Some of this subjectivity is trivial, such as a preference for coffee over tea. Such trivial subjectivity either does not impact the validity of research or can be consciously dismissed if relevant to a study….

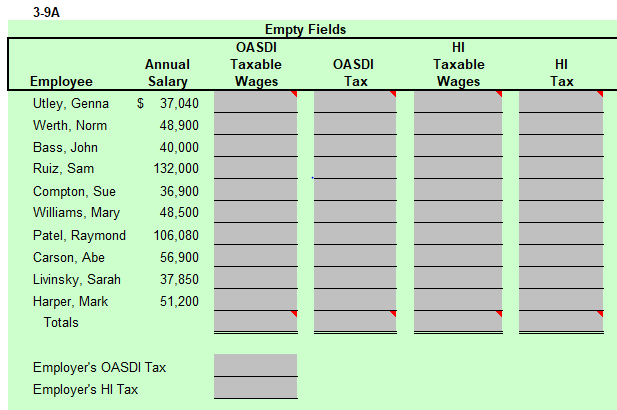

Who Is Exempt from Paying Social Security Tax?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Who Is Exempt from Paying Social Security Tax?If you work for one employer and it withholds an incorrect amount of Social Security taxes, you need to ask your employer to correct its error and refund the overpayment. You generally cannot claim the overpayment on your income tax return and receiv…

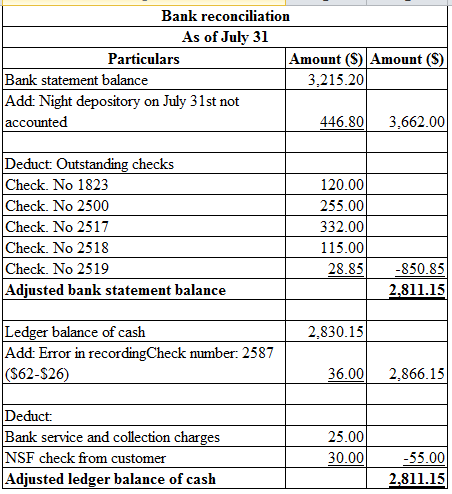

What is a checking account?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a checking account?By doing this, they help you avoid incurring any charges—especially if you use the funds right away. You’re responsible for any checks you deposit, so you’ll have to repay any funds you use if the check bounces after you’ve taken the money….

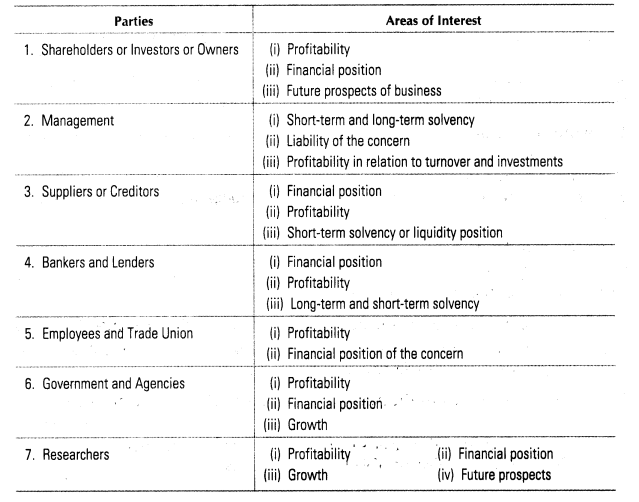

Ten Common Notes to the Financial Statements

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Ten Common Notes to the Financial StatementsThe notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the comp…

What Is a Capital Asset?

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Is a Capital Asset?Accounts receivable usually appear on balance sheets below short-term investments and above inventory. Receivables can be classified as accounts receivables, notes receivable and other receivables ( loans, settlement amounts due for non- current asse…

Abnormal Spoilage

Posted on Posted on: 14.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Abnormal SpoilageNormal spoilage is the standard amount of waste or scrap that is caused by production, and which is difficult to avoid. For example, stamping parts out of a sheet of metal will inevitably result in some of the metal being rendered unusable. Abnormal …

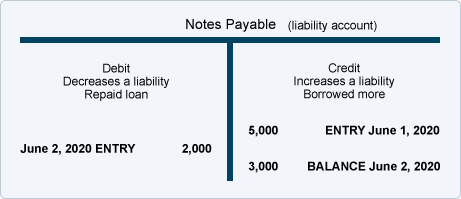

What are the account categories, their normal balances, and how do they affect financial statements?

