How it works: You divide the cost of an asset, minus its salvage value, over its useful life. That determines how much depreciation you deduct each year. Example: Your party business buys a bouncy castle for $10,000….

Amortization Expense Definition

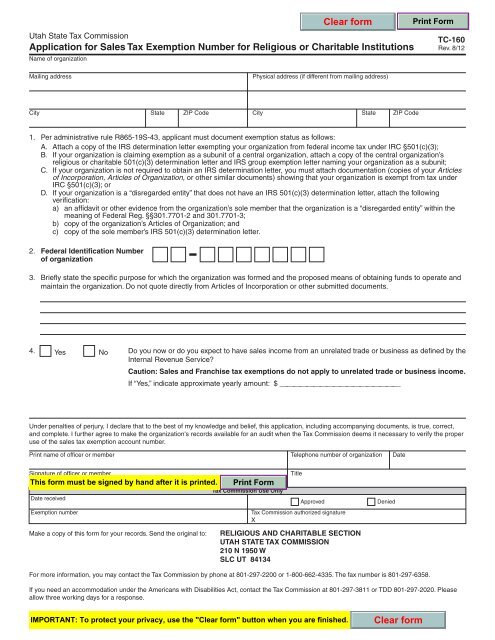

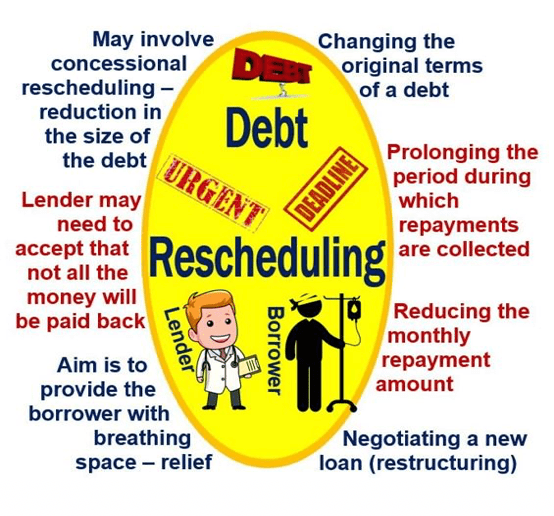

Posted on Posted on: 02.11.2021 Modified on: 11.01.2022Categories Bookkeeping 101Refinancing the loan can help you save a lot of money in the monthly loan amortizations. In computer science, amortized analysis is a method of analyzing the execution cost of algorithms over a sequence of operations. This information may include lin…

Project Accounting Software For Services

Posted on Posted on: 29.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Another important thing to keep in mind when it comes to project-based accounting is that accuracy is key—this includes timesheets and resource allocation. Brainy…

Accounting Cycle Guide

Posted on Posted on: 29.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101Once the cycle concludes, steps are taken to begin the next accounting cycle. Once a transaction is recorded as a journal entry, it should post to an account in the general ledger. The general ledger provides a breakdown of all accounting activities …

What Are The Purpose Of A Post Closing Trial Balance?

Posted on Posted on: 28.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101Each entry causes a difference between the adjusted and post-closing trial balances. That way, you are prepared to enter accurate information into the financial statements….

Contra Asset Definition

Posted on Posted on: 28.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101Therefore, the depreciation of the equipment increases by approximately $50,000 for each year of use. This method uses the initial purchase value and subtracts the accumulated depreciation value for the time period to result in the total value of the…

Accounting Debit & Credit Rules

Posted on Posted on: 28.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101As you can see above, if you increase an asset account, it will require a debit, but if you increase a liability account, it will require a credit. The cost of goods sold of $2,800 decreases the inventory, and is therefore a credit entry. It will hav…

