GDP (gross domestic product) is the most popular measure of national output. The main challenge in using this method is how to avoid counting the same product more than once. Output is the result of an economic process that has used inputs to produce…

How do I identify outliers in Likert-scale data before getting analyzed using SmartPLS?

Posted on Posted on: 20.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How do I identify outliers in Likert-scale data before getting analyzed using SmartPLS?It is justifiable to exclude ‘outlier’ data points from statistical analysis for significance level of 0.005 or less according R.A. However, choosing a value of significance level for outlier detection is one of the problems. The second problem is th…

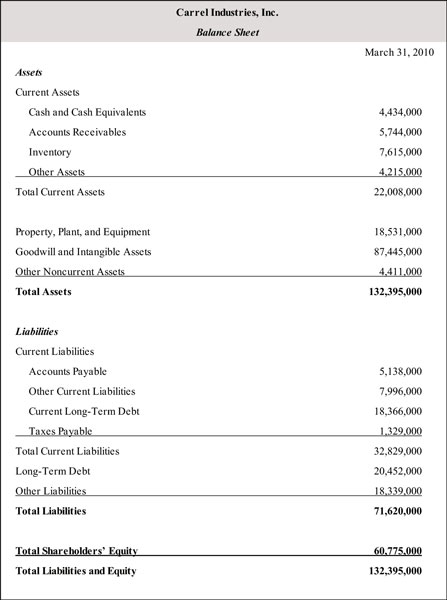

Noncurrent liabilities

Posted on Posted on: 20.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Noncurrent liabilitiesTechnically, a negative liability is a company asset, and so should be classified as a prepaid expense. A negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Unearned revenue…

Asset Definition and Example

Posted on Posted on: 20.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Asset Definition and ExampleCurrent assets consist of cash and cash equivalents, which is generally the first line item on the asset side of the balance sheet when a balance sheet is prepared based on liquidity. Cash equivalents are generally commercial papers that a company in…

Is a house an asset or liability?

Posted on Posted on: 20.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is a house an asset or liability?Cash equivalents are generally commercial papers that a company invest which is as liquid as cash. Other current assets are accounts receivables which the amount of money the company owes from the debtors to whom they have sold their goods on credit….

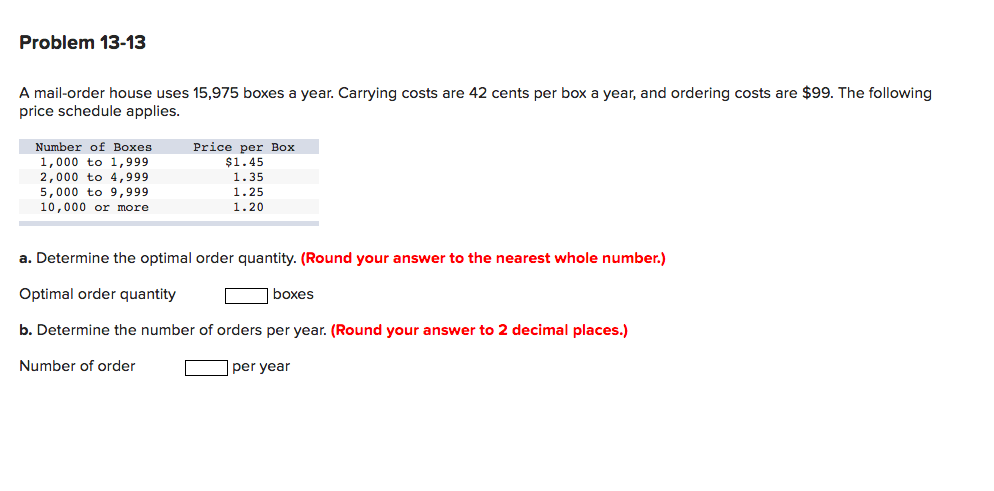

What Are the Limitations of Activity Based Costing

Posted on Posted on: 20.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Are the Limitations of Activity Based CostingActivity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, a…

What is the double declining balance method of depreciation?

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is the double declining balance method of depreciation?New hardware runs faster, uses less energy and provides more cores every year, likewise SaaS platforms often employ rapid upgrade cycles with a constant influx of improvements. In that context it doesn’t make sense to sink money into technology that …

Fixed cost

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Fixed costIf you pay someone a mix of fixed salary plus commission, then they represent both fixed and variable costs. The cost of inventory is the “carrying cost” of holding and storing inventory over a certain period of time. It’s calculated to determine the…

Opportunity

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OpportunityEven clipping coupons versus going to the supermarket empty-handed is an example of an opportunity cost unless the time used to clip coupons is better spent working in a more profitable venture than the savings promised by the coupons. Opportunity co…

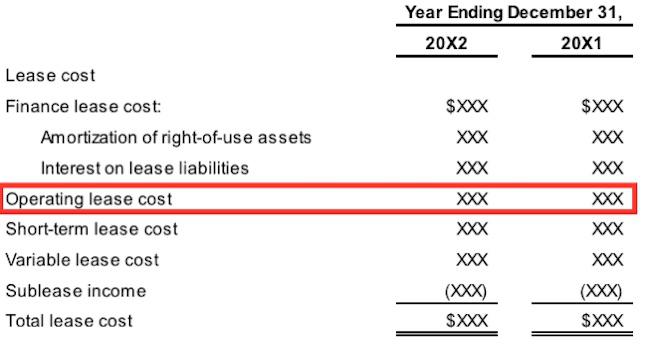

Capitalized Lease Method Definition

Posted on Posted on: 17.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Capitalized Lease Method DefinitionIt guarantees the lessee, also known as the tenant, use of an asset and guarantees the lessor, the property owner or landlord, regular payments for a specified period in exchange. Both the lessee and the lessor face consequences if they fail to uphol…