When you make a change to your auto insurance, you might need to do it in the middle of your billing cycle. If the change you make impacts your insurance cost, then your insurance company will prorate your premium….

Bookkeeping 101

Prepaid Insurance

Posted on Posted on: 01.10.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Prepaid InsuranceA prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. The reason why is because most prepaid assets are consumed within a few months of being recorded. If a prepaid expense were likely to not be…

petty

Posted on Posted on: 01.10.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on petty“The most freeing thing one can do in a relationship is let go of worries about what all could possibly go wrong and focus on what is going right,” Chronister says. For instance, Chronister suggests placing your focus on the things your partner does …

Preferred Stock Definition

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Preferred Stock DefinitionThis differs from how common stock shareholders, who benefit whenever a company grows, are paid. Why companies issue preferred stock is different than the reason they go public and offer common stock. Preferred stock is a form of equity, or a stake i…

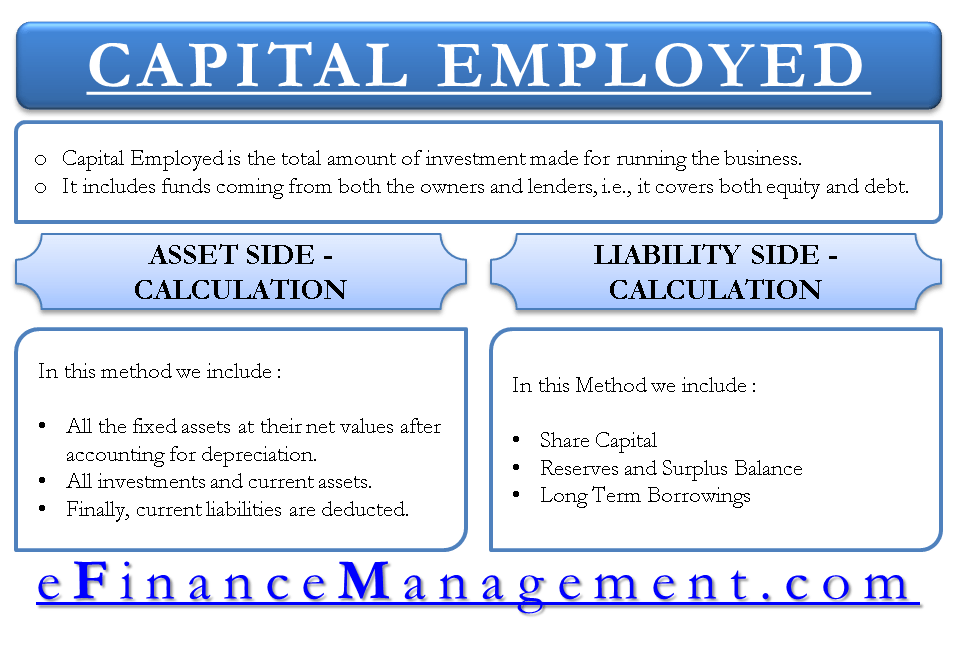

Paid in capital

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Paid in capitalSplit between assets, liabilities, and equity, a company’s balance sheet provides for metric analysis of a capital structure. Debt financing provides a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing p…

Idle time vs overtime in cost accounting?

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Idle time vs overtime in cost accounting?The New York Department of Labor website may have additional specific information on wage laws in the state. $9.00 an hour for employers with four or more employees. The Nebraska Department of Labor website may have additional specific information on…

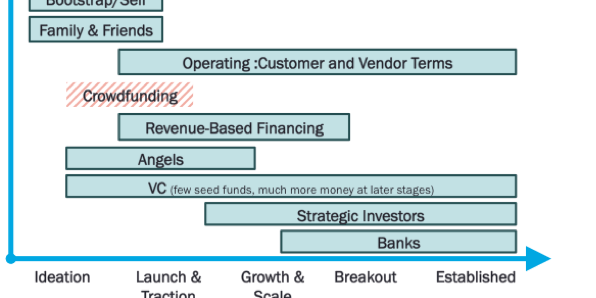

IT Equipment

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on IT EquipmentHere are a few types of costs for new business owners to consider. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash you’ll require….

FINAL ACCOUNTS OF NON-TRADING ORGANIZATIONS

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on FINAL ACCOUNTS OF NON-TRADING ORGANIZATIONSA non-operating expense is an expense incurred from activities unrelated to core operations. Non-operating expenses are deducted from operating profits and accounted for at the bottom of a company’s income statement. Examples of non-operating expense…

The cost of sales

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The cost of salesOperating expenses include marketing, rental and administrative expenses. Discontinued operations refer to sold or shuttered business units….

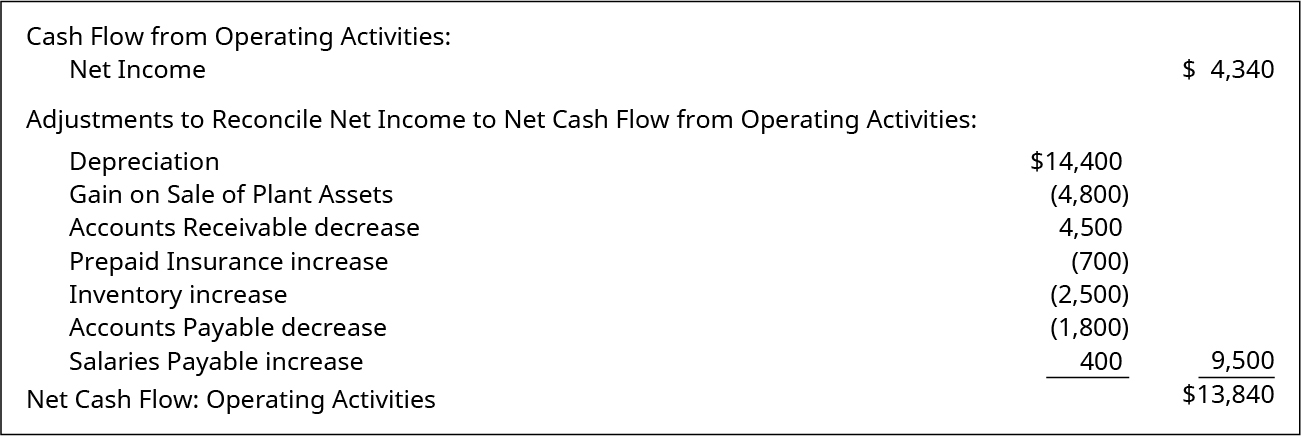

Cash Flow from Operating Activities

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow from Operating ActivitiesMany line items in the cash flow statement do not belong in the operating activities section. This increase would have shown up in operating income as additional revenue, but the cash had not yet been received by year end. Thus, the increase in recei…