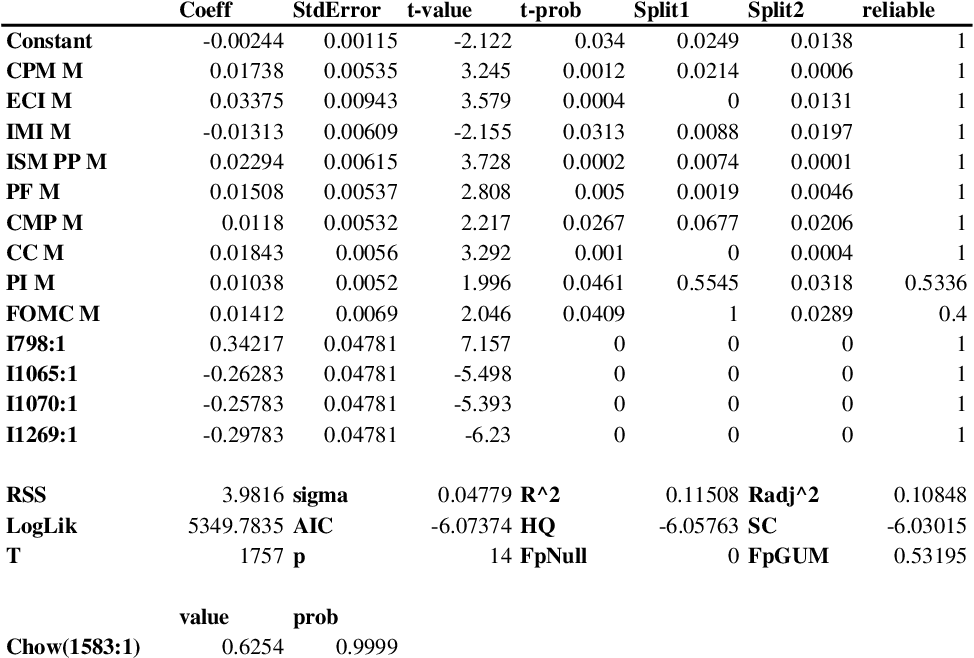

Degree Of Financial Leverage Dfl

Posted on Posted on: 27.10.2021 Modified on: 11.01.2022Categories Bookkeeping 101Financial leverage ratios, sometimes called equity or debt ratios, measure the value of equity in a company by analyzing its overall debt picture. … In other words, the financial leverage ratios measure the overall debt load of a company and compar…

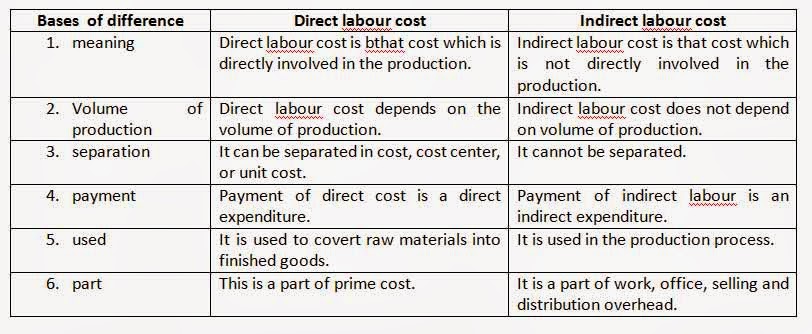

What does Manufacturing Overhead include?

Posted on Posted on: 23.09.2021 Modified on: 11.01.2022Categories Business Accounting Blog Leave a comment on What does Manufacturing Overhead include?This account includes both direct costs and indirect costs. Direct costs are pretty straightforward – they include money you had to pay for materials and money you had to pay your workers to work. All the indirect costs for the production process its…

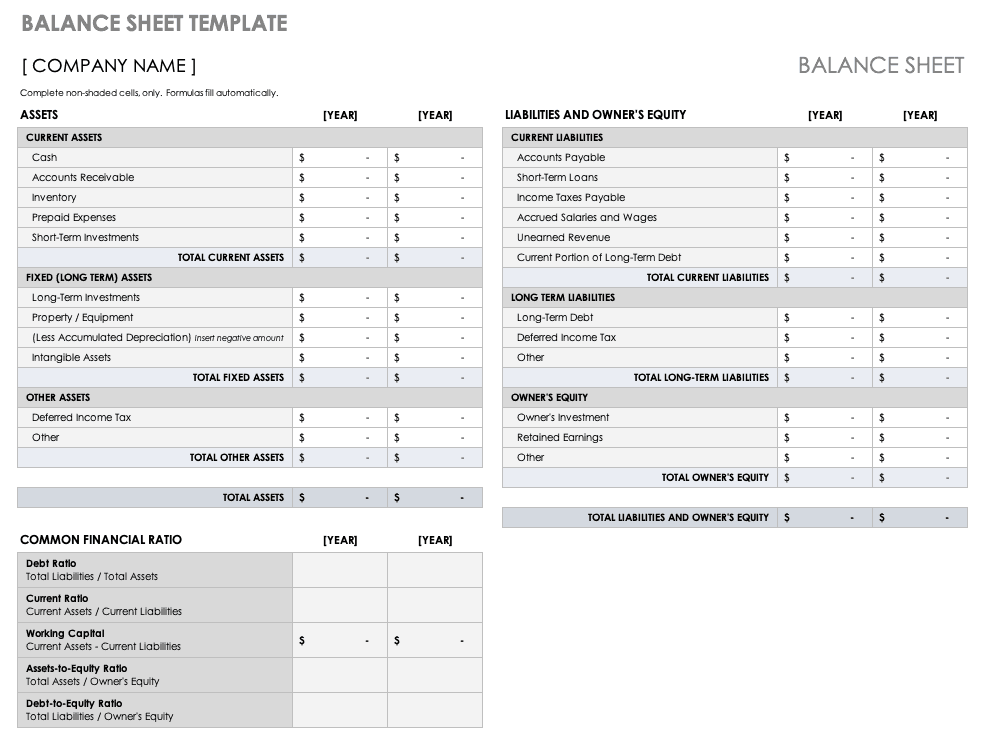

What are Charts of Accounts in Bookkeeping?

Posted on Posted on: 16.09.2021 Modified on: 11.01.2022Categories Business Accounting Blog Leave a comment on What are Charts of Accounts in Bookkeeping?For instance, say you paid $10,000 for marketing during one particular month. Accordingly, the ‘marketing expenses’ will be listed as ‘-$10,000’ for that month’s balance. There are more financial transactions you’ll have to write up that may or may n…