Sunk cost dilemma describes the decision of whether to stick with a project you’ve invested in that has not yet achieved desired results. In a financial sense, a line can be drawn between sunk costs and other costs you incur that have no immediate be…

Disadvantages of Partnership: Everything You Need to Know

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Disadvantages of Partnership: Everything You Need to KnowWithin a partnership, members are vulnerable to unlimited liability for their overall actions. Every partner is personally liable for any company debts and responsibilities. If the company lacks the assets to cover an organizational debt, then credit…

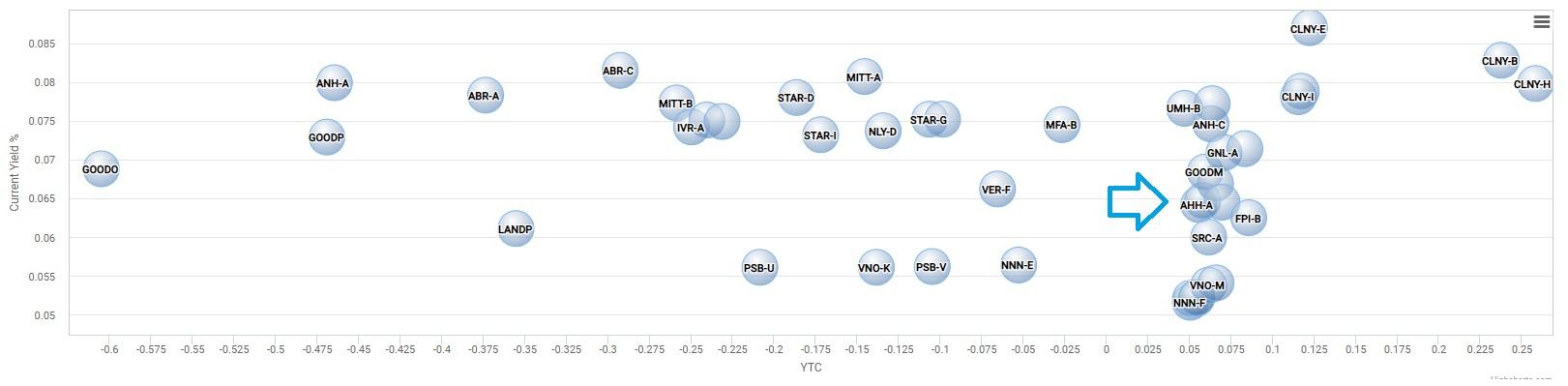

What Happens to a Preferred Stock in a Buyout?

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Happens to a Preferred Stock in a Buyout?For example, a bond with a par value of $1,000 can be redeemed at maturity for $1,000. This is also important for fixed-income securities such as bonds or preferred shares because interest payments are based on a percentage of par. So, an 8% bond wit…

