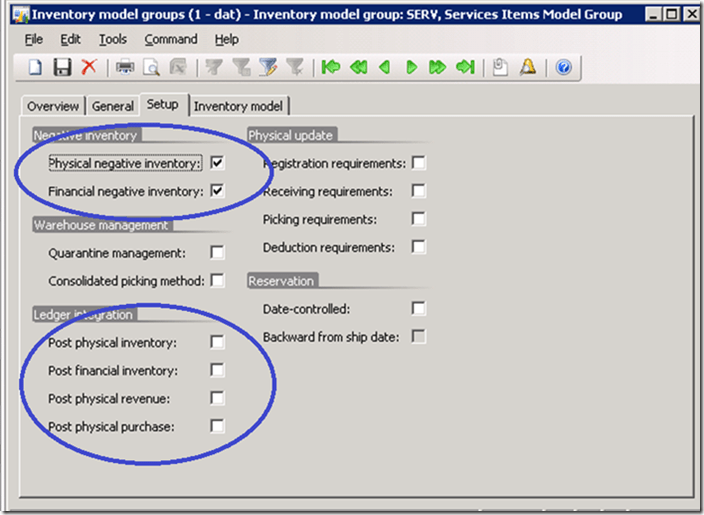

By performing a physical inventory count a business can keep its information accurate and current. How often should a company go through the warehouse and track their products and supplies? Inventory controlling helps revenue and expenses be recogniz…

Cost of Inventory

Posted on Posted on: 30.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cost of InventoryHow often should a company go through the warehouse and track their products and supplies? Physical inventory is an actual count of the goods in stock. This can involve counting, weighing, and otherwise measuring items, as well as asking third partie…

phantom profit

Posted on Posted on: 30.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on phantom profitThe chapter closes with suggestions for future research on the nonprofit performing arts. For example, companies must strictly adhere to the Internal Revenue Service’s (IRS) Tax rule 409A statute. This rule limits a company’s options in instituting d…

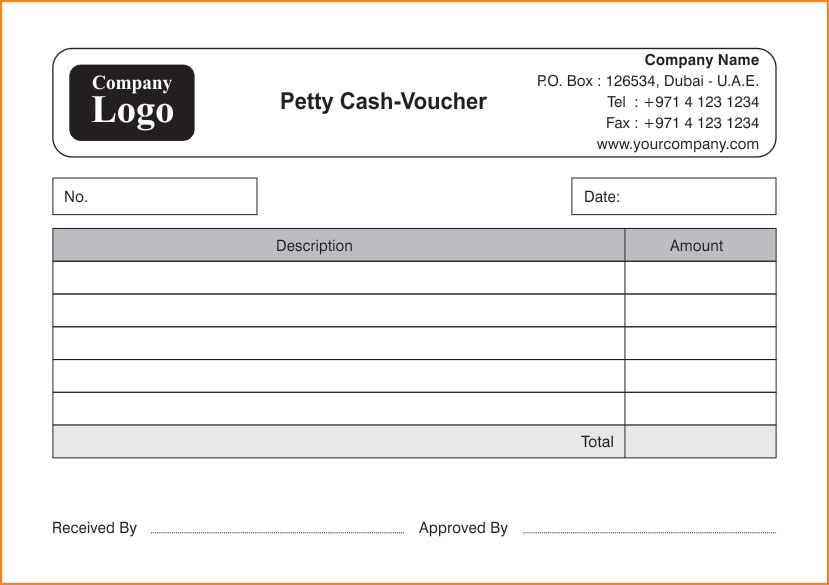

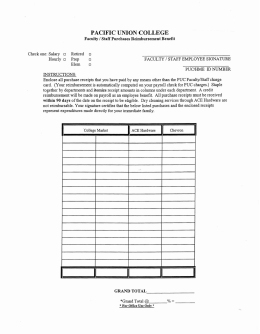

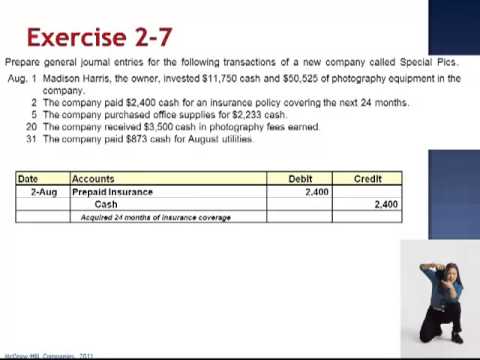

3.5 Cash Voucher and Petty Cash Voucher

Posted on Posted on: 30.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 3.5 Cash Voucher and Petty Cash VoucherA petty cash voucher is usually a small form that is used to document a disbursement (payment) from a petty cash fund. Petty cash vouchers are also referred to as petty cash receipts and can be purchased from office supply stores….

What does it mean to replenish the petty cash fund?

Posted on Posted on: 30.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What does it mean to replenish the petty cash fund?The cashier creates a journal entry to record the petty cash receipts. This is a credit to the petty cash account, and probably debits to several different expense accounts, such as the office supplies account (depending upon what was purchased with …

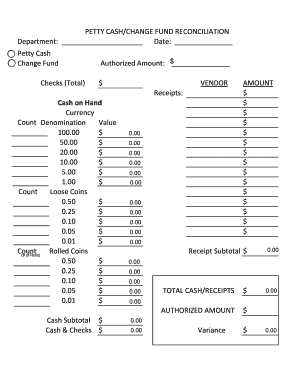

cash short and over definition and meaning

Posted on Posted on: 30.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on cash short and over definition and meaningTo control the petty cash fund properly and record it correctly for tax purposes, the fund should be stored in a secure location and reconciled frequently. Petty cash is a highly liquid asset, which means that it’s easily stolen….

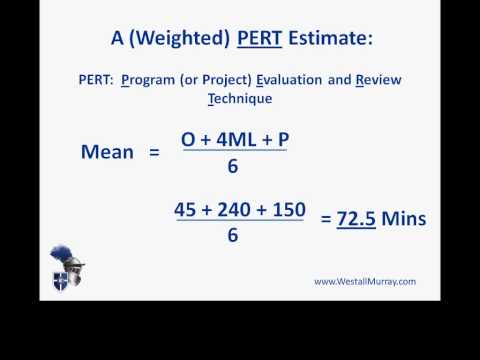

What are PERT Advantages And Disadvantage?

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are PERT Advantages And Disadvantage?PERT charts depend on the ability to predict precise time frames for multitudes of tasks. Complicated projects involving many activities and suppliers can make this prediction difficult, as explained by U.S. Unexpected events occur, and sometimes the…

Understanding Periodic vs. Perpetual Inventory

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding Periodic vs. Perpetual InventoryA more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor. If a company has several locations, a perpetual inventory system centralizes this management. It amalgamates al…

3 Types of Inventory

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 3 Types of InventoryAs expected, the extent to which resources generated by sales can be used to pay operating expenses and provide net income is dependent on both revenue and the cost of goods sold. Amid the ongoing LIFO vs. FIFO debate in accounting, deciding which me…

Statement of Net Position- Reporting Requirements for Annual Financial Reports

Posted on Posted on: 29.07.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Statement of Net Position- Reporting Requirements for Annual Financial ReportsFor this reason, it is strongly recommended to report restricted dollars separately, and to pay particular attention to the unrestricted amounts when planning and making operational decisions. In addition, directors and managers need adequate trainin…