You can calculate payment amounts using the straight-line amortization method if you know the total value of the loan including interest and its length. Mortgage repayment constitutes amortization because the bank loses its claim to the loan, and thus loses an intangible financial asset. Accountants like the straight line method because it is easy to use, renders fewer errors over the life of the asset, and expenses the same amount everyaccounting period.

Notice that the effect of this journal is to post the interest of 4,249 to the interest expense account. In the straight line amortization method, the bond’s carrying value changes each period while the bond interest expense each period remains the same. This displays a changing interest rate when the carrying value fluctuates each period while interest remains the same.

This amount is applied as an expense each year rather than entered as a one-time expense because it provides a long-term benefit for the company. For example, something like manufacturing equipment – a tangible asset – has long-term benefits for a company. Now, say some manufacturing machinery will benefit a business for five years.

AccountingTools

Thus, the accounting handbooks advise to only use this rule when the results do not differ significantly from the effective interest method. With effective interest method, the bond payable and discount/premium is calculated using the effective market interest rate versus the coupon rate used in straight-line method. Below is the amortization schedule for this bond issue using effective interest.

The table below shows how this example bond would be accounted for over the full 10-year period. Note that the only static figure is the amount of cash interest — interest expense and amortization are different in every single year. Over time, the carrying amount of the bonds is slowly reduced to $100,000 due to the amortization of the premium each year. Each year, the company will have to pay $8,000 in cash interest (coupon rate of 8% X $100,000 in face value). In addition, it will also record a charge for the amortization of the discount.

Simply divide the cost of the patent by the number of years that the patent will be useful. In this example, the amount is $10,000 divided by 10 to get a cost of $1,000 per year that you apply to your accounting documents.

Say your company purchased a patent for $10,000, and its useful life is 10 years. To calculate depreciation of that patent, an intangible asset, you use the straight-line amortization method.

- Notice that the effect of this journal is to post the interest of 4,249 to the interest expense account.

- The straight line bond amortization method is one method of amortizing the premium or discount on bonds payable over the term of the bond, the alternative more acceptable method is the effective interest rate method.

- As before, the final bond accounting journal would be to repay the face value of the bond with cash.

Unlike more complex methodologies, such asdouble declining balance, straight line is simple and only uses three different variables to calculate the amount of depreciation each accounting period. At the end of the eachaccounting period, Tiger would record a journal entry by debiting interest expense for $4,772 and crediting discount on bonds payable for $772 and cash for $4,000.

This graph shows the monthly cash interest payments allocated in to the total interest payment (the static $30,000) and $8,790 that is amortized from bond discount. As you can see, the figures remain the same throughout the 6 payment periods due to the straight-line amortization method. Below, you will see the numbers will change for the effective interest method because we will be amortizing the discount on bonds payable at effective market interest rate, instead of a constant rate. The straight-line amortization method is one of the simplest methods to use to account for the cost of intangible assets. To use this method, you need to know the cost of the asset and its useful life.

