There are many accounting software options that are great for managing everything from your sales invoices to maintaining income statements and balance sheets. This software allows you to keep and edit notes on specific clients, which is accessible t…

Nonprofit Financial Statements

Posted on Posted on: 10.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Nonprofit Financial StatementsA board-only organization typically has a self-selected board and a membership whose powers are limited to those delegated to it by the board. The Model Nonprofit Corporation Act imposes many complexities and requirements on membership decision-makin…

What is non-monetary reward? definition and meaning

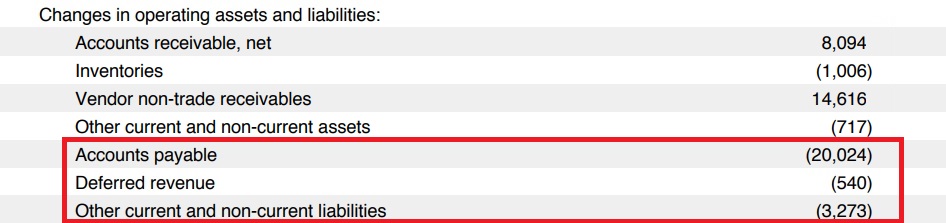

Posted on Posted on: 10.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is non-monetary reward? definition and meaningExamples of monetary assets include cash, accounts receivable, notes receivable, and investments. Examples of monetary liabilities include accounts payable, notes payable, sales taxes payable, and various accrued expenses. Assets and liabilities that…

Periodic Interest Rate Definition

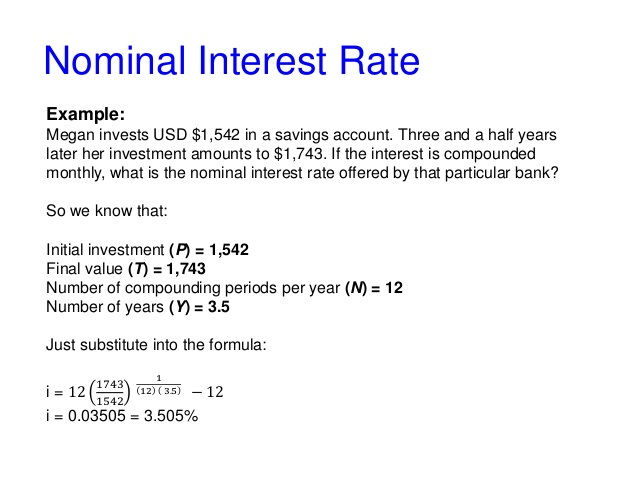

Posted on Posted on: 10.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Periodic Interest Rate DefinitionA real rate of return is the annual percentage return realized on an investment, which is adjusted for changes in prices due to inflation or other external factors. Adjusting the nominal return to compensate for factors such as inflation allows you t…

Net Operating Income: What is it? How Do You Calculate it?

Posted on Posted on: 10.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Net Operating Income: What is it? How Do You Calculate it?If you want to easily calculate your NOI, use our free NOI calculator. Cap rate, short for capitalization rate, is a return on investment metric. It is a calculation used to determine the profitability of a real estate investment. Simply put, the cap…

Does U.S. GAAP prefer FIFO or LIFO accounting?

Posted on Posted on: 10.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Does U.S. GAAP prefer FIFO or LIFO accounting?The methods are not actually linked to the tracking of physical inventory, just inventory totals. This does mean a company using the FIFO method could be offloading more recently acquired inventory first, or vice-versa with LIFO. However, in order fo…

Difference Between Fair Value & Net Realizable Value

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Fair Value & Net Realizable ValueEvery business has to keep a close on its inventory and periodically access its value. The reason for that is there are several negative impacts like damage of inventory, obsolescence, spoilage etc. which can affect the inventory value in a negative …

Recording a Cost of Goods Sold Journal Entry

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Recording a Cost of Goods Sold Journal EntryThis means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded. The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current ma…

$27,500 (Income Tax Calculator) California

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on $27,500 (Income Tax Calculator) CaliforniaFor every exemption claimed on your W-4 form, you will subtract the current rate from your gross income. The concepts of gross and net income have different meanings, depending on whether a business or a wage earner is being discussed. For a company,…

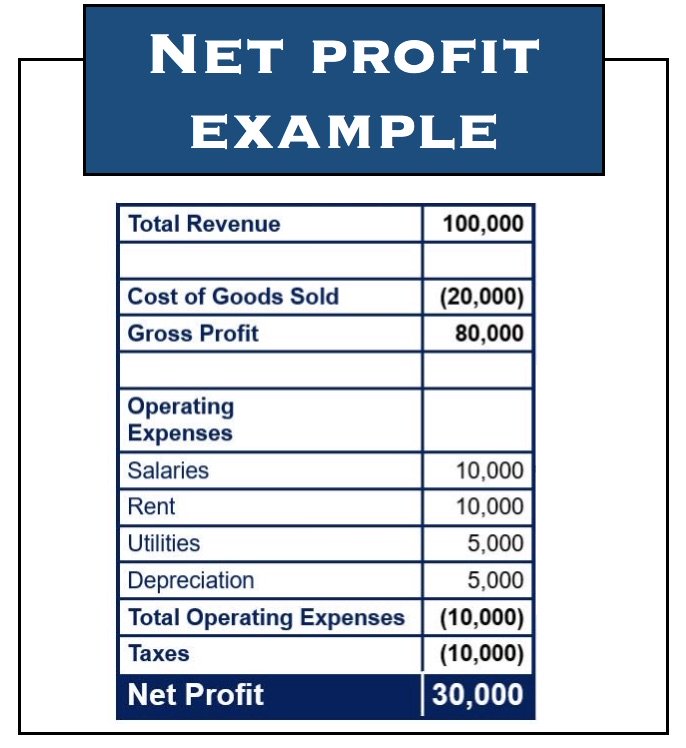

P&L — Profit & Loss Statement — Definition & Example

Posted on Posted on: 09.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on P&L — Profit & Loss Statement — Definition & ExampleThe top line of the P&L statement isrevenue, or the total amount of income from the sale of goods or services associated with the company’s primary operations. Deducting expenses for the running of the business, such as rent, cost of goods, freig…