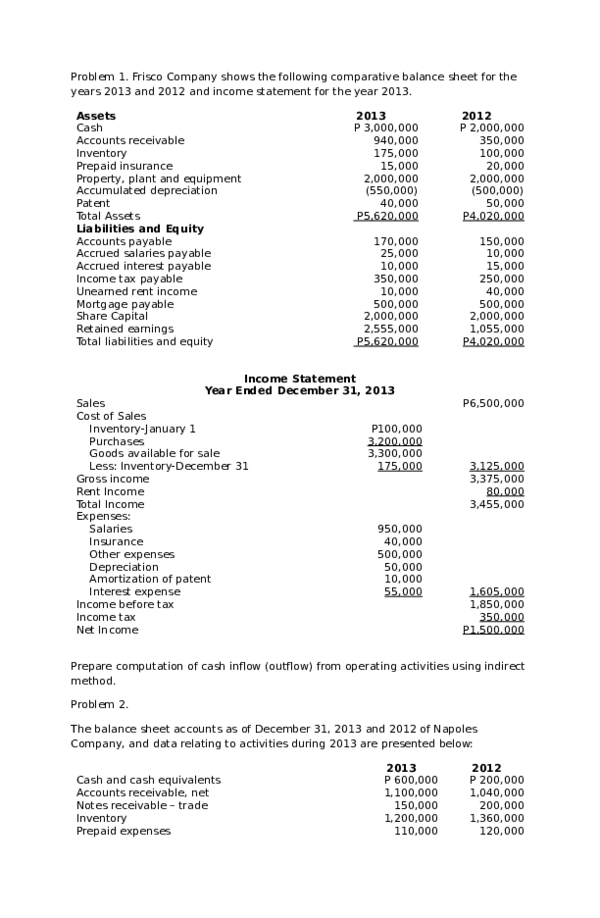

Current liabilities are short-term liabilities of a company, typically less than 90 days. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the tot…

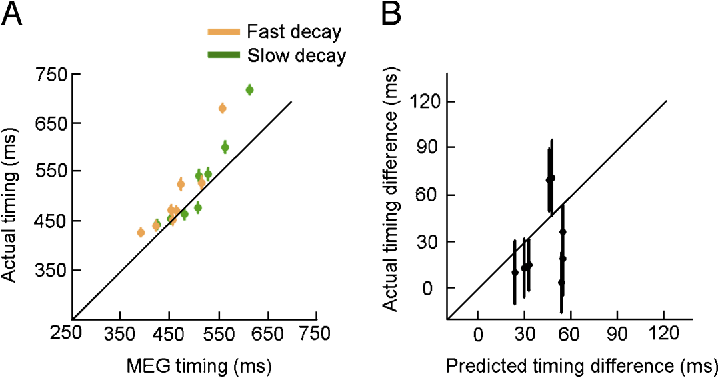

Timing Differences

Posted on Posted on: 22.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Timing DifferencesThese are future taxable temporary differences because future periods’ taxable income will exceed GAAP income as the differences reverse; thus they give rise to deferred income tax liabilities. The computation of taxable income for the purpose of fil…

What Actually Happens When You Block Someone on Your iPhone

Posted on Posted on: 22.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What Actually Happens When You Block Someone on Your iPhoneIt’s just too complex to recover by manually, but we have built the functionality to recover Screen Time restrictions into iPhone Backup Extractor since the iOS 12 betas. iTunes backups not only include your phone settings and your personal data but …

14 Things You Should Know About Time Deposits in the Philippines

Posted on Posted on: 22.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on 14 Things You Should Know About Time Deposits in the PhilippinesIn other words, the funds are held for a fixed period, and the depositor is allowed to make many withdrawals as per bank policy. Demand deposits and term deposits refer to two different types of deposit accounts available at a bank or similar financi…

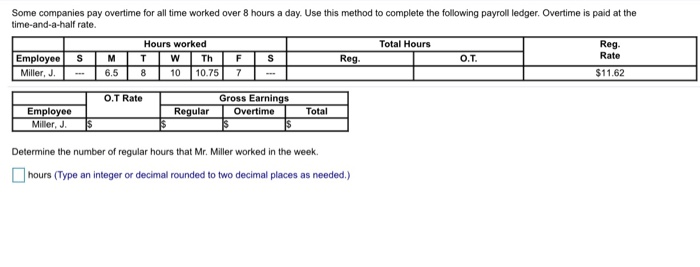

Can an Employer Pay Me Late in California?

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Can an Employer Pay Me Late in California?Additional time regularly alluded to as “O.T.” is a term normally used to portray the abundance of hours a representative worked past 40 hours for each week. The business is required by government law or Fair Labor Standards Act (FLSA) to pay time an…

What is Full Disclosure Principle?

