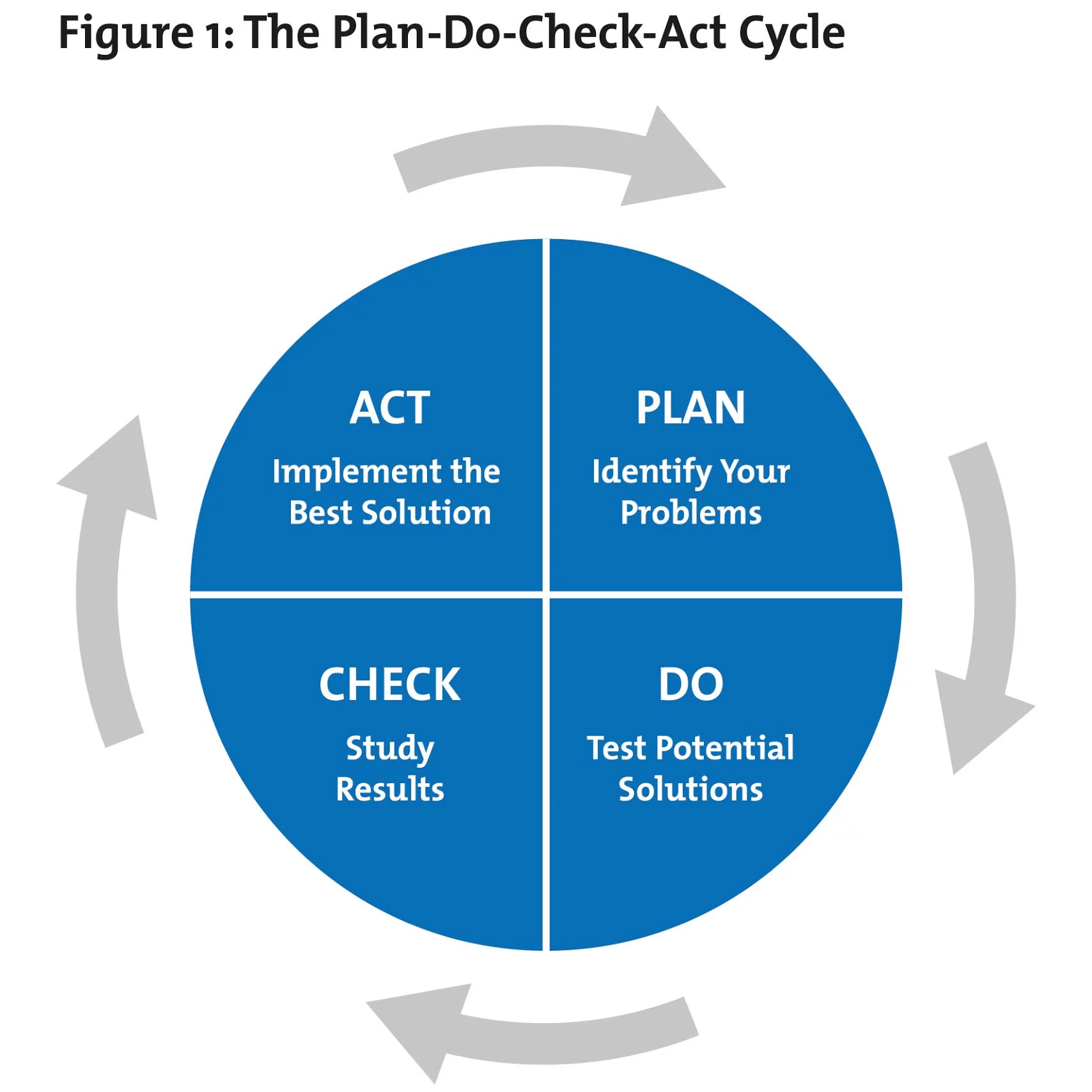

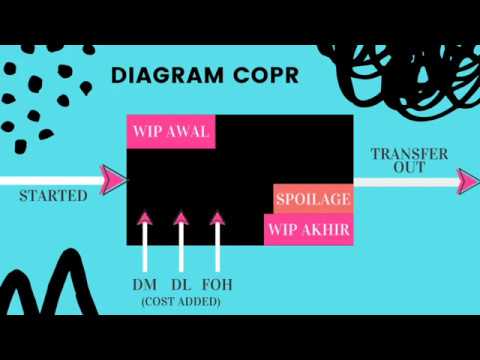

Costing methods and techniques

Posted on Posted on: 09.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Costing methods and techniquesTo calculate the standard cost of direct materials, multiply the direct materials standard price of $10.35 by the direct materials standard quantity of 28 pounds per unit. The result is a direct materials standard cost of $289.80 per case….

Stakeholder definition

Posted on Posted on: 09.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Stakeholder definitionA stake is a vital interest held by someone either inside or outside the business and can include ownership interests, legal obligations and moral rights. Examples of stakeholders include shareholders, employees, customers, suppliers, governments, ot…

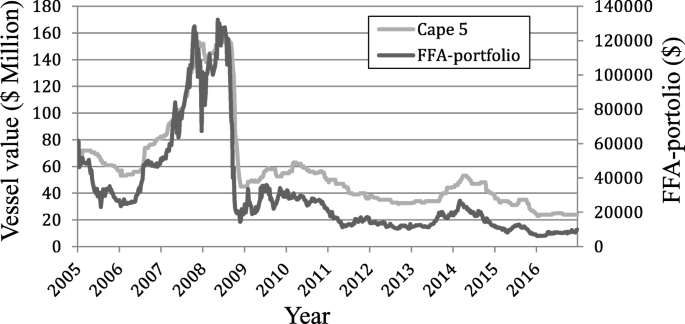

Spot Market

Posted on Posted on: 08.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Spot MarketThe difference between the prices of the two contracts would be cash settled in the investor’s brokerage account, and no physical product will change hands. However, the trader could also lose if the commodity’s price was lower than the purchase pric…

Measuring Your Food Waste

Posted on Posted on: 08.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Measuring Your Food WasteIf that’s the case, it made you money and the expense is recorded as cost of goods sold. When something spoils or expires before you can sell it, you have to take the expense as a deduction from your net profits. In a double-entry accounting system, …

