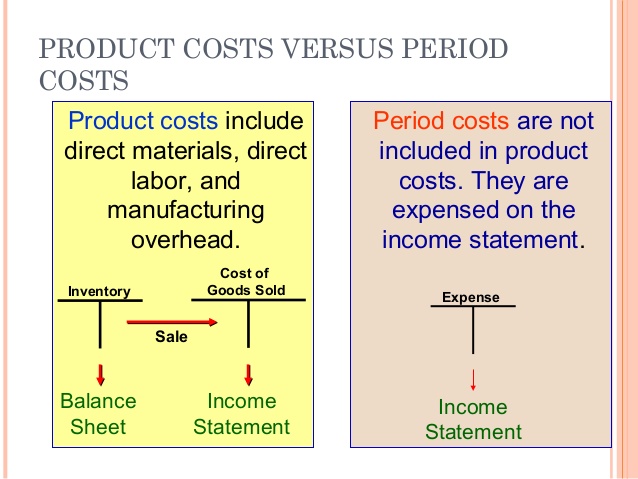

If a product is unsold, the product costs will be reported as inventory on the balance sheet. When the product is sold, its cost is removed from inventory and will be included on the income statement as the cost of goods sold. Prime costs are the cos…

Discontinued Operations: Its Impact on Financial Reporting

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Discontinued Operations: Its Impact on Financial ReportingIn financial accounting, discontinued operations refer to parts of a company’s core business or product line that have been divested or shut down and that are reported separately from continuing operations on the income statement. Each of the above i…

Heritage interpretation

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Heritage interpretationThe remaining part of the Roman Empire, in the eastern Mediterranean, continued as what came to be called the Byzantine Empire. Centuries later, a limited unity would be restored to western Europe through the establishment in 962 of a revived “Roman …

Gross Income Allocation Sample Clauses

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Gross Income Allocation Sample ClausesIf the tax return preparer is not consulted during the drafting phase, the tax return preparer should consult with the drafter(s) of a partnership agreement when necessary to clarify any ambiguities therein, including the issues raised in this articl…

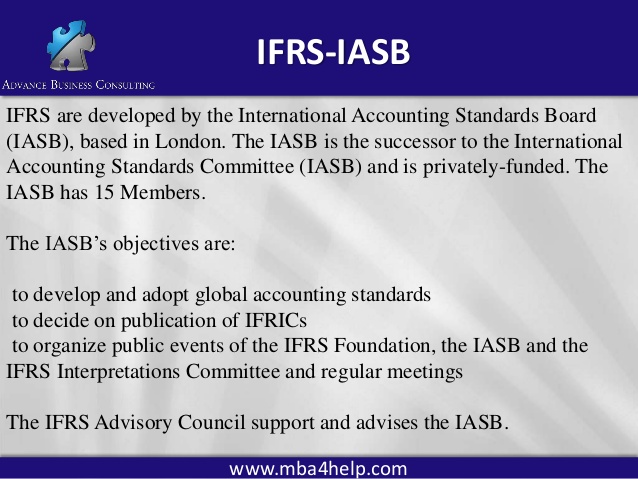

IFRS vs. U.S. GAAP: What’s the Difference?

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on IFRS vs. U.S. GAAP: What’s the Difference?The basic purpose of the IASB Framework is to provide assistance and guidance to the IASB in developing new or revised standards in addition to assisting the preparers of financial statements in applying the standards and dealing with issues which ar…

10 Quick Ways to Drive Organic Growth

Posted on Posted on: 05.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 10 Quick Ways to Drive Organic GrowthThese four strategies each leverage new or existing products or markets in order to help the company grow. In this case, they will need to determine if the new market fits their target market, or the population in which they want to sell their produc…

