The current ratio measures a company’s ability to pay short-term and long-term obligations and takes into account the total current assets (both liquid and illiquid) of a company relative to the current liabilities. The following ratios are commonly …

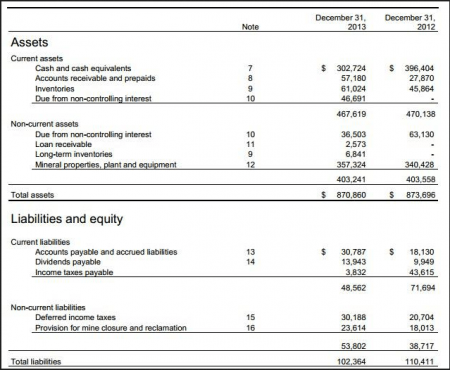

Types of Liabilities

Posted on Posted on: 04.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Types of LiabilitiesBecause a bond typically covers many years, the majority of a bond payable is long term. The present value of a lease payment that extends past one year is a long-term liability. Deferred tax liabilities typically extend to future tax years, in which…

Roles & Responsibilities Of A Company Shareholder

Posted on Posted on: 04.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Roles & Responsibilities Of A Company ShareholderAs these assets generate profits and as the profits are reinvested in additional assets, shareholders see a return as the value of their shares increases as stock prices rise. If the corporation chooses to pay an annual dividend, then shareholders wi…

What are the key differences between CRM and SFA?

Posted on Posted on: 04.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What are the key differences between CRM and SFA?Both enlisted and officer candidates will list in order of preference the SF Groups in which they prefer to serve (1st, 3rd, 5th, 7th, 10th) and the languages in which they prefer to be trained. Language selection is dependent on the Defense Language…

Difference Between Latch and Flip Flop

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference Between Latch and Flip FlopThe number of arcs required to model can vary within the sequential elements. In this paper we will be discussing about the methodology to find the setup time, hold time or C-Q delay of flip-flops and latches….

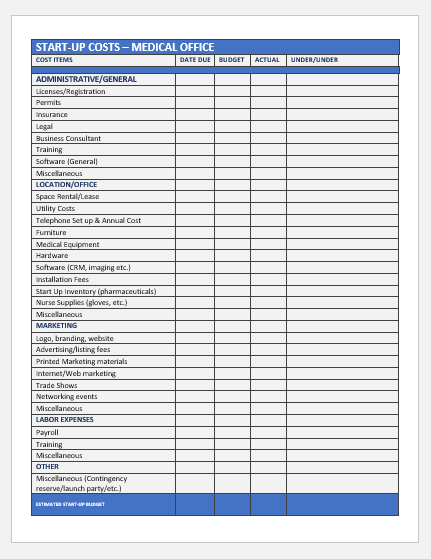

Accounting for Startup Costs: How to Track Your Expenses

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Accounting for Startup Costs: How to Track Your ExpensesAssume the same facts, but she incurred $23,000 of start-up costs. She can claim $5,000 off the top as a current deduction. The remaining $18,000 must be amortized over the 180-month period, which is a monthly amount of $100….

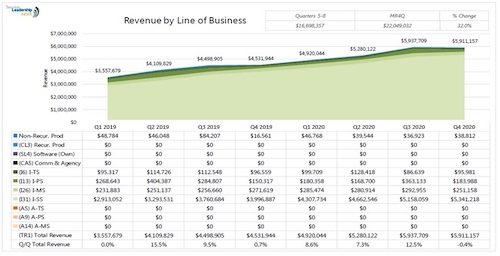

revenues definition and meaning

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on revenues definition and meaningIf a company does not pay cash immediately, you cannot credit Cash. But because the company owes someone the money for its purchase, we say it has an obligation or liability to pay. Most accounts involved with obligations have the word “payable” in t…

Trademark Examples

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Trademark ExamplesA well-known example of a service mark is “Geek Squad‚” which identifies a national computer repair and troubleshooting company. Though service marks are technically distinct from trademarks‚ they receive the same protection and have similar requirem…

List These Monthly Expenses in Your Budget

Posted on Posted on: 03.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on List These Monthly Expenses in Your Budgetsupporting services expenses definition. One of two broad functional categories for sorting and reporting a nonprofit organization’s expenses. (The other is program expenses.) Supporting services expenses consists of 1) management and general expense…

Personal expense

Posted on Posted on: 02.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Personal expense50/20/30 rule to create your budget, especially if you’re a young adult. The 50/20/30 guideline offers a basic financial strategy for your spending and saving….