It also removes a disadvantage previously imposed on brick-and-mortar stores. Hyper markets combine speciality stores, limited line stores in a single level store. It includes furniture, large and small appliances, clothing items, etc. This video tea…

Bookkeeping 101

Should You Consider a Trading Coach?

Posted on Posted on: 11.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Should You Consider a Trading Coach?He has over thirty years of experience trading in the equity markets and has traded options in his stock portfolio and for income generation since 1999. His formal finance training includes graduate level business and finance courses and advanced opt…

Hold Definition

Posted on Posted on: 11.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Hold DefinitionNext level supplier relationship management can even get you and your suppliers to balance inventory between supplier ownership and your own. If you can get your suppliers to hold stock for you, you may be able to pass those inventory holding costs o…

I Lost My Share Certificate. Do I Still Own the Stock?

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on I Lost My Share Certificate. Do I Still Own the Stock?They will tell you how to issue a return on stock certificates. Losing a share certificate can be remedied by contacting the company’s investor relations department….

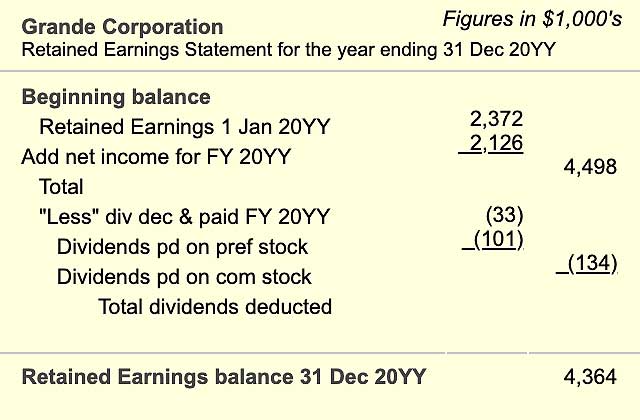

How Does a Statement of Shareholders’ Equity Help a Company’s Plan?

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Does a Statement of Shareholders’ Equity Help a Company’s Plan?Definition: The statement of stockholders’ equity is a financial report that shows the changes in all of the major equity accounts during a period. In other words, it’s a financial statement that reports the transactions that increase or decrease the…

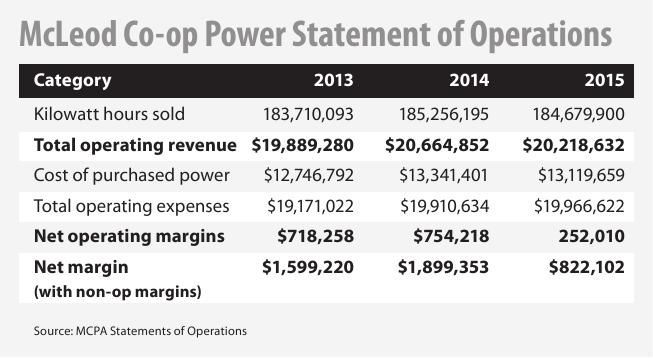

Difference Between Statement of Operation and Statement of Income

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Statement of Operation and Statement of IncomeThe statement of operations is one of the three primary financial statements used to assess a company’s performance and financial position (the two others being the balance sheet and the cash flow statement). The statement of operations summarizes a …

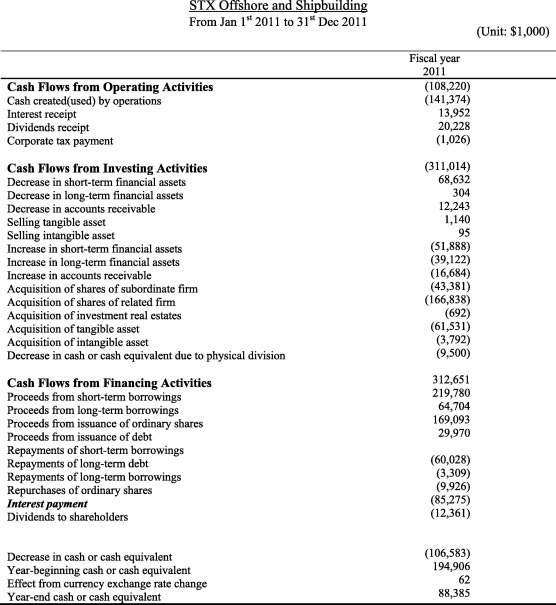

What’s More Important, Cash Flow or Profits?

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What’s More Important, Cash Flow or Profits?The purpose of the cash flow statement is to show where an entities cash is being generated (cash inflows), and where its cash is being spent (cash outflows), over a specific period of time (usually quarterly and annually). It is important for analyz…

statement of activities definition and meaning

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on statement of activities definition and meaningFunctional reporting provides a tool used to determine if the nonprofit is using its resources efficiently. One of the main financial statements of a nonprofit organization. This financial statement reports the revenues and expenses and the changes i…

The Difference Between FASB & GASB Effects on the Statement of Cash Flows

Posted on Posted on: 10.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Difference Between FASB & GASB Effects on the Statement of Cash FlowsConvergence proponents assert that a single set of standards would make it easier and more cost-effective for large multi-national corporations to report using one set of financial reporting standards for all countries. They believe it would make fin…

What Are State Payroll Taxes?

Posted on Posted on: 09.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are State Payroll Taxes?In the US, withholding by employers of tax on wages is required by the federal, most state, and some local governments. Taxes withheld include federal income tax, Social Security and Medicare taxes, state income tax, and certain other levies by a few…