The earned income tax credit is worth up to $6,557 for a family with three or more children. One out of five taxpayers who are eligible for the credit fails to claim it, according to the IRS. Some taxpayers miss this valuable credit because they are …

Bookkeeping 101

Difference between paid in capital and retained earnings

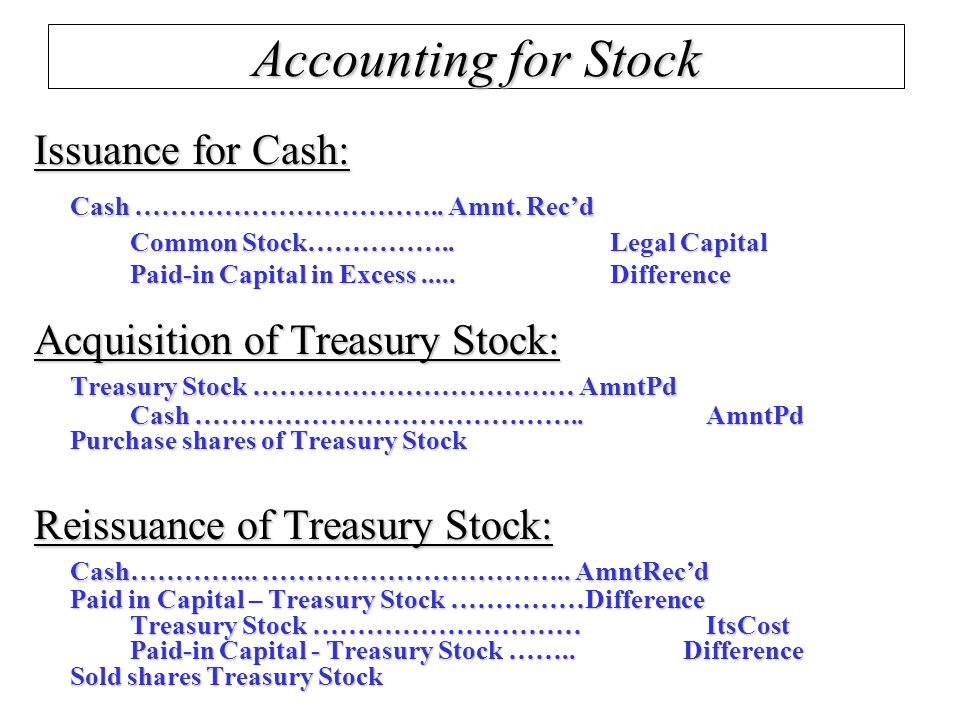

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference between paid in capital and retained earningsAll paid-up capital is listed under the shareholders’ equity section of the issuing company’s balance sheet. Legal capital is that amount of a company’s equity that cannot legally be allowed to leave the business; it cannot be distributed through a d…

In Accounting, What Is the Difference Between a Liability Account and an Expense Account?

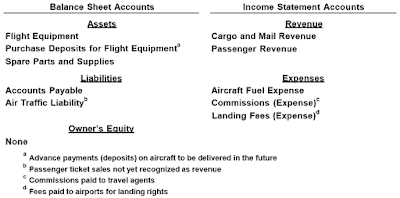

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on In Accounting, What Is the Difference Between a Liability Account and an Expense Account?The payment of the insurance expense is similar to money in the bank, and the money will be withdrawn from the account as the insurance is “used up” each month or each accounting period. Prepaid insurance is usually considered a current asset, as it …

Taxability of Employer-Provided Lodging

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Taxability of Employer-Provided LodgingThe IRS has special rules for educational institutions that provide lodging for their employees. The value of certain campus lodging is not taxable if the employee pays adequate rent….

How useful is ROCE as an indicator of a company’s performance?

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How useful is ROCE as an indicator of a company’s performance?The opening balance is the amount of funds in a company’s account at the beginning of a new financial period. It is the first entry in the accounts, either when a company is first starting up its accounts or after a year-end. The opening balance may…

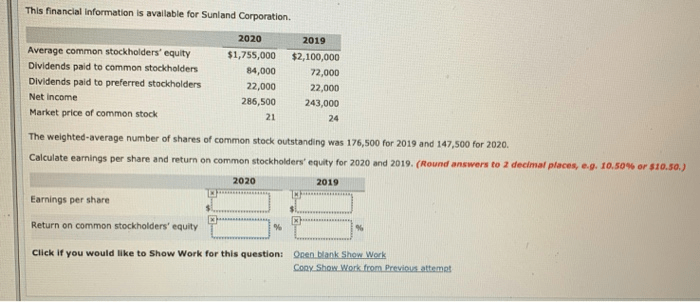

Return on common stockholders' equity ratio

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Return on common stockholders' equity ratioAn investor could conclude that TechCo’s management is above average at using the company’s assets to create profits. Relatively high or low ROE ratios will vary significantly from one industry group or sector to another….

