Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property…

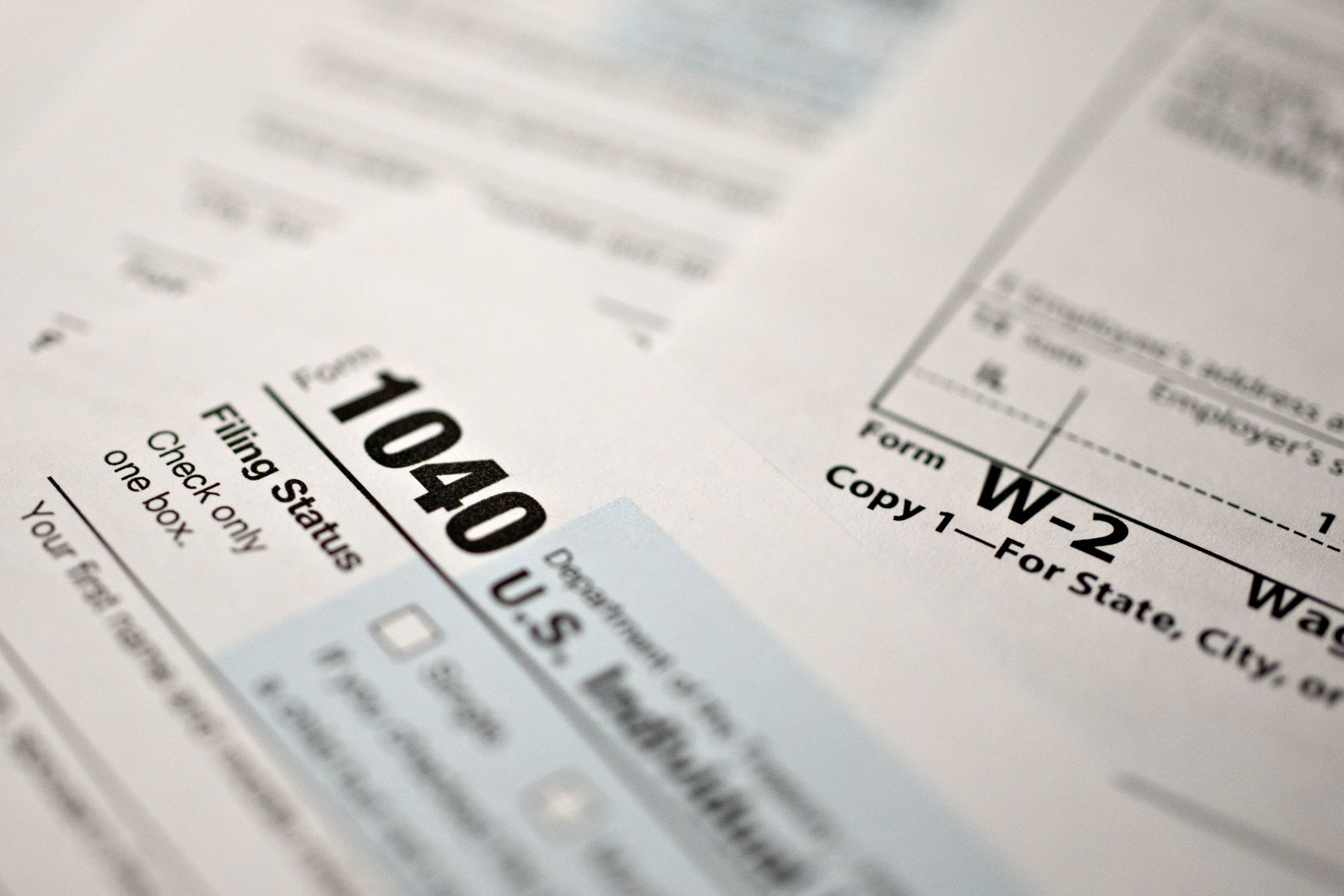

The “New” IRS Independent Contractor Test – The More Things Change The More They Stay The Same

Posted on Posted on: 10.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The “New” IRS Independent Contractor Test – The More Things Change The More They Stay The SameWithholding of tax on wages includes income tax, social security and medicare, and a few taxes in some states. Certain minimum amounts of wage income are not subject to income tax withholding. Wage withholding is based on wages actually paid and empl…

