The company’s investment in commercial paper was worth $17.4 billion and mutual funds were $800 million. government securities of $8.2 billion and certificates/time deposits of $7.3 billion. Mortgage/asset-backed securities were at $20 billion and mu…

What is a temporary account?

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is a temporary account?A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. Temporary accounts include revenue, expenses, and dividend…

Solved: What is the definition of restricted donations

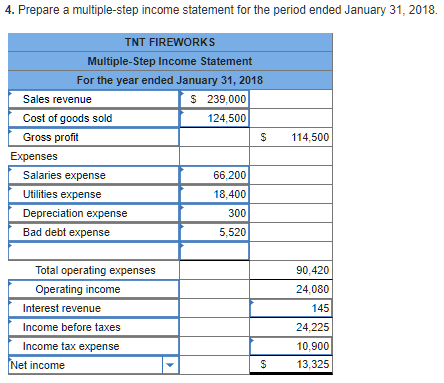

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Solved: What is the definition of restricted donationsAs shown in the income statement below, new income from a grant with donor restrictions is recorded and displayed in the With Donor Restrictions column. Often associated with funds held by donations to nonprofit organizations or endowments, restricte…

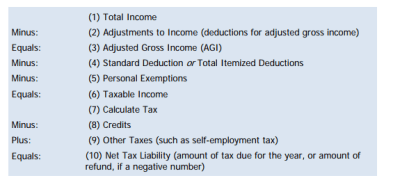

How Much of My Internet Expenses Are Deductible on My 1040?

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How Much of My Internet Expenses Are Deductible on My 1040?Plus, the work related percentage of your home internet use and phone expenses can be claimed as tax deductions. Proper tracking and claiming of tax deductions is the biggest strategy for getting the best tax refund. Along the way—and this is serious…

Is accounts payable an expense?

Posted on Posted on: 17.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Is accounts payable an expense?Payable. “Income tax expense” is what you’ve calculated that our company owes in taxes based on standard business accounting rules. You report this expense on the income statement. “Income tax payable” is the actual amount that your company owes in t…

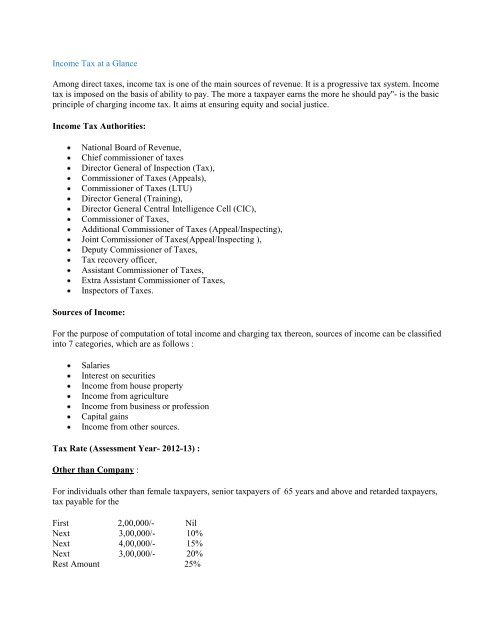

What does “tax liability” mean? Is that the amount

Posted on Posted on: 17.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What does “tax liability” mean? Is that the amountLine 23 of Form 1040. Two lines on Form 1040 actually refer to your tax liability. Line 16 tells you the total tax you owe for the year, then line 23 tells you how much of that amount is still outstanding. Payments you’ve already made appear on line …

