A provision is an amount that is put aside to cover a future liability. The purpose of a provision is to make the balance of current year more accurate, as there may be costs which could be accounted for in either the current or previous financial ye…

What is a sole proprietorship?

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a sole proprietorship?Furthermore, operating as either type of business structure means that you will need to pay taxes on the company’s profits. A partnership operates as a pass-through tax entity, meaning that the profits and losses pass through to the owners who report…

A Sole Proprietorship or a Limited Partnership?

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on A Sole Proprietorship or a Limited Partnership?An LLP has at least one general partner and one limited partner. The general partner is like a sole proprietor — she has full control over business activities and may be held liable for business obligations. The limited partner is a silent partner, …

Dividend Per Share

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Dividend Per ShareA company’s EPS, equal to net income divided by the number of outstanding shares, is often easily accessible via the firm’s income statement. The retention ratio, meanwhile, refers to the opposite of the payout ratio, as it instead measures the propo…

Bad debt expense

Posted on Posted on: 11.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Bad debt expenseMore than half of the organizations treat less than 15 percent of their advertising as overhead. For those organizations, if advertising were their only expense, their program spending ratios would be greater than 85 percent—an excellent figure by an…

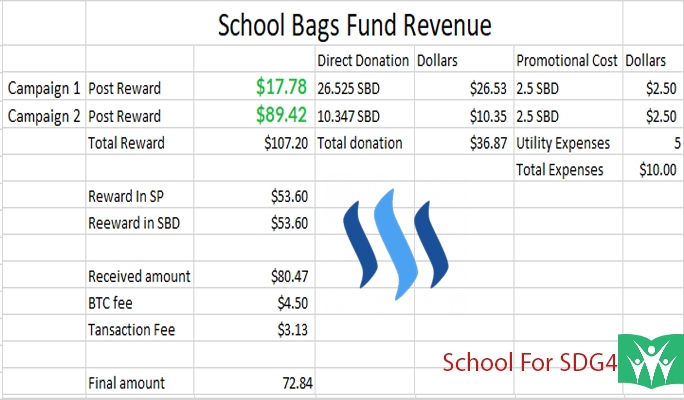

What is Program Budget ?

Posted on Posted on: 10.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is Program Budget ?From its most recent audited financial statements, advertising and promotions represented over 35 percent of total expenses. Such a high percentage of expenses devoted to advertising is unheard of in for-profit companies, which simply cannot both com…

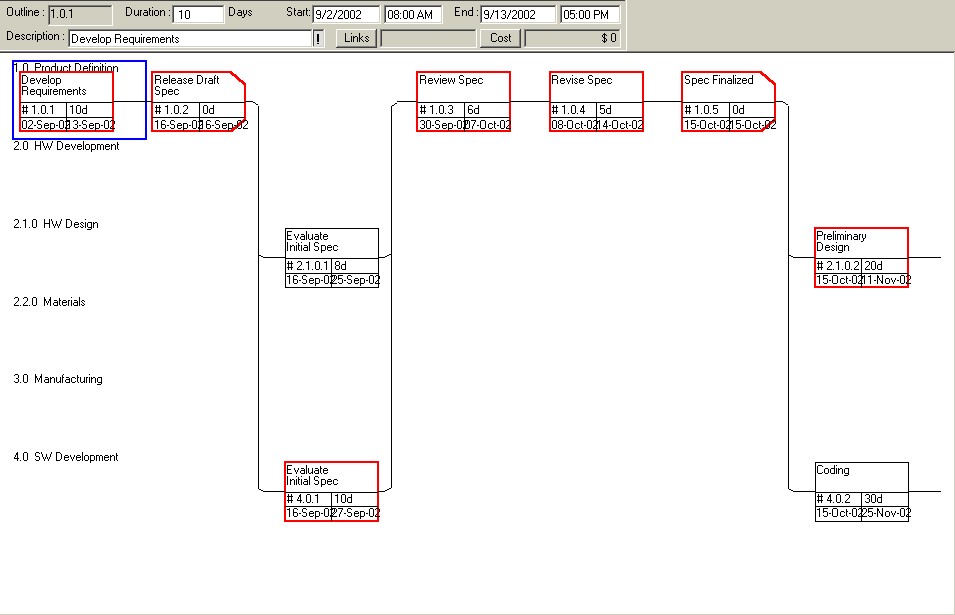

PERT Estimation Technique

Posted on Posted on: 10.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on PERT Estimation TechniqueDue to the budget constraints it might be difficult to effectively apply the most appropriate methodological instruments. A PERT chart, sometimes called a PERT diagram, is a project management tool used to schedule, organize and coordinate tasks with…