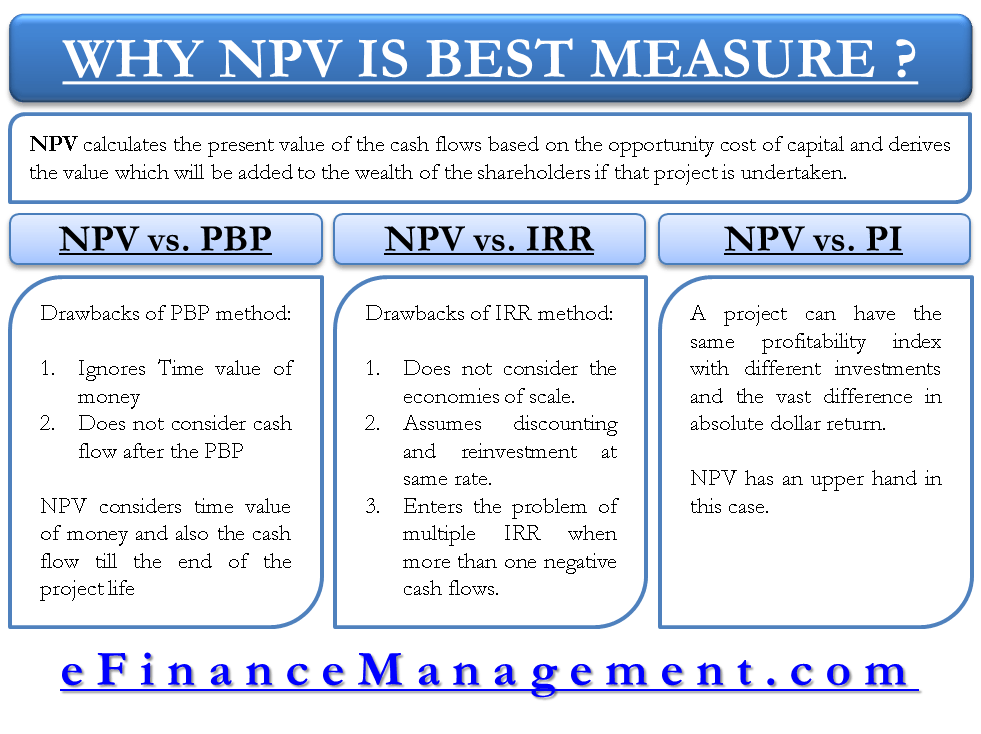

What condition makes the value of IRR greater than 100%?

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What condition makes the value of IRR greater than 100%?Further information about potential problems with the IRR method (compared to NPV) may be obtained from most finance textbooks. One major problem with IRR is the possibility of obtaining multiple rates of return (multiple “roots”) when solving for th…

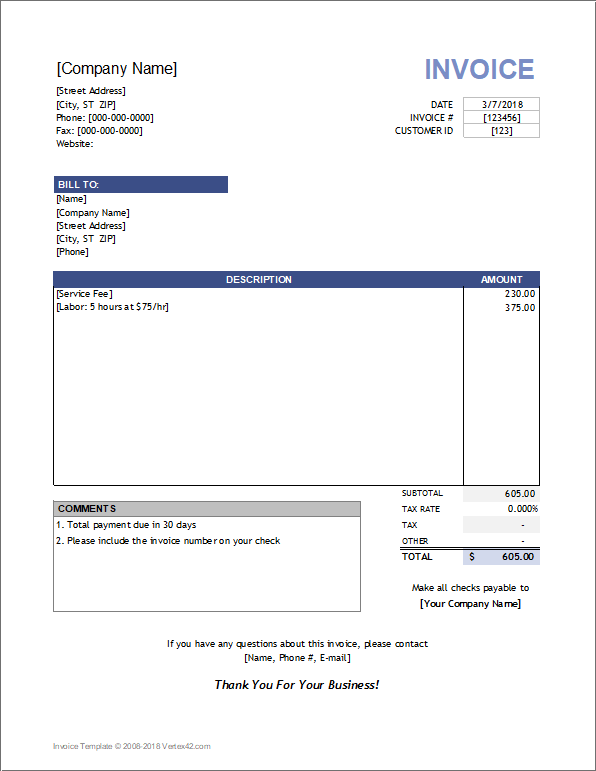

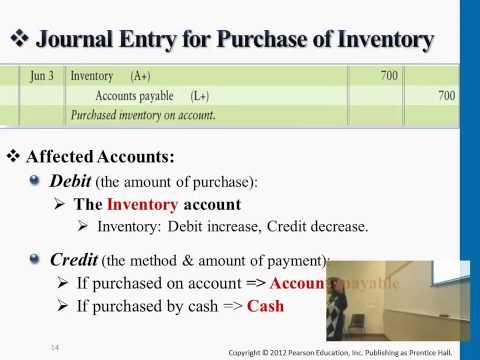

Invoice Examples for Every Kind of Business

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Invoice Examples for Every Kind of BusinessOn the other hand, when a company makes a payment for items purchased on credit, this results in a debit to accounts payable (decrease). A report that lists the accounts and amounts that are debited for a group of invoices entered into the accounting…