Posted on Posted on: 13.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are the account categories, their normal balances, and how do they affect financial statements?Since both are on the debit side, they will be added together to get a balance on $24,000 (as is seen in the balance column on the January 9 row). On January 12, there was a credit of $300 included in the Cash ledger account….

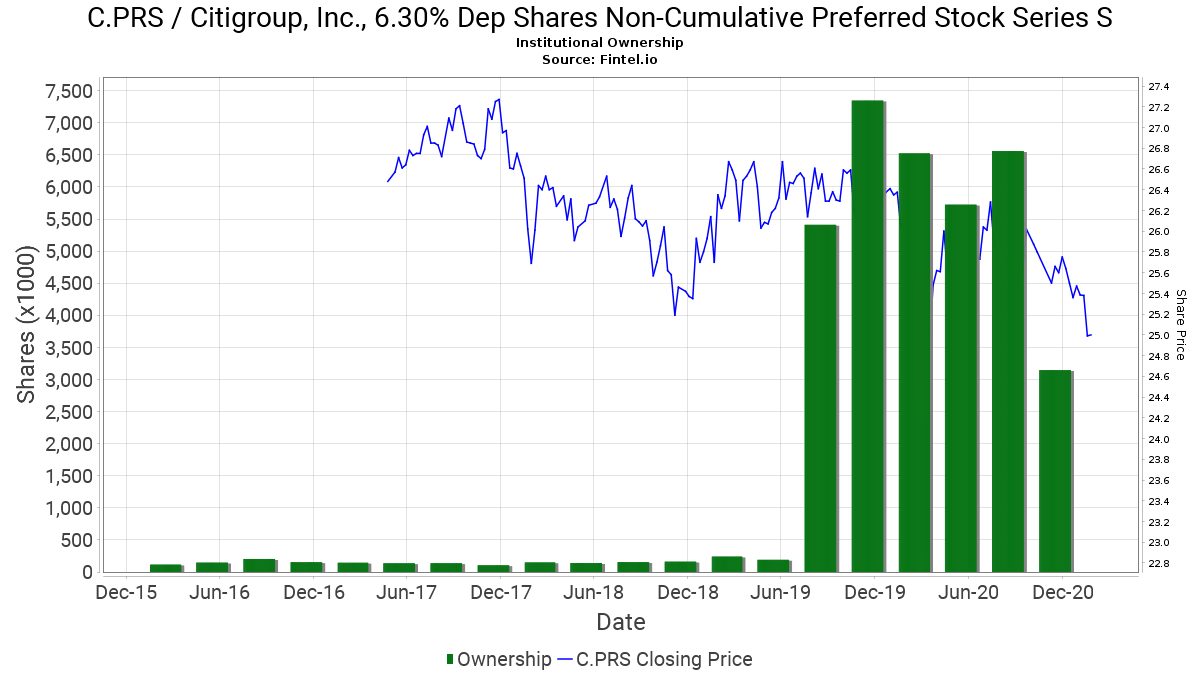

What are the different types of preference shares?

Posted on Posted on: 13.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are the different types of preference shares?Because they are subject to scrutiny by investors, stock companies tend to focus more than mutuals on short-term results. Stock insurers are also likely to invest in higher-yielding (and riskier) assets than mutual companies. The main difference betw…

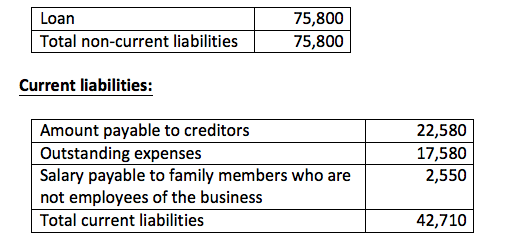

What are current assets and liability?

Posted on Posted on: 13.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are current assets and liability?The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. Noncu…

Callable Preferred Stock Definition

Posted on Posted on: 13.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Callable Preferred Stock DefinitionHowever, the relative move of preferred yields is usually less dramatic than that of bonds. Companies also use preferred stocks to transfer corporate ownership to another company. For one thing, companies get a tax write-off on the dividend income of…