Year-to-date

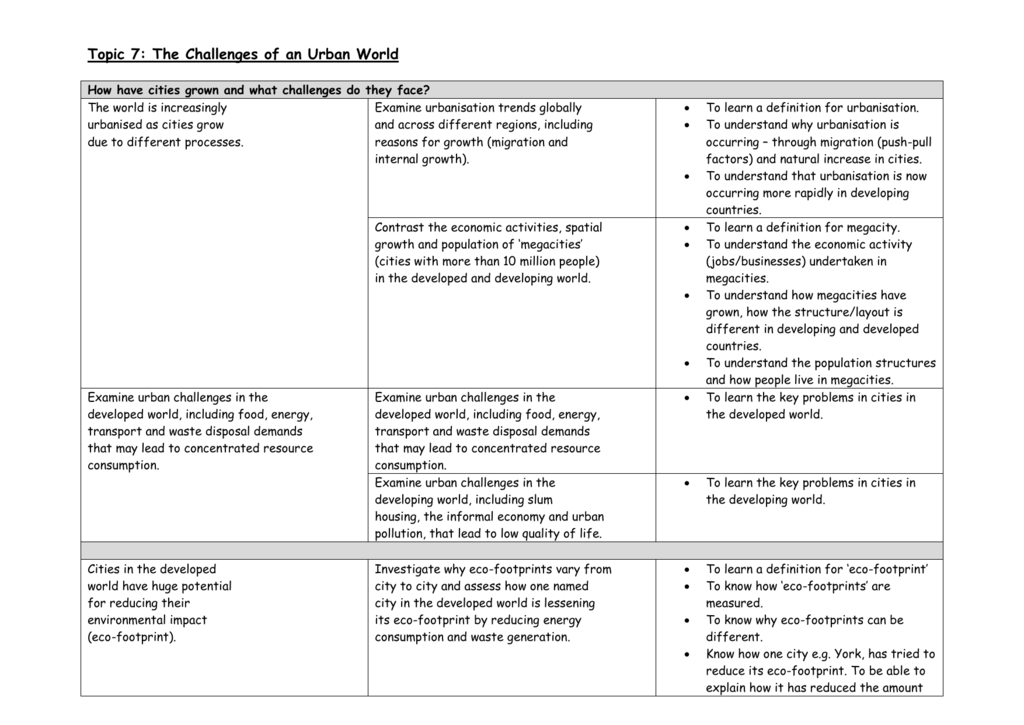

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Year-to-dateUnlike annual statements, interim statements do not have to be audited. Interim statements increase communication between companies and the public and provide investors with up-to-date information between annual reporting periods. A financial stateme…

