Generally, the accounts payable GL is for money owed that hasn’t been paid yet, whereas expenses are costs which have already been incurred. Accounts payable is also a permanent account that appears on the balance sheet, whereas expenses is a tempora…

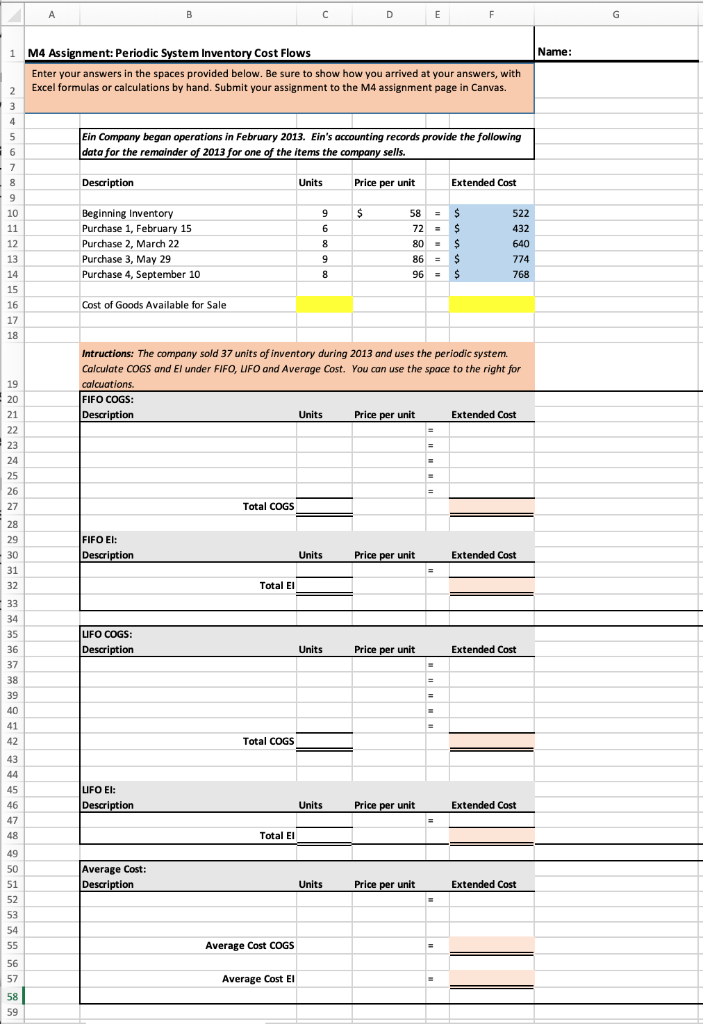

Periodic Inventory System

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Periodic Inventory SystemThe bad news is the periodic method does do things just a little differently. Business types using the periodic inventory system include companies that sell relatively few inventory units each month such as art galleries and car dealerships….

Periodic Sentence

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Periodic SentenceThe largest family of elements consists of transition metals. The center of the periodic table contains the transition metals, plus the two rows below the body of the table (lanthanides and actinides) are special transition metals….

Pension vs 401

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Pension vs 401That means Maria is entitled to receive a specific amount of benefits each month until she dies based on her pay rate and years of service. It’s up to ConSoft to make sure there are enough funds set aside to pay all of the pensioners what they have b…

Pension contributions and tax relief for limited company owners

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Pension contributions and tax relief for limited company ownersPension expense is the amount that a business charges to expense in relation to its liabilities for pensions payable to employees. The amount of this expense varies, depending upon whether the underlying pension is a defined benefit plan or a defined…

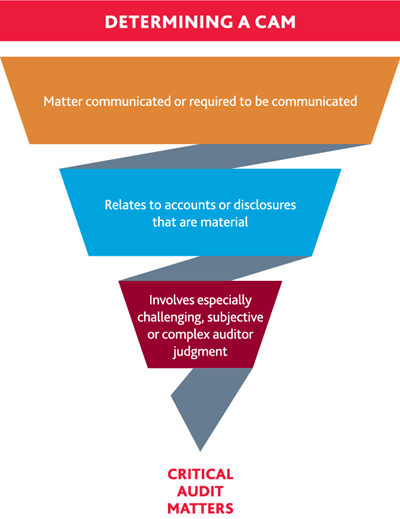

Global Risk and Regulation: The Role of the PCAOB

Posted on Posted on: 28.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Global Risk and Regulation: The Role of the PCAOBWe are now starting to evaluate the extent to which investors are recognizing improvement in the reliability of financial reporting by U.S. public companies. That is, today we are in a better position to reflect on the impact of the Act and whether w…

Sarbanes-Oxley Act of 2002: Definition, Summary

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Sarbanes-Oxley Act of 2002: Definition, SummaryAccordingly, upon adoption of this standard, a reference to generally accepted auditing standards in auditors’ reports is no longer appropriate or necessary. The Public Company Accounting Oversight Board (PCAOB) was established with the passage of th…

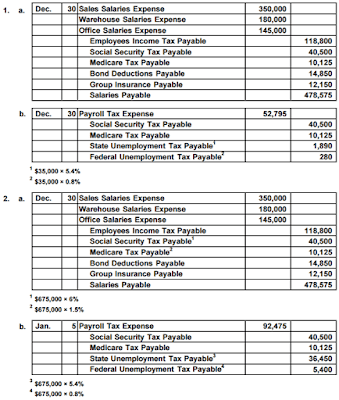

Payroll Taxes in 2020: The Dos and Don’ts

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Payroll Taxes in 2020: The Dos and Don’tsThe Medicare tax rate is 1.45 percent, with no maximum income limit. These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers….

How to Change Your Social Security Disability Payee

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Change Your Social Security Disability PayeeWhen making a payment, customers should always stop and undertake further checks if they do not receive a ‘Confirmation of Payee’ match against the details they have been given. Customers should take particular care if a payee advises or coerces them…

Payback Pay

Posted on Posted on: 27.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Payback PayAlternatively, shop for rewards from the Rewards Catalogue, buy instant e-Vouchers with PAYBACK Points; increase the redemption choices. It not only lets you redeem your Points for products but also rewards you with exciting offers on each transactio…