In the chart of accounts, the Cash account is a current asset account. Office Supplies is an operating expense account, and Accounts Payable is a liability account. Asset accounts, for example, can be divided into cash, supplies, equipment, deferred …

Bookkeeping 101

How to Find Dropshipping Suppliers and Wholesalers

Posted on Posted on: 15.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Find Dropshipping Suppliers and WholesalersSupplier Relationship Management is the process of planning and managing all relationship with vendors that supply any products or services to a business. This may involve raw material suppliers, utility suppliers or cleaning services suppliers….

Boeing Suppliers

Posted on Posted on: 15.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Boeing SuppliersSelecting the right suppliers for your business needs is vital to ensure that you are able to deliver your products and services on time, at the right price, and in compliance with your quality standards. By implementing specific supplier’s selection…

The statement of account

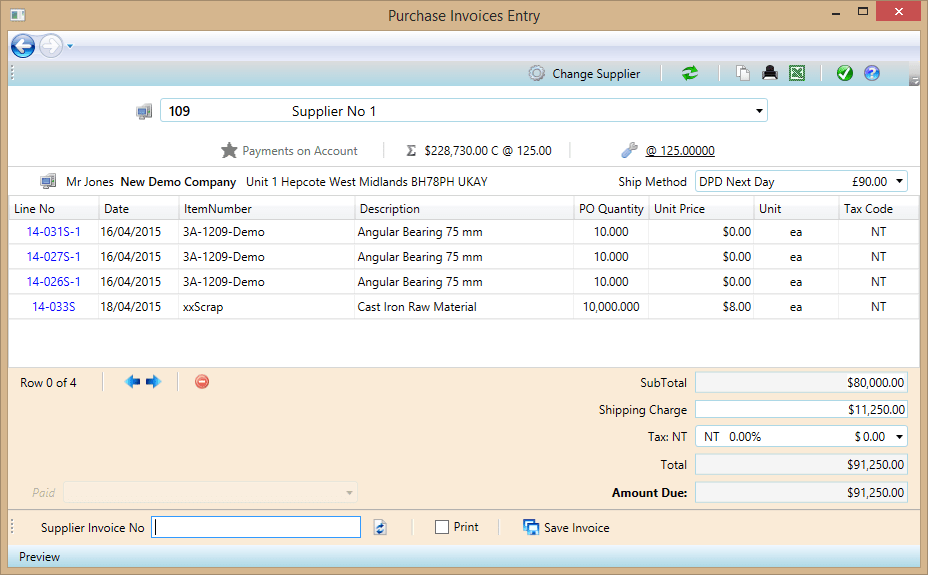

Posted on Posted on: 15.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The statement of accountThe invoice is created by a supplier, and it is a statement of services or products produced and delivered to a customer, including the amount owed. An invoice may be created before or after the product or service is received….

What Is the Purpose of Having a Ledger & a Journal in an Accounting System?