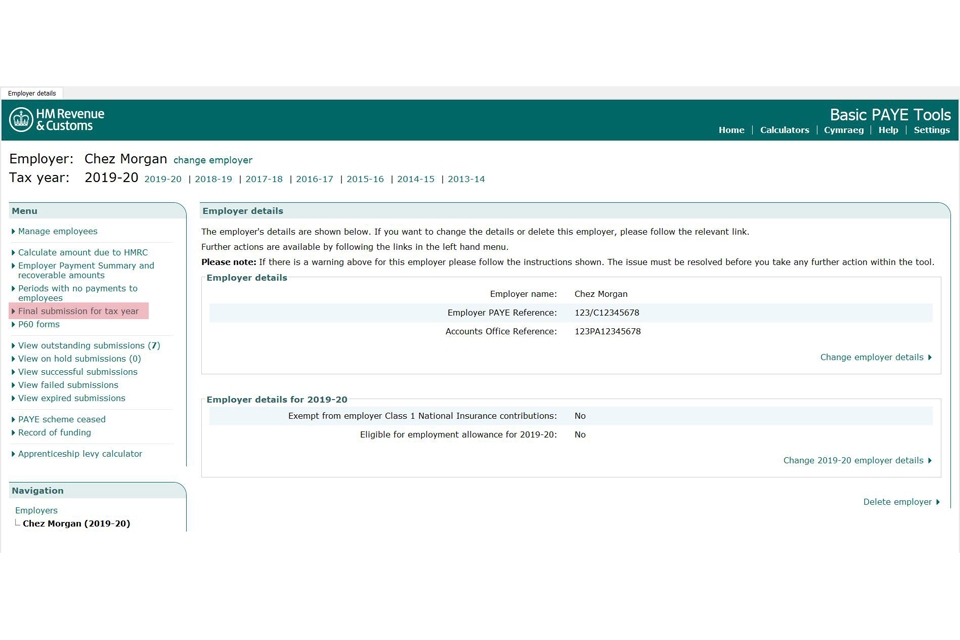

Internal Revenue Code

Posted on Posted on: 17.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Internal Revenue CodeIn most instances, you will be asked to verify or explain specific issues in question on your tax return, such as income figures or deductions. Depending on the circumstances, you may be able to respond to the audit via mail, though in some cases, th…

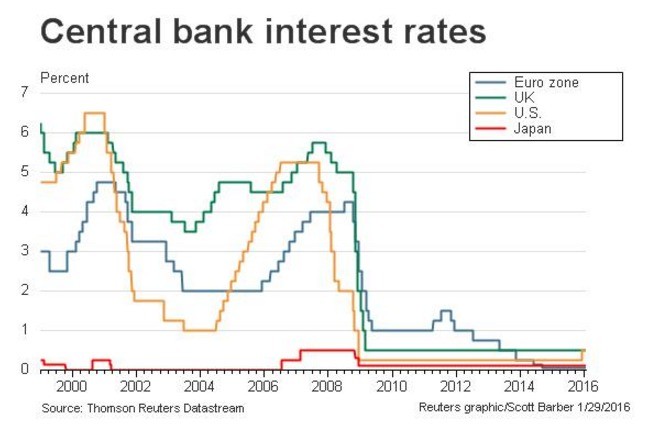

United States Fed Funds Rate

Posted on Posted on: 17.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on United States Fed Funds RateThe Board decides on changes in discount rates after recommendations submitted by one or more of the regional Federal Reserve Banks. The FOMC decides on open market operations, including the desired levels of central bank money or the desired federal…

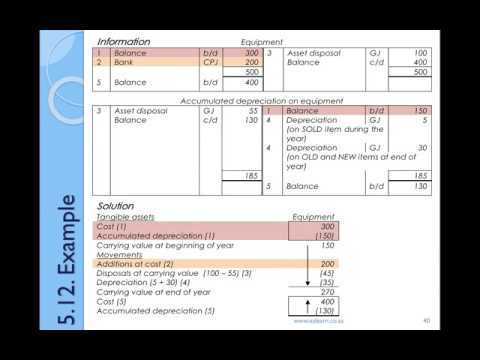

Tangible

Posted on Posted on: 16.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on TangibleCalculated intangible value is a method of valuing a company’s intangible assets. Intangible assets include patents and other intellectual property. A brand is an identifying symbol, logo, or name that companies use to distinguish their product from …

T-accounts

Posted on Posted on: 16.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on T-accountsThus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. Accountants record increases in asset, expense, and owner’s drawing accounts on the debit side, and they …