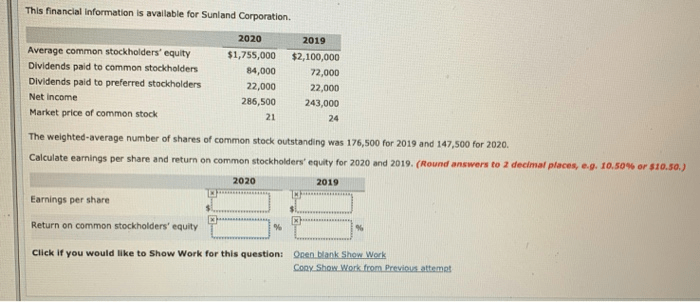

An investor could conclude that TechCo’s management is above average at using the company’s assets to create profits. Relatively high or low ROE ratios will vary significantly from one industry group or sector to another….

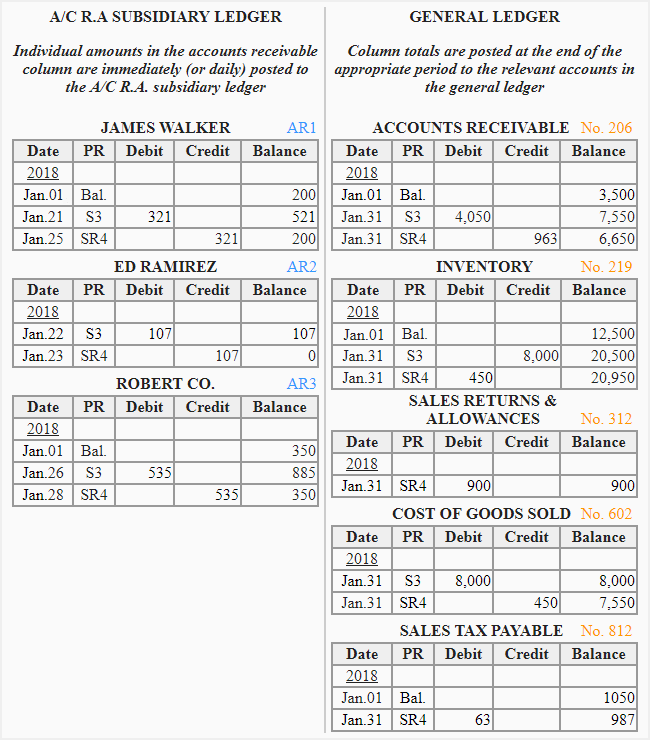

Sales journal entry

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Sales journal entryThe net sales figure on an income statement shows how much revenue remains from gross sales when sales discounts, returns and allowances are subtracted. 3/7 EOM – this means the buyer will receive a cash discount of 3% if the bill is paid within 7 da…

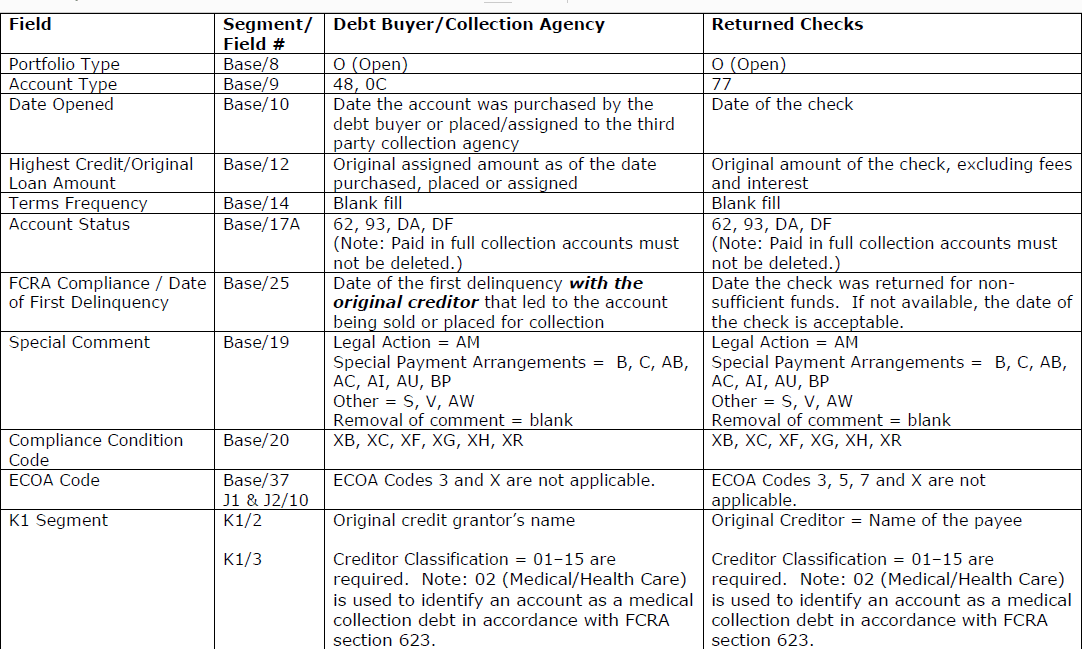

What to Do About Returned Checks

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on What to Do About Returned ChecksTell them you’re trying to build good credit you want to make sure that this bad check someone wrote you doesn’t sabotage the process. If they do report to either those bureaus you can request a free copy of your report each year. Those reports are u…

Purchase Discount in Accounting

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Purchase Discount in AccountingAnd if the payments are not made in time, an anti-revenue account name purchase discounts lost is debited to record the loss. Next, let’s assume that the corporation focuses on the bad debts expense. As a result, its November income statement will be…

Collateral

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on CollateralThis means that the borrower still retains the ownership of the property, but the lender has a claim against it. Secured loans are an excellent way to work towards building your credit score. The lower interest rates are also an advantage to choosing…

Do Social Security Taxes Withheld Count Toward My Tax Return?

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Do Social Security Taxes Withheld Count Toward My Tax Return?However, if you end up with excess Social Security taxes withheld, you’d get a refund on your tax return that you could put toward paying any federal income taxes due. If you check your pay stubs, you’ve probably noticed that in addition to income ta…

$27,500 Income Tax Calculator California

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on $27,500 Income Tax Calculator CaliforniaIn general, individuals and businesses usually seek to take advantage of as many tax deductions and credits as possible to reduce the total taxes paid and increase their annual net of tax value. Enrollment in, or completion of, the H&R Block Inco…

How to Calculate Percentages

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How to Calculate PercentagesTo use the preceding example, a markup of $30 from the $70 cost yields the $100 price. Or, stated as a percentage, the markup percentage is 42.9% (calculated as the markup amount divided by the product cost). You purchased an item for $10, you mark i…

long-term assets definition and meaning

Posted on Posted on: 25.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on long-term assets definition and meaningThe remaining assets are long-term, or assets that cannot easily be converted to cash within a year. Property, Plant, and Equipment, also termed Fixed Assets, includes buildings, automobiles, and machinery that the business owns. You might also see a…

HOW TO DOUBLE YOUR MONEY

Posted on Posted on: 24.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on HOW TO DOUBLE YOUR MONEYThe interest rate on a debt security is largely determined by the perceived repayment ability of the borrower; higher risks of payment default almost always lead to higher interest rates to borrow capital. Also known as fixed-income securities, most …