Quantitative or physical units method of joint cost allocation

Posted on Posted on: 08.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Quantitative or physical units method of joint cost allocationThe only things that matter are the future consequences. Any costs incurred prior to making the decision have already been incurred no matter what decision is made. This is known as the bygones principle or the marginal principle. In economics and bu…

Split definition and meaning

Posted on Posted on: 08.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Split definition and meaningThe HP Garage at 367 Addison Avenue is now designated an official California Historical Landmark and is marked with a plaque calling it the “Birthplace of ‘Silicon Valley'”. The company got its first big contract in 1938, providing its test and measu…

Direct material variance

Posted on Posted on: 08.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Direct material varianceFixed overhead expenditure variance is calculated by subtracting the actual fixed overhead cost from the budgeted fixed overhead cost. It can be favorable when the budgeted fixed overhead is less than the actual fixed overhead or adverse when the act…

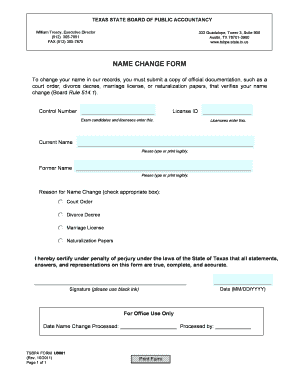

What is document?

Posted on Posted on: 07.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is document?As explained in the last paragraph, the purchases invoice is the original of the sales invoice sent by the supplier to the customer. Therefore, the sales invoice and the purchases invoice contains the same details. The only difference is that purchas…