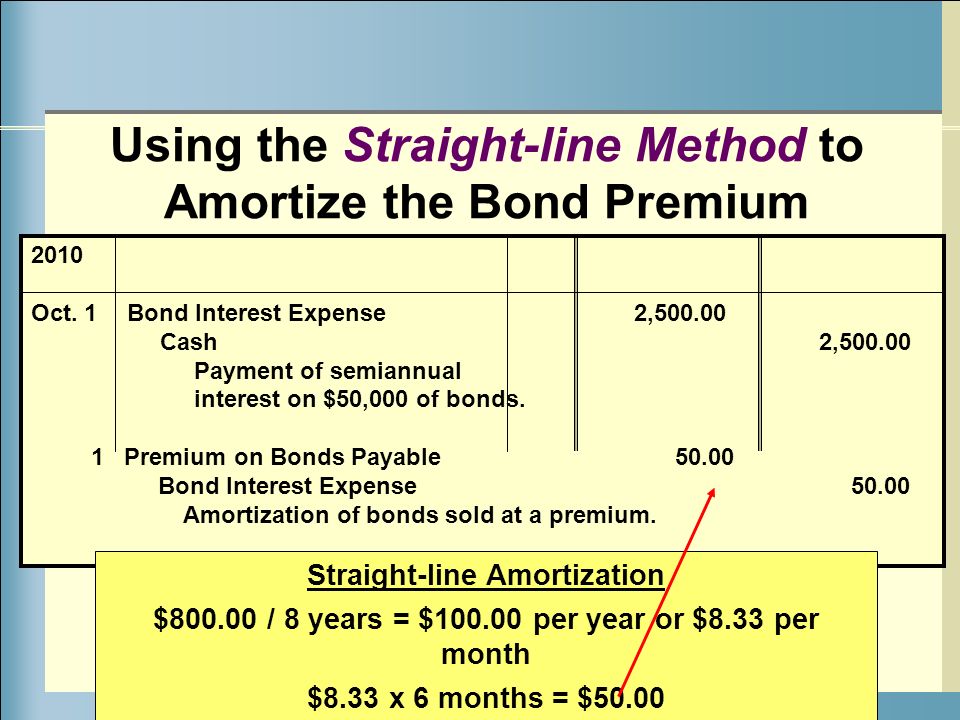

Notice that the effect of this journal is to post the interest calculated in the bond amortization schedule to the interest expense account. From the bond amortization schedule, we can see that at the end of period 4, the ending book value of the bond is reduced to 120,000, and the premium on bonds payable has been amortized to interest expense. The final bond accounting journal would be to repay the par value of the bond with cash. The straight line amortization method is one method of calculating how the premium or discount on bonds payable should be amortized to the interest expense account over the lifetime of the bond.

What is Straight Line Amortization?

Intangible assets include patents, trademarks, copyrights, research and development, brand name recognition, company goodwill and certain proprietary business methodologies. These things provide a benefit for a business but are not physical products that can be touched or spent. The company incurs a $38,790 bond interest expense each period but only pays out $30,000 in cash because the remaining $8,790 will be repaid when the bond becomes due. This $8,790 credit to Discount on Bonds Payable account increases the bonds’ carrying value because it is a contra-asset account, which is subtracted from the Bond Payable account. The below table shows the decreases in the Discount on Bond Payable along with increase in bond’s carrying value each period.

This annual amortization amount is the discount on the bonds ($10,000) divided by the 10-year life of the bond, or $1,000 per year. Thus, the company will record $9,000 of interest expense, of which $8,000 is cash and $1,000 is the amortization of the discount. Straight line amortization is always the easiest way to account for discounts or premiums on bonds. Under the straight line method, the premium or discount on the bond is amortized in equal amounts over the life of the bond. Though straight-line amortization applies to bonds in the investment industry, the method can technically apply to any situation in which a person or a company must make uniform payments over a set period of time.

Depreciation is a way for companies to account for the costs of assets over a period of time rather than all at once on their financial statements. Unlike depreciation, which applies to tangible assets, amortization applies to intangible assets. Straight-line amortization is one of the simplest methods, dividing the cost of assets equally over the time that they are used.

Systematically moving the same amount each accounting period from a balance sheet account to an income statement account. If the amount of discount is significant, the effective interest method of amortization should be used. It’s a common accounting tool used alongside depreciation when an asset is being expensed over the years. When it comes to bonds, amortization is an adjustment used to account for the difference between the bond’s stated interest rate and the amount for which the company actually sold it.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

The straight line bond amortization method is one method of amortizing the premium or discount on bonds payable over the term of the bond, the alternative more acceptable method is the effective interest rate method. As before, the final bond accounting journal would be to repay the face value of the bond with cash.

Rather than accounting for the total cost of the machinery on the balance sheet all at once, the cost can be allocated over the five-year period. This way, the cost is balanced against the benefit that is acquired from the machinery over time. The same thing can be done for intangible assets and is referred to as amortization rather than depreciation.