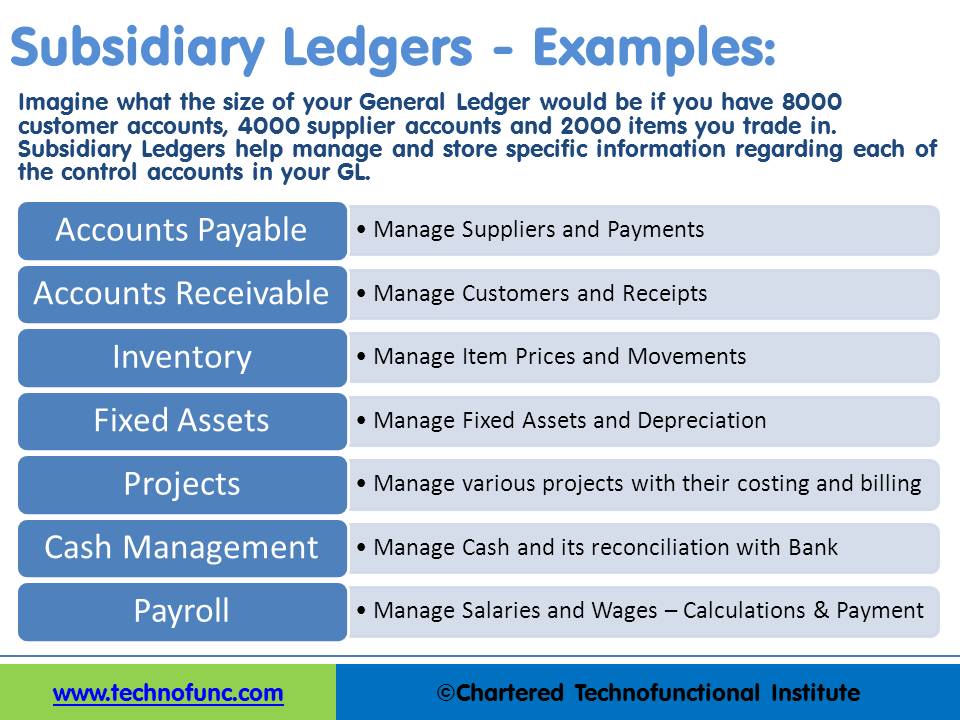

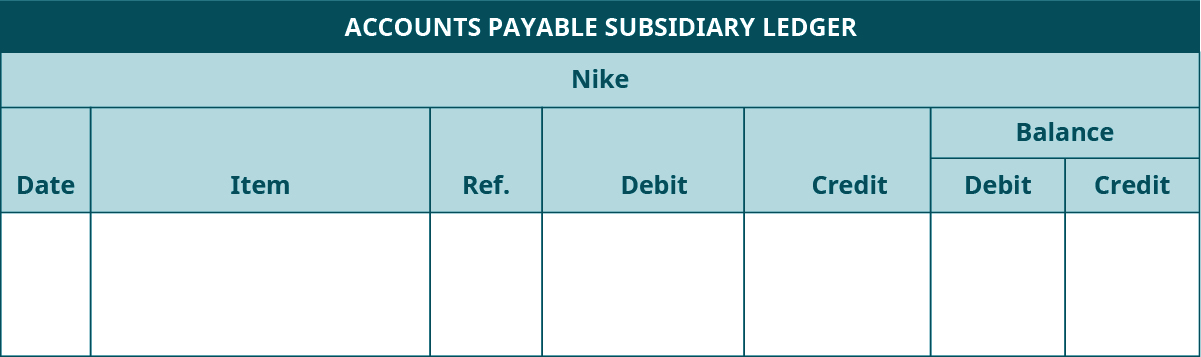

Posted on Posted on: 14.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Is the Purpose of Having a Ledger & a Journal in an Accounting System?For large scale businesses where many transactions are conducted, it may not be convenient to enter all transactions in the general ledger due to the high volume. In such cases, individual transactions are recorded in ‘subsidiary ledgers’, and the to…

Reasons Companies Have Subsidiaries

Posted on Posted on: 14.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Reasons Companies Have SubsidiariesSubsidiary ledgers contain detailed information regarding business transactions and financial accounts. This information is maintained separately from the company’s general ledger. Large business organizations often use subsidiary ledgers because the…

What is the point in reissuing a financial statement?

Posted on Posted on: 14.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is the point in reissuing a financial statement?Subsequent event is the accounting term for a financial transaction that occurs after completion of the balance sheet for a specified period but before the company’s full set of financial statements is prepared….

Learn about creating an S Corporation

Posted on Posted on: 14.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Learn about creating an S CorporationWalmart Express stores, including those branded as Neighborhood Markets. On February 15, 2017, Walmart announced the acquisition of Moosejaw, a leading online active outdoor retailer, for approximately $51 million….

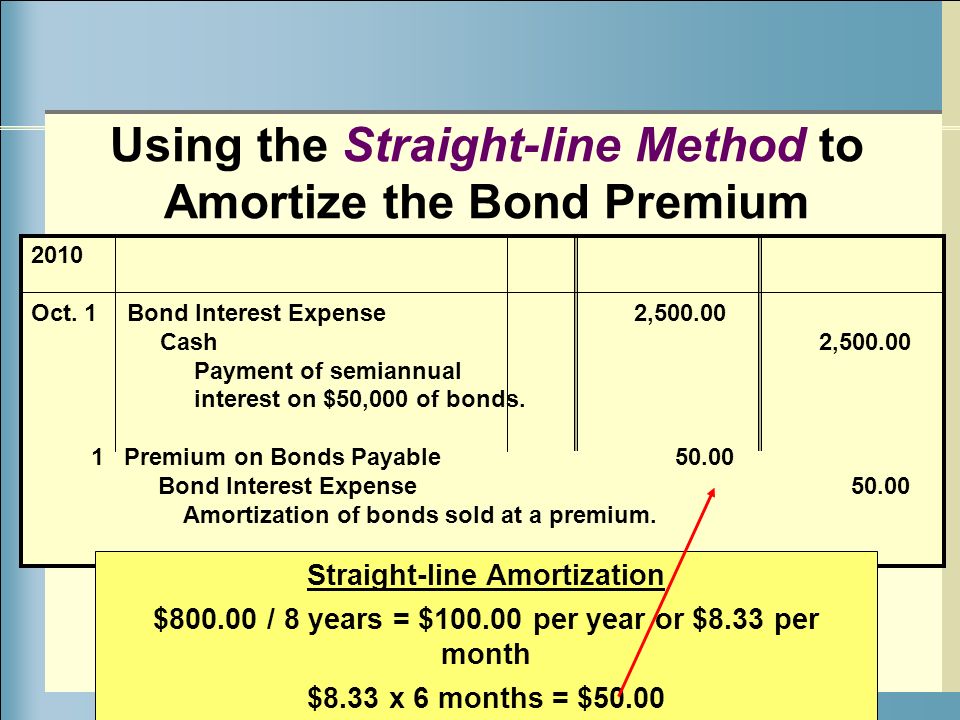

Bond Discount or Premium Amortization

Posted on Posted on: 14.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Bond Discount or Premium AmortizationNotice that the effect of this journal is to post the interest of 4,249 to the interest expense account. In the straight line amortization method, the bond’s carrying value changes each period while the bond interest expense each period remains the s…

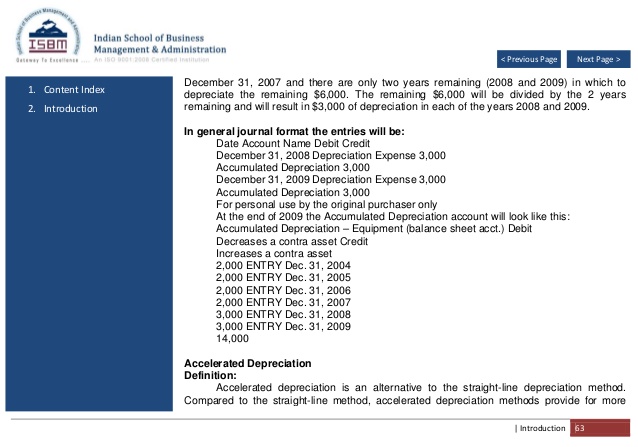

How to Calculate Building Depreciation

Posted on Posted on: 11.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Building DepreciationA popular method of accelerated depreciation is the double-declining method. This method begins the depreciation process at 200 percent of the straight-line method. The calculation subtracts salvage value from the cost of the asset. The total is then…