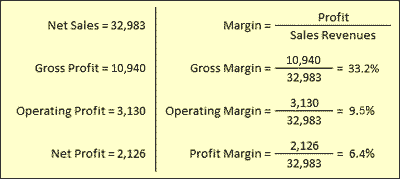

Net income is the portion of a company’s revenues that remains after it pays all expenses. Owner’s equity is the difference between the company’s assets and liabilities. It is the owner’s share of the proceeds if you were to liquidate the company tod…

The difference between income and assets

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The difference between income and assetsBoth the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities. Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as i…

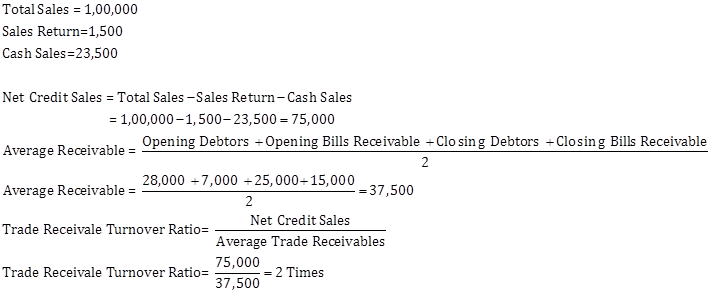

How to Figure Out Cash Sales From Financial Statements

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Figure Out Cash Sales From Financial StatementsAlso, there may be production-related expenses (such as facility rent) even when there is no production at all, as would be the case when there is a union walkout. In these cases, it is possible for there to be a cost of goods sold expense even in th…

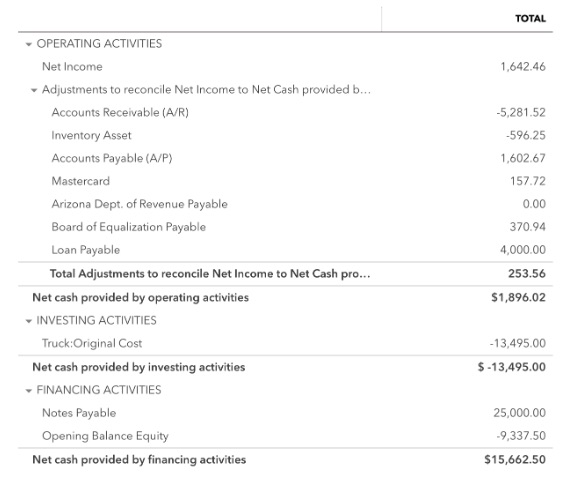

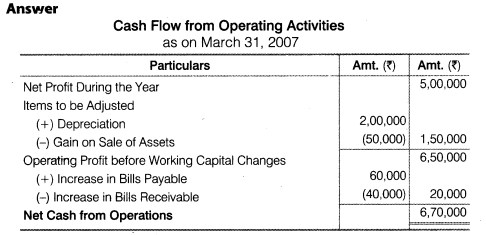

What Are Investing Activities? How to Report Investment Activities on the Cash Flow Statement

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are Investing Activities? How to Report Investment Activities on the Cash Flow StatementIf it’s coming from normal business operations, that’s a sign of a good investment. If the company is consistently issuing new stock or taking out debt, it might be an unattractive investment opportunity. The company engaged in a number of financing …

Cash Flow From Financing Activities – CFF Definition

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow From Financing Activities – CFF DefinitionCash flow from financing activities (CFF) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. Financing activities include transactions involving debt, equity, and dividends….

How Can I Calculate the Carrying Value of a Bond?

Posted on Posted on: 08.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Can I Calculate the Carrying Value of a Bond?Your account books don’t always reflect the real-world value of your business assets. The carrying value of an asset is the figure you record in your ledger and on your company’s balance sheet. The carrying amount is the original cost adjusted for fa…

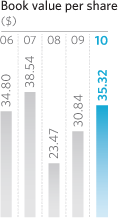

Book Value Per Share Financial Ratio

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Book Value Per Share Financial RatioNet book value is the amount at which an organization records an asset in its accounting records. Net book value is calculated as the original cost of an asset, minus any accumulated depreciation, accumulated depletion, accumulated amortization, and …

How to Calculate Net Income From Retained Earnings

Posted on Posted on: 07.07.2020 Modified on: 03.03.2022Categories Bookkeeping 101 Leave a comment on How to Calculate Net Income From Retained EarningsThe net income applicable to common shares figure on an income statement is the bottom-line profit belonging to the common stockholders, who are the ultimate owners, a company reported during the period being measured. (To get the basic earnings per …

How Much Less Do Nonprofit CEOs Get Paid Than For-Profit CEOs?

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Much Less Do Nonprofit CEOs Get Paid Than For-Profit CEOs?Which of the following statements is not correct with respect to contributions to a private not-for-profit? A) Contributions to a not-for-profit are recorded at fair market value at the date of receipt….

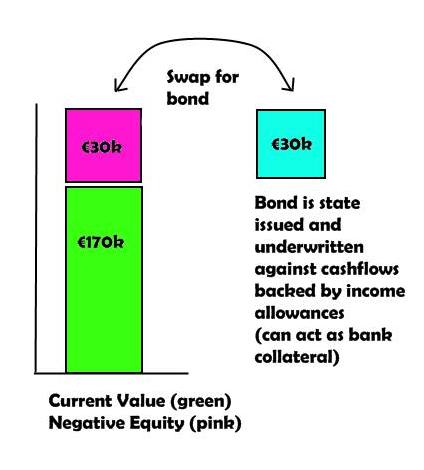

Negative Shareholders Equity

Posted on Posted on: 07.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Negative Shareholders EquityIt’s debit balance will reduce the owner’s capital account balance and the owner’s equity. The drawing account’s purpose is to report separately the owner’s draws during each accounting year. Since the capital account and owner’s equity accounts are …