However, EBIDA is not often used by analysts, who instead opt for either EBITDA or EBIT. Understanding Earnings Before Interest, Depreciation and Amortization (EBIDA) There are various ways to calculate EBIDA, such as adding interest, depreciation, a…

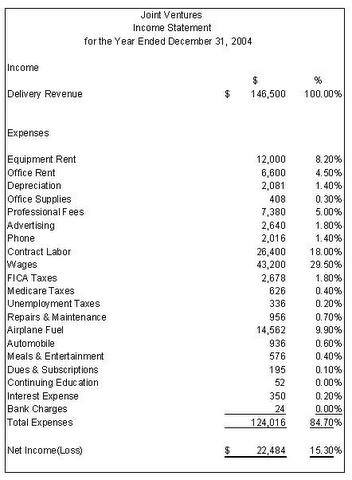

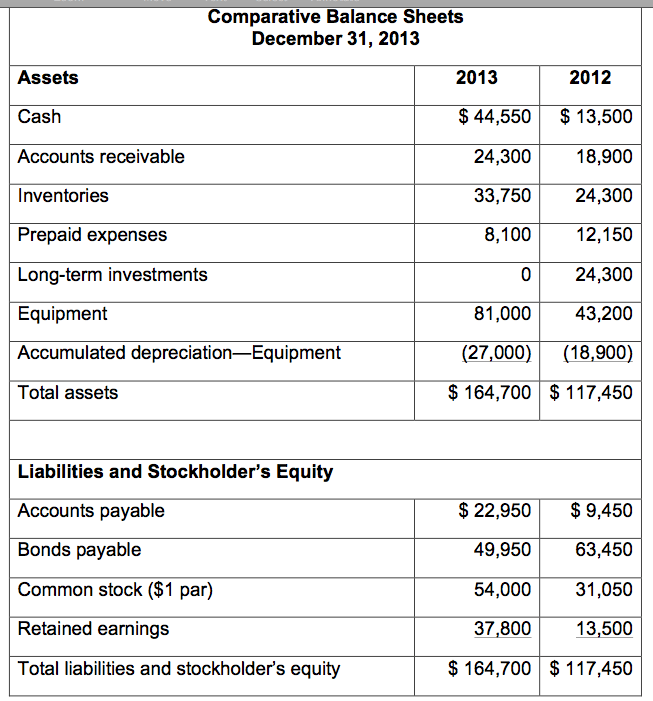

Do Salary Expenses Go on a Balance Sheet?

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do Salary Expenses Go on a Balance Sheet?Operating and non-operating expenses are listed in different sections of a firm’s income statement. At the top the income statement, the cost of goods sold is subtracted from revenues to find the gross profit….

When Does A Hobby Become A Business?

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on When Does A Hobby Become A Business?The NOL can generally be used to offset the company’s tax payments in other tax periods through an Internal Revenue Service (IRS) tax provision called a loss carryforward. A net operating loss (NOL) is a valuable asset because it can lower a company’…

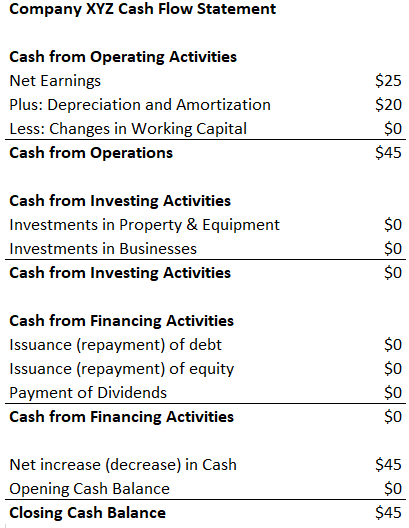

Cash Flow from Investing Activities

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow from Investing ActivitiesThere is typically an operating activities section of a company’s statement of cash flows that shows inflows and outflows of cash resulting from a company’s key operating activities. Capital expenses are treated differently for business taxes purpose…

Par bond

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Par bondSay, an investor purchases a bond for $950 and another investor purchases the same bond for $1,020. On the bond’s maturity date, both of the investors will be repaid $1,000 par value of the bond. Some states require that companies cannot sell shares …

Using Debit and Credit: Golden Rules of Accounting, Concepts, Examples

Posted on Posted on: 16.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Using Debit and Credit: Golden Rules of Accounting, Concepts, ExamplesImproving your credit scores takes time, but the sooner you address the issues that might be dragging them down, the faster your credit scores will go up. Having bad credit presents serious problems with your personal finances, so it’s important to k…

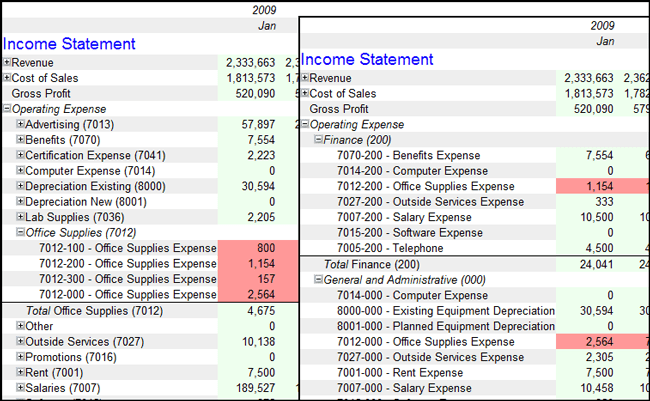

Easily Manage Business Expense Records

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Easily Manage Business Expense RecordsThe cost you can expense includes the cost to buy and set up the item. Office supplies are tangible objects that aid in the operation of your business. Office expenses can include electronic equipment, such as a computer, printer or fax machine….

OEM definition and meaning

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OEM definition and meaningTo answer this question, we’ll need to compare OEM vs. aftermarket parts in depth. Economies of scale mean the competitive leverage a larger company usually has over a smaller company. With OEMs, companies can benefit from the economies of scale of h…

Planned obsolescence

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Planned obsolescenceFew design elements highlight so clearly the design tradeoffs to be made between present and future costs. However, this approach conflicts with traditional facilities budgeting and procurement, which focus on first cost alone, preventing the effecti…

Validity and objectivity of tests

Posted on Posted on: 15.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Validity and objectivity of testsFurther, such tax services could be a violation of other SEC rules on auditor independence, where, for example, the firm represents the audit client before tax court or federal court of claims. An accounting firm is prohibited from providing to an au…