Therefore, the aim of the tutor’s investigation is to examine whether these independent variables – revision time and IQ – result in a change in the dependent variable, the students’ test scores. However, it is also worth noting that whilst this is t…

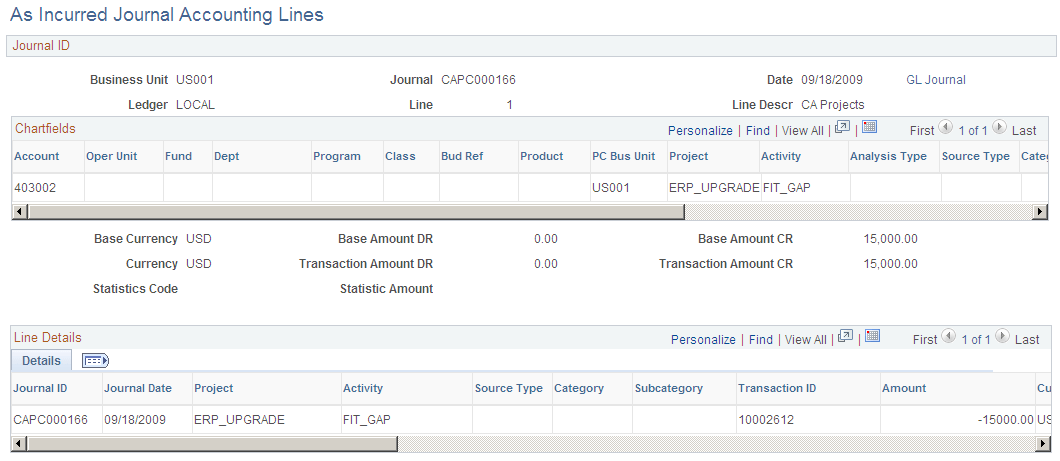

What are the meanings between 'incur' and 'occur' in accounting?

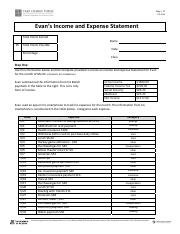

Posted on Posted on: 02.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are the meanings between 'incur' and 'occur' in accounting?It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period. Incurred Losses — the total amount of paid claims and loss reserves associated with a particular time pe…

Why do single people have to pay more taxes? : NoStupidQuestions

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Why do single people have to pay more taxes? : NoStupidQuestionsThe rate on the first $9,700 of taxable income would be 10%, then 12% on the next $29,775, then 22% on the final $10,525 falling in the third tax bracket. This is because marginal tax rates only apply to income that falls within that specific bracket…

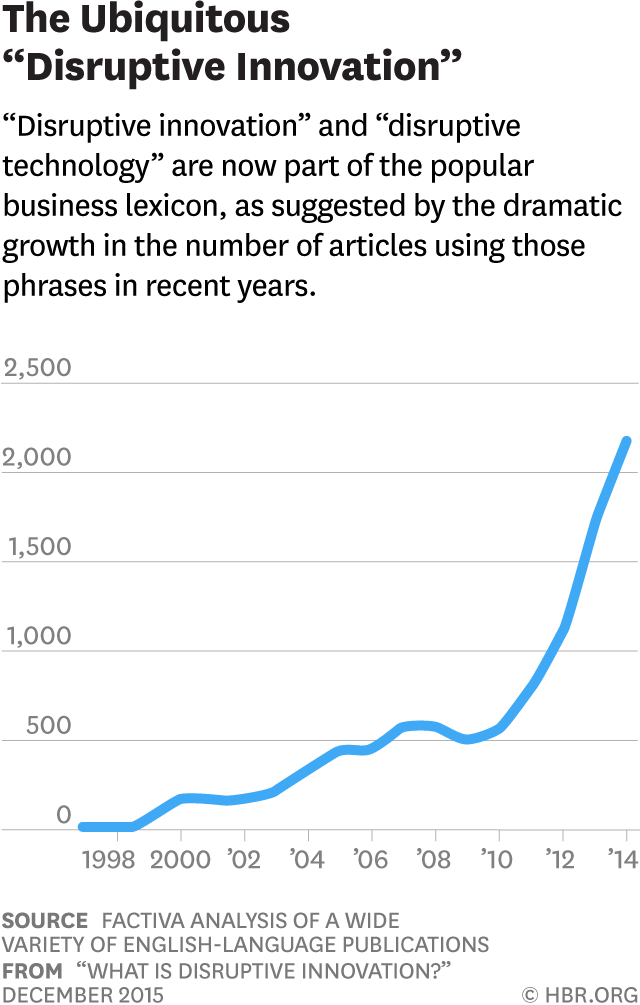

Incremental Synonyms & Antonyms

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Incremental Synonyms & AntonymsBoth the revenue and direct costs are therefore relevant for the incremental analysis. A sunk cost is a cost which a business has already incurred and which cannot be recovered in the future. As these historical costs cannot change, they should not b…

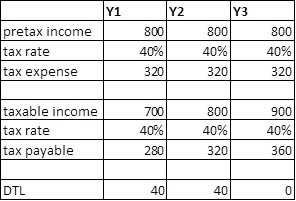

Income Taxes Payable

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Income Taxes PayableA temporary difference is the difference between the asset or liability provided on the tax return (tax basis) and its carrying (book) amount in the financial statements. This difference will result in a taxable or deductible amount in the future….

Do You Record Income Tax Expenses in Journal Entries?

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do You Record Income Tax Expenses in Journal Entries?This can be done with the help of accounting standards like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standard (IFRS). In this method, the deferred income tax amount is based on tax rates in effect when the…

What’s the difference between operating income and gross income?

Posted on Posted on: 01.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What’s the difference between operating income and gross income?Also known as gross profit, gross income doesn’t include expenses such as salaries, income taxes and office supplies. Gross profit is used to figure out a company’s gross margin, which measures how efficiently your company is producing and distributi…

What does the status “In Transit” mean?

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What does the status “In Transit” mean?I am a Canadian citizen and I will be travelling from Calgary to Delhi via London and will have a 19 hour layover in London. During this time I would like to visit my cousin in London. I would like your advise if I can go out during this time. If so …

The Difference Between Cash Transfers & In-Kind Benefits

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Difference Between Cash Transfers & In-Kind Benefitsadjective. paid or given in goods, commodities, or services instead of money: in-kind welfare programs. paying or returning something of the same kind as that received or offered….

How to Calculate Loan Payments with Excel PMT Function

Posted on Posted on: 29.05.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Loan Payments with Excel PMT FunctionThough personal loans are not tax deductible, other types of loans are. Interest paid on mortgages, student loans, and business loans often can be deducted on your annual taxes, effectively reducing your taxable income for the year. If you pay money …