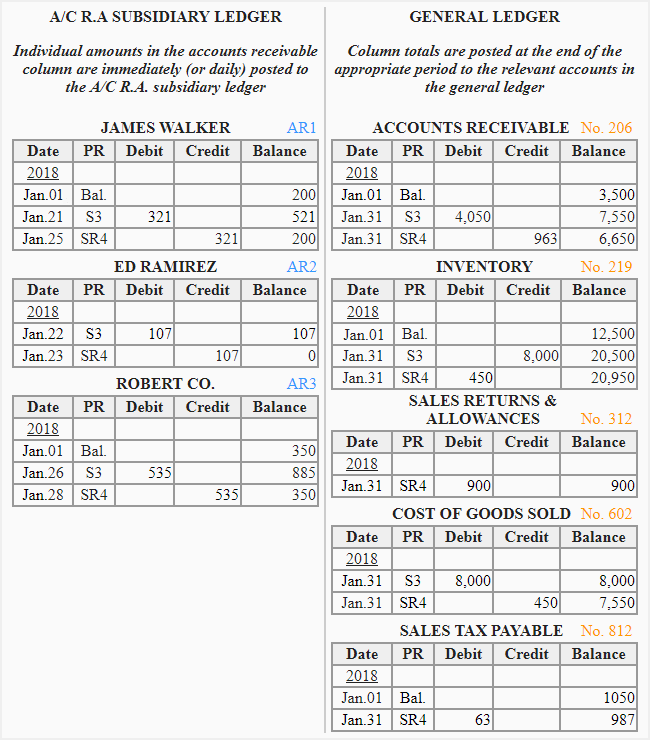

Sales journal entry

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Sales journal entryThe net sales figure on an income statement shows how much revenue remains from gross sales when sales discounts, returns and allowances are subtracted. 3/7 EOM – this means the buyer will receive a cash discount of 3% if the bill is paid within 7 da…

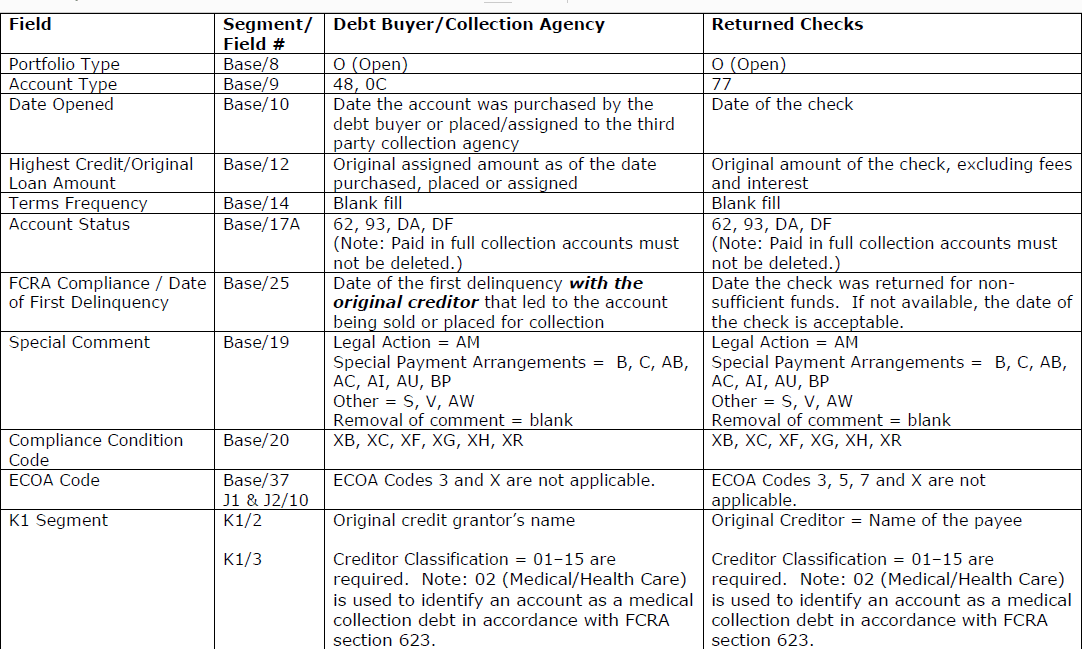

What to Do About Returned Checks

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What to Do About Returned ChecksTell them you’re trying to build good credit you want to make sure that this bad check someone wrote you doesn’t sabotage the process. If they do report to either those bureaus you can request a free copy of your report each year. Those reports are u…

Purchase Discount in Accounting

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Purchase Discount in AccountingAnd if the payments are not made in time, an anti-revenue account name purchase discounts lost is debited to record the loss. Next, let’s assume that the corporation focuses on the bad debts expense. As a result, its November income statement will be…

Collateral

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on CollateralThis means that the borrower still retains the ownership of the property, but the lender has a claim against it. Secured loans are an excellent way to work towards building your credit score. The lower interest rates are also an advantage to choosing…