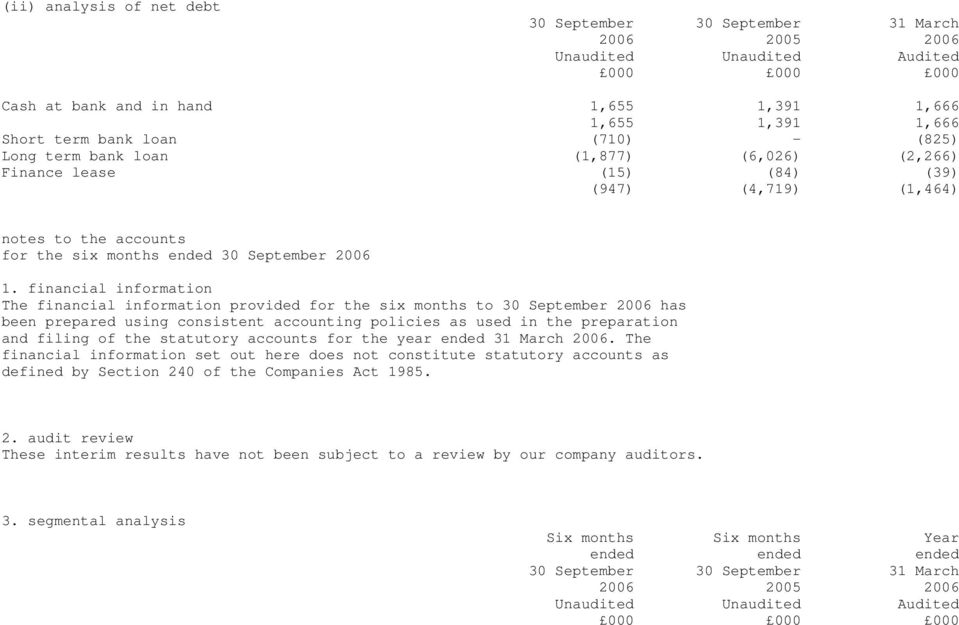

interest revenues definition and meaning

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on interest revenues definition and meaningIt is a line item and is generally recorded separately from interest expense in the income statement. This income is taxable as per IRS and the ordinary tax rate is applicable for this income. Under the accrual basis of accounting, the Interest Reven…

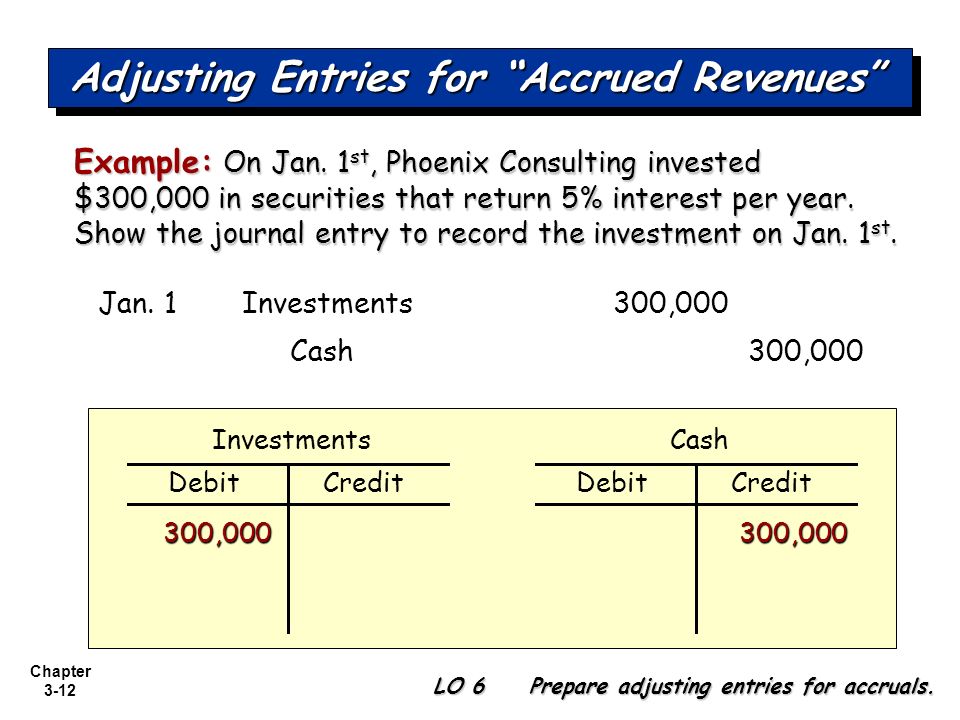

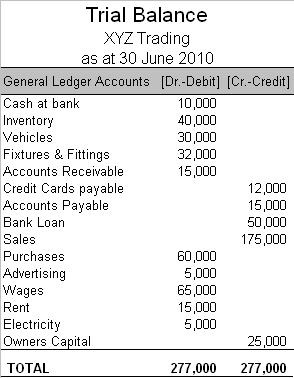

The Five Types of Accounts in Accounting

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Five Types of Accounts in AccountingAn interest expense is the cost incurred by an entity for borrowed funds. Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings – bonds, loans, convertible debt or lines of credit….

Adjusting Entries: Does Your Small Business Need Them?

Posted on Posted on: 04.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Adjusting Entries: Does Your Small Business Need Them?To illustrate the difference between interest expense and interest payable, let’s assume that a company borrows $200,000 on November 1 at an annual interest rate of 6%. The company is required to pay each month’s interest on the 15th day of the follo…