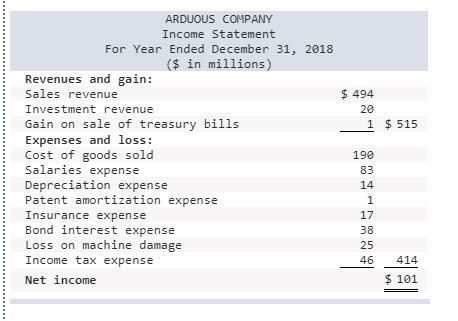

Understanding the Difference Between Revenue vs. Profit

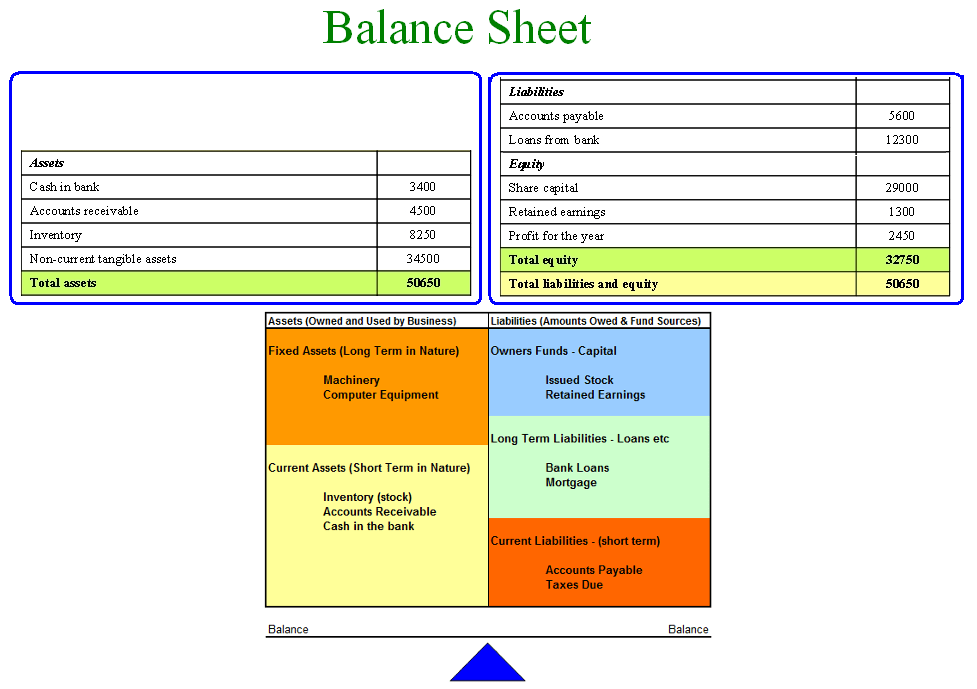

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding the Difference Between Revenue vs. ProfitBalance sheet is prepared based on transactions and transactions can take place only between two entities. For this purpose, promoter/s are considered as entity/ies separate from business. Having shown business as a separate entity in the balance she…