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What is Full Disclosure Principle?She will report all activity for her business from April 1st to March 31st of the next year in her formal financial statements. She will include the revenues or the amount her business earned from selling pet supplies and all the expenses or the cost…

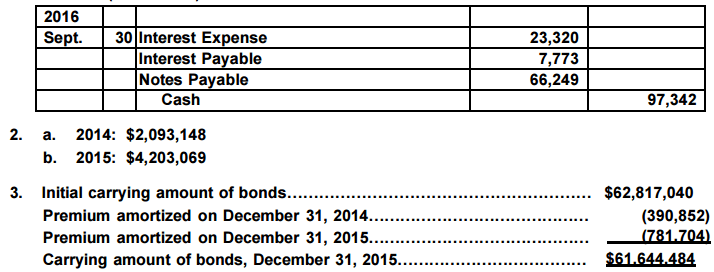

Discount on Bonds Payable Example

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Discount on Bonds Payable ExampleThe acquisition premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments for tax reporting purposes. Review prior calculations and adjustments you have made and consult your tax advisor and IRS Publication 550, Invest…

The Five Elements of Visual Merchandising

Posted on Posted on: 21.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The Five Elements of Visual MerchandisingOperating Cycle for a Merchandiser A merchandising company’s operating cycle begins by purchasing merchandise and ends by collecting cash from selling the merchandise. Companies try to keep their operating cycles short because assets tied up in inven…

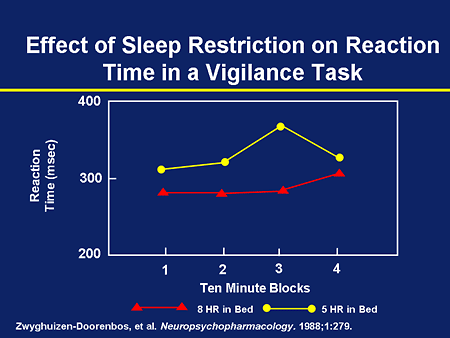

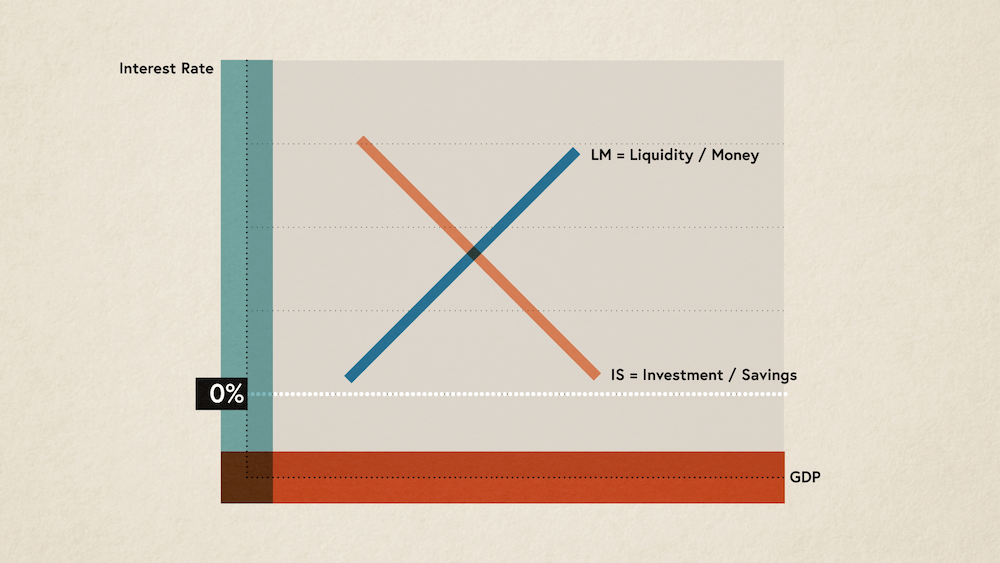

Understanding Real vs. Nominal Interest Rates

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Understanding Real vs. Nominal Interest RatesFor example, if a customer owes the business money, the company may convert the account receivable into a note. The customer then becomes a borrower and pays interest, at a fixed rate, until the loan amount is paid….

OneClass: The internal rate of return is defined as the: A. maximum rate of return a firm expects to

Posted on Posted on: 18.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on OneClass: The internal rate of return is defined as the: A. maximum rate of return a firm expects toThis, along with the fact that long projects with fluctuating cash flows may have multiple distinct IRR values, has prompted the use of another metric called modified internal rate of return (MIRR). The internal rate of return is calculated by discou…