Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities). To calculate tangible book value, we must subtract the balance sheet value of intangibles from common equity and then divide the result by shares outstanding.

What is the difference between book value and net book value?

Net book value is the amount at which an organization records an asset in its accounting records. Net book value is calculated as the original cost of an asset, minus any accumulated depreciation, accumulated depletion, accumulated amortization, and accumulated impairment.

Spotting Creative Accounting on the Balance Sheet

Book value of an asset refers to the value of an asset when depreciation is accounted for. The book value of assets and shares are the value of these items in a company’s financial records.

Depreciation is used to record the declining value of buildings and equipment over time. Amortization is used to record the declining value of intangible assets such as patents. The carrying value, or book value, is an asset value based on the company’s balance sheet, which takes the cost of the asset and subtracts its depreciation over time.

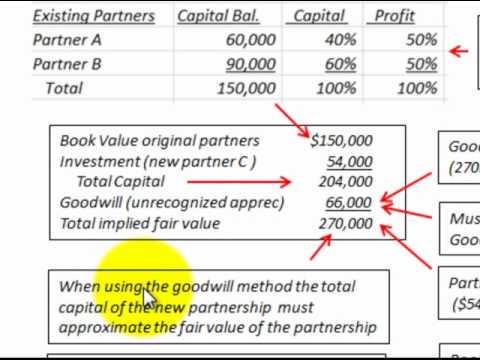

Intangible assets, such as goodwill, are assets that you can’t see or touch. Intangible assets have value, just not in the same way that tangible assets do; you cannot easily liquidate them. By calculating tangible book value we might get a step closer to the baseline value of the company. It’s also a useful measure to compare a company with a lot of goodwill on the balance sheet to one without goodwill.

Assets net book value is negative and depreication is charged in Positive,

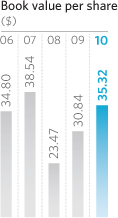

The carrying value of an asset is based on the figures from a company’s balance sheet. Both depreciation and amortization expenses can help recognize the decline in the value of an asset as the item is used over time. An even better approach is to assess a company’s tangible book value per share (TBVPS). Tangible book value is the same thing as book value except it excludes the value of intangible assets.

How to Evaluate a Company’s Balance Sheet

Specifically, it compares the company’s stock price to its book value per share (BVPS). The market capitalization (company’s value) is its share price multiplied by the number of outstanding shares. The book value is the total assets – total liabilities and can be found in a company’s balance sheet. In other words, if a company liquidated all of its assets and paid off all its debt, the value remaining would be the company’s book value. A good measure of the value of a stockholder’s residual claim at any given point in time is the book value of equity per share (BVPS).

It calculates total company assets minus intangible assets and liabilities. Net book value can be very helpful in evaluating a company’s profits or losses over a given time period.

Most commonly, book value is the value of an asset as it appears on the balance sheet. This is calculated by subtracting the accumulated depreciation from the cost of the asset. It is an established accounting practice that an asset is held based on its original costs, even if the market value of the asset has changed considerably since its purchase. Measuring book value is figured as the net asset value of a company calculated as total assets minus intangible assets and liabilities.

- It is an established accounting practice that an asset is held based on its original costs, even if the market value of the asset has changed considerably since its purchase.

- Most commonly, book value is the value of an asset as it appears on the balance sheet.

However, in practice, depending on the source of the calculation, book value may variably include goodwill, intangible assets, or both. The value inherent in its workforce, part of the intellectual capital of a company, is always ignored. When intangible assets and goodwill are explicitly excluded, the metric is often specified to be “tangible book value”. The term book value derives from the accounting practice of recording asset value at the original historical cost in the books.

A corporation’s book value is used in fundamental financial analysis to help determine whether the market value of corporate shares is above or below the book value of corporate shares. Neither market value nor book value is an unbiased estimate of a corporation’s value. The corporation’s bookkeeping or accounting records do not generally reflect the market value of assets and liabilities, and the market or trade value of the corporation’s stock is subject to variations. The book value per share is a market value ratio that weighs stockholders’ equity against shares outstanding. In other words, the value of all shares divided by the number of shares issued.

These values can be found in the company’s balance sheet and accounting tools such as journals and ledgers. An asset’s book value is equal to its carrying value on the balance sheet, and companies calculate it netting the asset against its accumulated depreciation.

Free Financial Statements Cheat Sheet

While the book value of an asset may stay the same over time by accounting measurements, the book value of a company collectively can grow from the accumulation of earnings generated through asset use. Since a company’s book value represents the shareholding worth, comparing book value with market value of the shares can serve as an effective valuation technique when trying to decide whether shares are fairly priced. The P/B ratio compares a company’s market capitalization, or market value, to its book value.

Book value can also be thought of as the net asset value of a company calculated as total assets minus intangible assets (patents, goodwill) and liabilities. For the initial outlay of an investment, book value may be net or gross of expenses such as trading costs, sales taxes, service charges and so on. When an asset is initially acquired, its carrying value is the original cost of its purchase.

To continue with the Walmart example, the value of goodwill on the balance sheet is $20.6 billion (we are assuming the only intangible asset material to this analysis is goodwill). Again, we would want to examine the trend in the ratio over time and compare it to similar companies to assess relative value. Book value (also known as net book value) is the total estimated value that would be received by shareholders in a company if it were to be sold or liquidated at a given moment in time.

AccountingTools

The fair value of an asset is usually determined by the market and agreed upon by a willing buyer and seller, and it can fluctuate often. In other words, the carrying value generally reflects equity, while the fair value reflects the current market price.

Monthly or annual depreciation, amortization and depletion are used to reduce the book value of assets over time as they are “consumed” or used up in the process of obtaining revenue. These non-cash expenses are recorded in the accounting books after a trial balance is calculated to ensure that cash transactions have been recorded accurately.

In accounting, book value is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made against the asset. Traditionally, a company’s book value is its total assets minus intangible assets and liabilities.