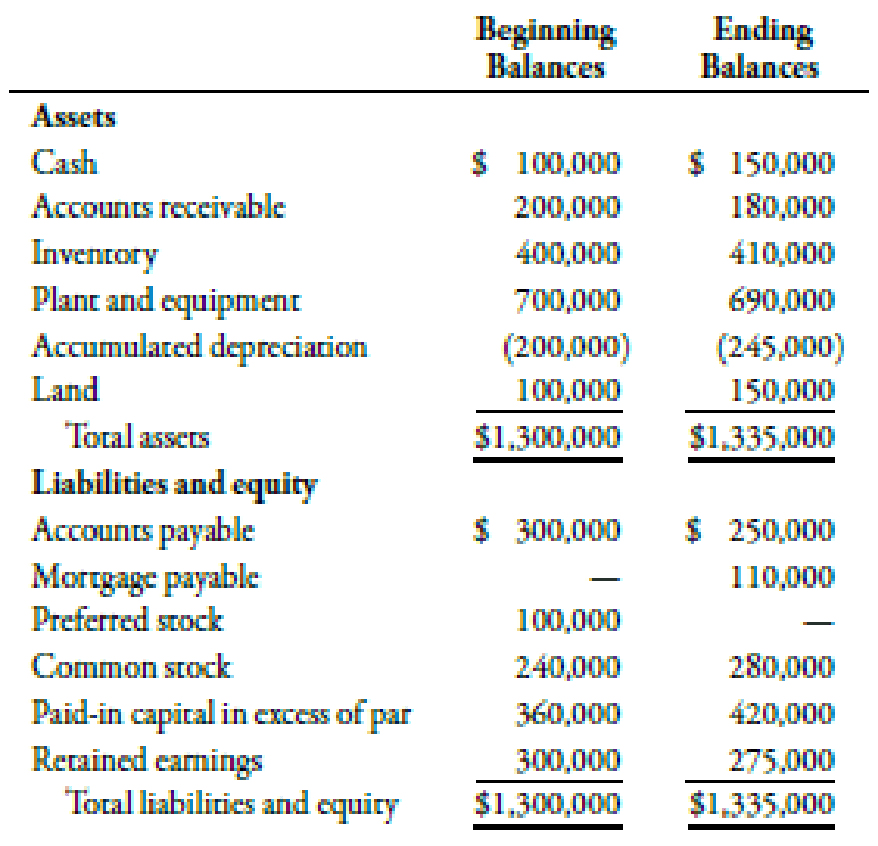

The difference between paid in capital and retained earnings?

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The difference between paid in capital and retained earnings?A company’s working capital is a core part of funding its daily operations. However, it’s important to analyze both the working capital and cash flow of a company to determine whether the financial activity is a short-term or long-term event….

Paid vacation

Posted on Posted on: 24.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Paid vacationThe extra pay may come in the form of a bonus, flat sum, straight-time or time-and-a-half pay or additional time off. For example, your employer could have a policy stating that weekly hours over 50 are paid at a salaried exempt employee’s straight-t…

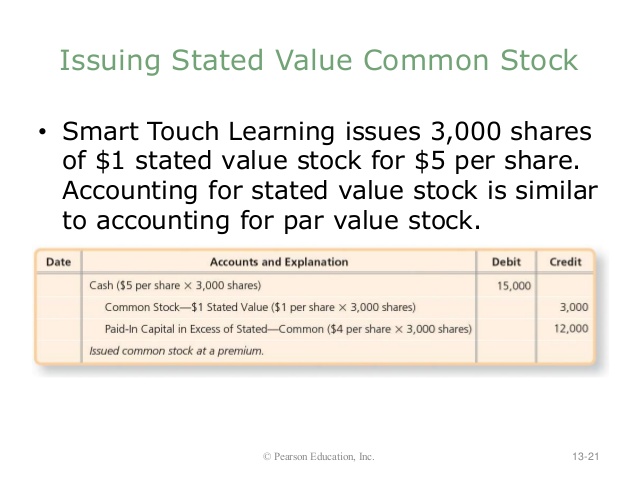

How to Reduce Paid In Capital

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Reduce Paid In CapitalPaid-in capital excess of par is the amount a company receives from investors in excess of its stated par value. For example, if a company issues 100 shares at $10 par value for $15, the $500 difference is credited under stockholders’ equity as paid-…

Does Selling Stocks Increase the Net Income on the Balance Statement?

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Does Selling Stocks Increase the Net Income on the Balance Statement?Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholder’s equity by the amount paid for the stock. You can also issue a repurchase tender offer to buy up shares at a stated price. Some companies…

Who is the mother of accounting?

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Who is the mother of accounting?In 1494, the first book on double-entry accounting was published by Luca Pacioli. Since Pacioli was a Franciscan friar, he might be referred to simply as Friar Luca. While Friar Luca is regarded as the “Father of Accounting,” he did not invent the sy…

Profit and Loss Statement

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Profit and Loss StatementThe income statement tells how you are doing financially regarding operating profit. It is how you keep score relative to the budget (the promise) and last year….

What is owners’ equity? definition and meaning

Posted on Posted on: 23.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is owners’ equity? definition and meaningOwner’s equity can be calculated by taking the total assets and subtracting the liabilities. Owner’s equity can be reported as a negative on a balance sheet; however, if the owner’s equity is negative, the company owes more than it is worth at that p…