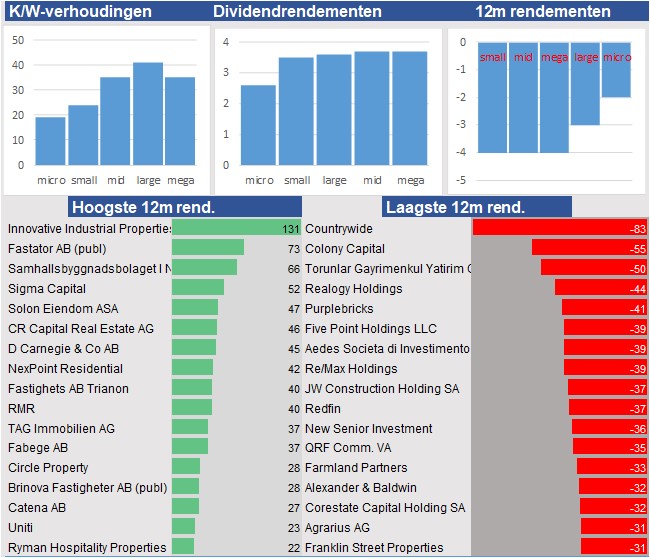

Profitability Ratios Definition

Posted on Posted on: 10.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Profitability Ratios DefinitionThe net profit margin concerns a company’s ability to generate earnings after taxes. Return ratios offer several different ways to examine how well a company generates a return for its shareholders. Some examples of profitability ratios are profit ma…

Profit Definition

Posted on Posted on: 10.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Profit DefinitionThe second level of profitability is operating profit, which is calculated by deducting operating expenses from gross profit. Gross profit looks at profitability after direct expenses, and operating profit looks at profitability after operating expen…

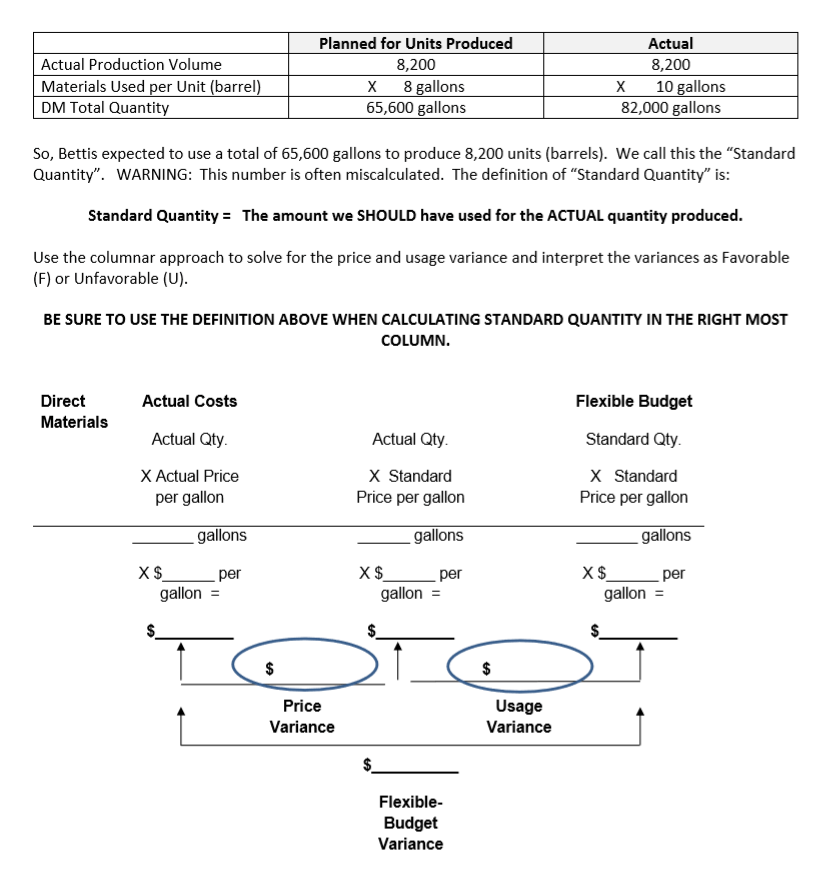

Gross Volume

Posted on Posted on: 07.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Gross VolumeProduction volume measures the total amount your company can produce over time. This KPI tracks the total number of products manufactured over a set period of time (days, weeks, months, quarters, years) and focuses on total output….