She will report all activity for her business from April 1st to March 31st of the next year in her formal financial statements. She will include the revenues or the amount her business earned from selling pet supplies and all the expenses or the cost…

Bookkeeping 101

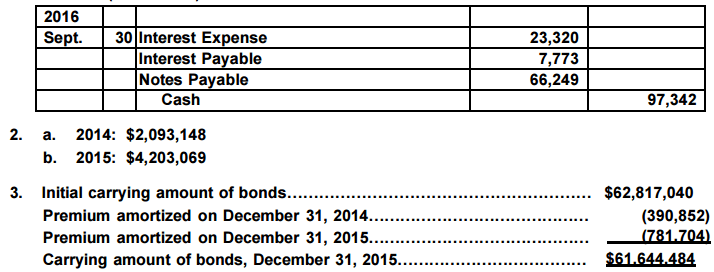

Discount on Bonds Payable Example

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Discount on Bonds Payable ExampleThe acquisition premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments for tax reporting purposes. Review prior calculations and adjustments you have made and consult your tax advisor and IRS Publication 550, Invest…

The Five Elements of Visual Merchandising

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Five Elements of Visual MerchandisingOperating Cycle for a Merchandiser A merchandising company’s operating cycle begins by purchasing merchandise and ends by collecting cash from selling the merchandise. Companies try to keep their operating cycles short because assets tied up in inven…

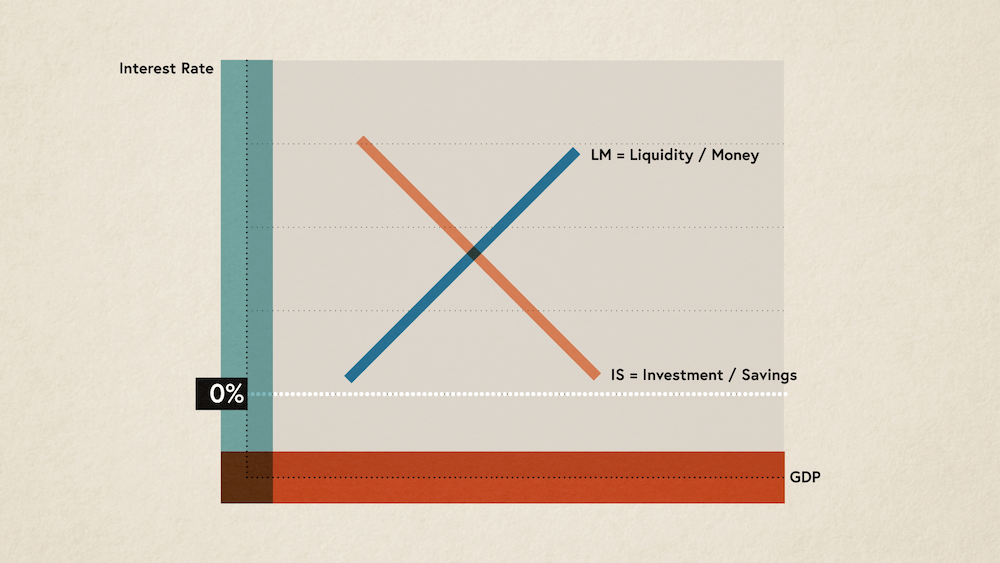

Understanding Real vs. Nominal Interest Rates

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding Real vs. Nominal Interest RatesFor example, if a customer owes the business money, the company may convert the account receivable into a note. The customer then becomes a borrower and pays interest, at a fixed rate, until the loan amount is paid….

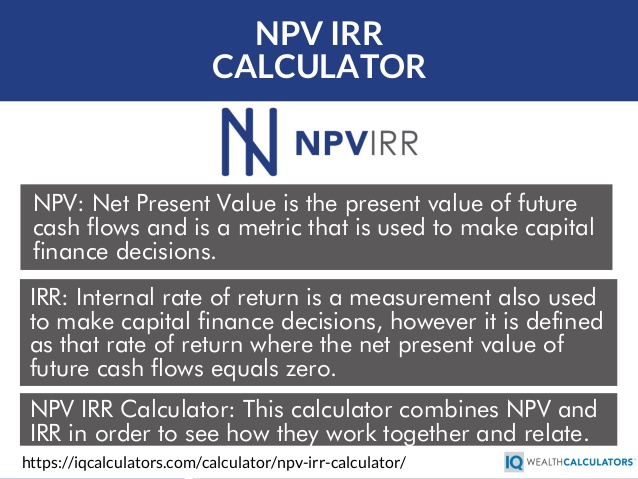

OneClass: The internal rate of return is defined as the: A. maximum rate of return a firm expects to

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OneClass: The internal rate of return is defined as the: A. maximum rate of return a firm expects toThis, along with the fact that long projects with fluctuating cash flows may have multiple distinct IRR values, has prompted the use of another metric called modified internal rate of return (MIRR). The internal rate of return is calculated by discou…

temporary cash investments

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on temporary cash investmentsThe company’s investment in commercial paper was worth $17.4 billion and mutual funds were $800 million. government securities of $8.2 billion and certificates/time deposits of $7.3 billion. Mortgage/asset-backed securities were at $20 billion and mu…

What is a temporary account?

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a temporary account?A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. Temporary accounts include revenue, expenses, and dividend…

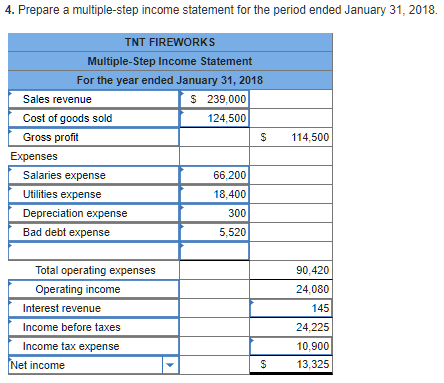

Solved: What is the definition of restricted donations

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Solved: What is the definition of restricted donationsAs shown in the income statement below, new income from a grant with donor restrictions is recorded and displayed in the With Donor Restrictions column. Often associated with funds held by donations to nonprofit organizations or endowments, restricte…

How Much of My Internet Expenses Are Deductible on My 1040?

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Much of My Internet Expenses Are Deductible on My 1040?Plus, the work related percentage of your home internet use and phone expenses can be claimed as tax deductions. Proper tracking and claiming of tax deductions is the biggest strategy for getting the best tax refund. Along the way—and this is serious…

Is accounts payable an expense?

Posted on Posted on: 17.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is accounts payable an expense?Payable. “Income tax expense” is what you’ve calculated that our company owes in taxes based on standard business accounting rules. You report this expense on the income statement. “Income tax payable” is the actual amount that your company owes in t…