The New York Department of Labor website may have additional specific information on wage laws in the state. $9.00 an hour for employers with four or more employees. The Nebraska Department of Labor website may have additional specific information on…

IT Equipment

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on IT EquipmentHere are a few types of costs for new business owners to consider. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash you’ll require….

FINAL ACCOUNTS OF NON-TRADING ORGANIZATIONS

Posted on Posted on: 30.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on FINAL ACCOUNTS OF NON-TRADING ORGANIZATIONSA non-operating expense is an expense incurred from activities unrelated to core operations. Non-operating expenses are deducted from operating profits and accounted for at the bottom of a company’s income statement. Examples of non-operating expense…

The cost of sales

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on The cost of salesOperating expenses include marketing, rental and administrative expenses. Discontinued operations refer to sold or shuttered business units….

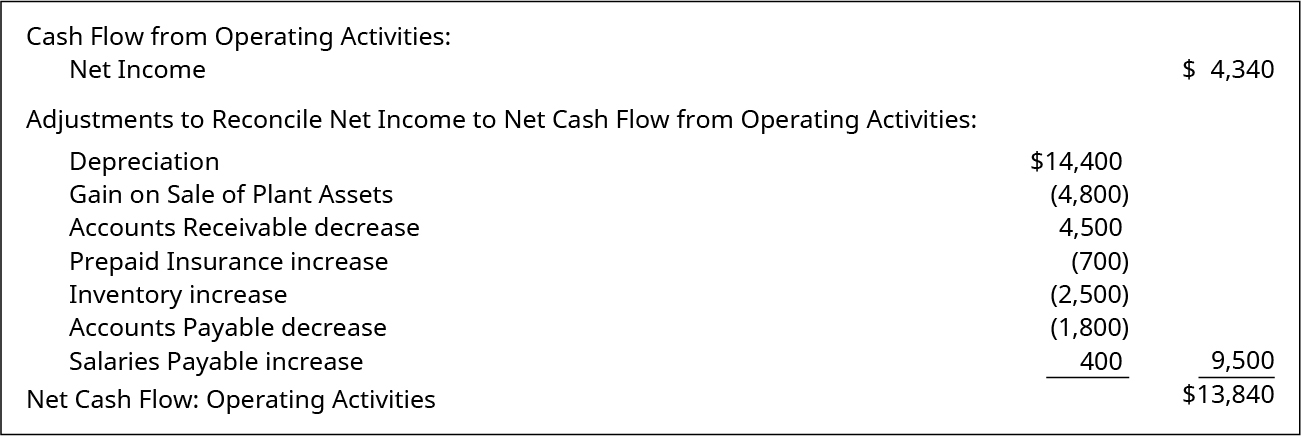

Cash Flow from Operating Activities

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Cash Flow from Operating ActivitiesMany line items in the cash flow statement do not belong in the operating activities section. This increase would have shown up in operating income as additional revenue, but the cash had not yet been received by year end. Thus, the increase in recei…

Miscellaneous Food Crops

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Miscellaneous Food CropsThe earned income tax credit is worth up to $6,557 for a family with three or more children. One out of five taxpayers who are eligible for the credit fails to claim it, according to the IRS. Some taxpayers miss this valuable credit because they are …

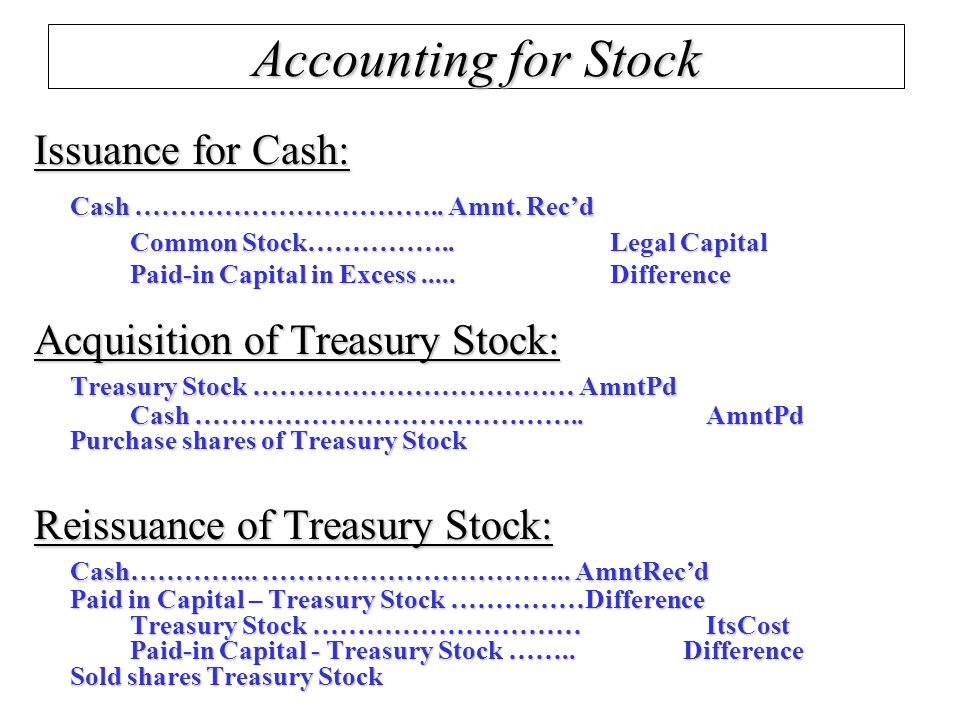

Difference between paid in capital and retained earnings

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Difference between paid in capital and retained earningsAll paid-up capital is listed under the shareholders’ equity section of the issuing company’s balance sheet. Legal capital is that amount of a company’s equity that cannot legally be allowed to leave the business; it cannot be distributed through a d…

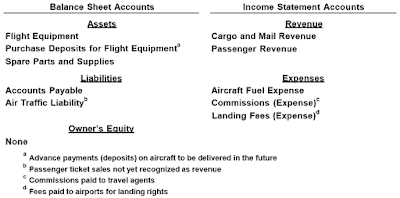

In Accounting, What Is the Difference Between a Liability Account and an Expense Account?

Posted on Posted on: 29.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on In Accounting, What Is the Difference Between a Liability Account and an Expense Account?The payment of the insurance expense is similar to money in the bank, and the money will be withdrawn from the account as the insurance is “used up” each month or each accounting period. Prepaid insurance is usually considered a current asset, as it …

Taxability of Employer-Provided Lodging

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on Taxability of Employer-Provided LodgingThe IRS has special rules for educational institutions that provide lodging for their employees. The value of certain campus lodging is not taxable if the employee pays adequate rent….

How useful is ROCE as an indicator of a company’s performance?

Posted on Posted on: 28.09.2020 Modified on: 11.01.2022Categories Bookkeeping 101 Leave a comment on How useful is ROCE as an indicator of a company’s performance?The opening balance is the amount of funds in a company’s account at the beginning of a new financial period. It is the first entry in the accounts, either when a company is first starting up its accounts or after a year-end. The opening balance may…