Return on investment (ROI) is a ratio between net profit (over a period) and cost of investment (resulting from an investment of some resources at a point in time). A high ROI means the investment’s gains compare favorably to its cost….

Ratio Analysis: Return on Capital Employed

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Ratio Analysis: Return on Capital EmployedReturn of capital (and here I differ with some definitions) is when an investor receives a portion of his original investment back – including dividends or income – from the investment. The ROIC formula is calculated by assessing the value in the den…

Is it better to have cash on hand or assets? : personalfinance

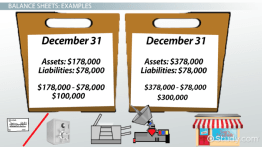

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is it better to have cash on hand or assets? : personalfinanceTo illustrate this, let’s assume that a machine with a cost of $100,000 was expected to have a useful life of five years and no salvage value. The company depreciated the asset at the rate of $20,000 per year for five years….

Long-Term Debt Definition

Posted on Posted on: 25.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Long-Term Debt DefinitionMGP had previously used a combination of cash flow generation and borrowings under its bank credit line (‘revolver’) to fund a warehouse expansion project and to build up aged whiskey inventory. In 2017, MGP elected to borrow long-term, fixed-rate se…

How to Calculate the Retained Earnings of a Start-Up Company

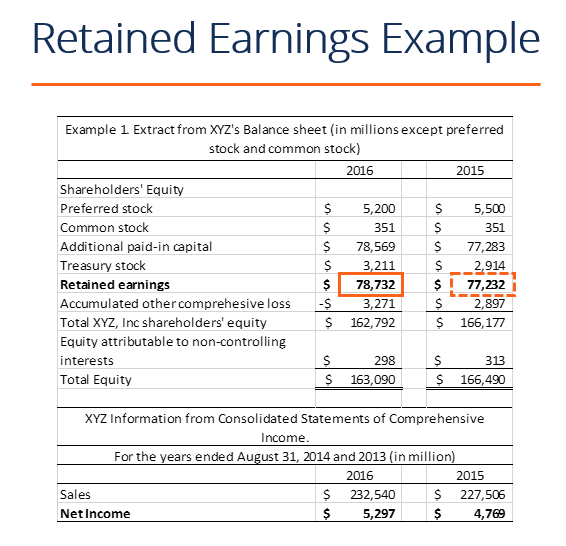

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate the Retained Earnings of a Start-Up CompanyThis statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement. The statement is a financial document that includes information regarding a firm’s retained earnings, along wi…

restriction

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on restrictionA restriction is an official rule that limits what you can do or that limits the amount or size of something. the lifting of restrictions on political parties and the news media. [ + on] The relaxation of travel restrictions means they are free to tr…

Restricted retained earnings

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Restricted retained earningsRestricted retained earnings refers to that amount of a company’s retained earnings that are not available for distribution to shareholders as dividends. The restriction will then decline as the dividends are paid off….

Long-Term Liabilities Definition

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Long-Term Liabilities DefinitionA company with higher liquidity ratios is considered healthier and poses less of a risk. This company will also receive a lower interest rate, which translates into higher profitability. A compensating balance is a minimum balance that a company must…

How to hide Instagram posts from certain followers

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to hide Instagram posts from certain followersYour friends on except, restricted list won’t be able to view your posts again. A restricted friend will see your past posts if their audience was set to Publicbut if they were set toFriends,they won’t be able to see them again. We have written a ver…

What is a Straight Line Depreciation? How to Calculate, Examples, and Definition in Accounting

Posted on Posted on: 24.08.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a Straight Line Depreciation? How to Calculate, Examples, and Definition in AccountingYou need to determine a suitable way to allocate cost of the asset over the periods during which the asset is used. Generally, the method of depreciation to be used depends upon the patterns of expected benefits obtainable from a given asset….