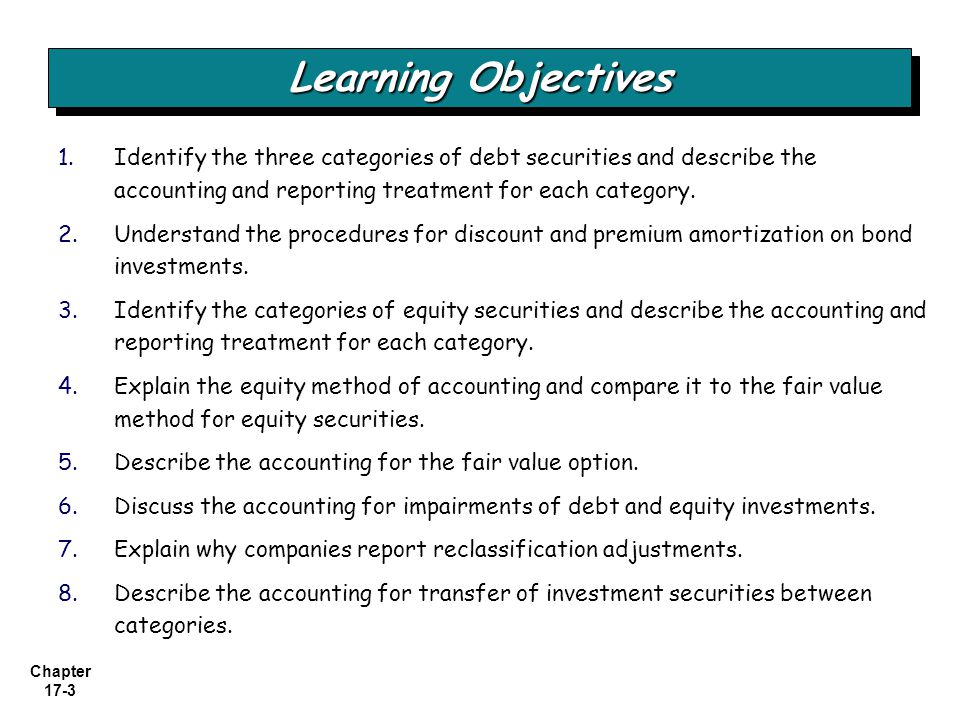

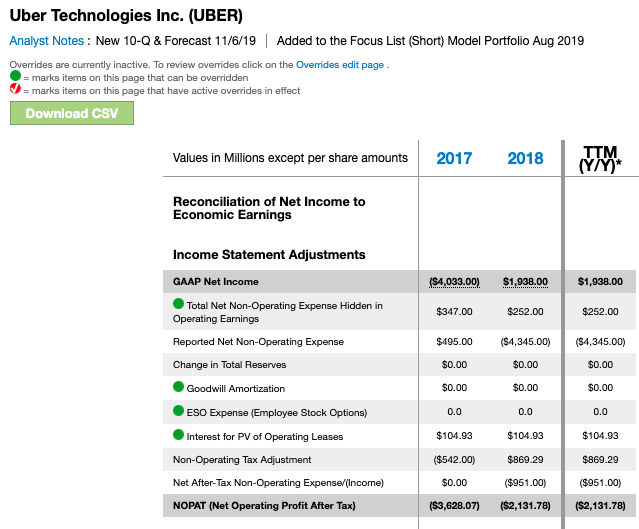

The Classification of Investments

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Classification of InvestmentsSo, the accounting choices made by investing companies when making investments in financial assets can have a major effect on its financial statements. The more your assets outweigh your liabilities, the larger your investors’ equity. It’s easy to in…

Cost Center Definition

Posted on Posted on: 09.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cost Center DefinitionIf you want to identify your cost centers and know how they fit within your economics, then download your free guide here. When you divide your company into profit centers, it allows you to delegate responsibility to decentralized units and treat the…

11 Types of Inventory / Stock

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 11 Types of Inventory / StockInventory is needed to calculate cost of goods sold on a business tax form. Inventory costs reduce business income and business taxes. This is the end-of-year inventory done by many retailers….

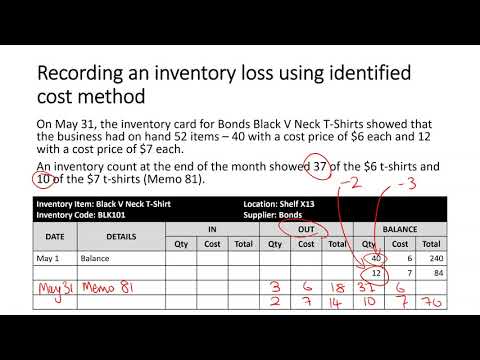

How to Account for the Value of Finished Goods Inventory

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Account for the Value of Finished Goods InventoryUnder FIFO/LIFO cost systems, the unit cost of an item is the value of one receipt in one layer, selected by the FIFO or the LIFO rule. Each receipt or assembly completion creates either a new layer for each organization. For a specified job number, …

Inventory Shrinkage in Retail: 4 Tips to Prevent It

Posted on Posted on: 08.06.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Inventory Shrinkage in Retail: 4 Tips to Prevent ItIt’s done by charging it to the cost of goods sold or by balancing the obsolete inventory allowance in the books. If you lose inventory to theft, or because a fire, flood or other disaster damaged your business, you can claim your loss as a tax deduc…