Although some people use the phrases “accounts payable” and “trade payables” interchangeably, the phrases refer to similar but slightly different situations. Trade payables constitute the money a company owes its vendors for inventory-related goods, such as business supplies or materials that are part of the inventory.

Current assets consist of cash and cash equivalents, which is generally the first line item on the asset side of the balance sheet when a balance sheet is prepared based on liquidity. Cash equivalents are generally commercial papers that a company invest which is as liquid as cash. Other current assets are accounts receivables which the amount of money the company owes from the debtors to whom they have sold their goods on credit. Revenue is only increased when receivables are converted into cash inflows through the collection.

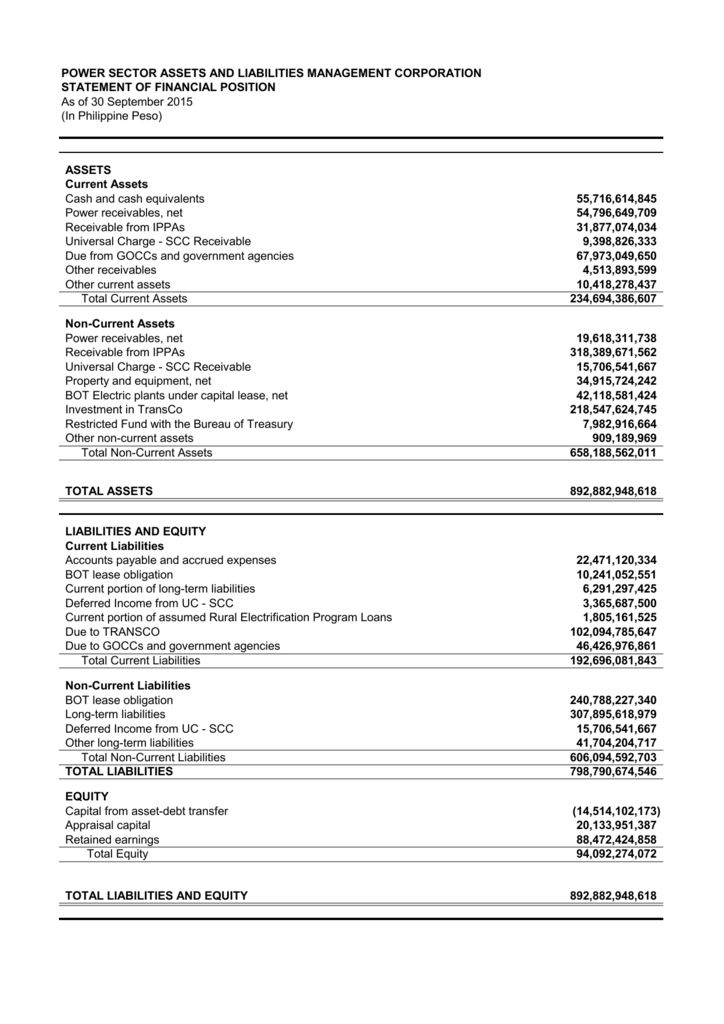

Both of these types of assets are initially recorded on the balance sheet, which helps investors, creditors, and banks assess the value of the company. The current ratio measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables.

The ratio of current assets to current liabilities is an important one in determining a company’s ongoing ability to pay its debts as they are due. On the balance sheet, current assets are normally displayed in order of liquidity; that is, the items that are most likely to be converted into cash are ranked higher. A company’s total accounts payable (AP) balance at a specific point in time will appear on its balance sheetunder the current liabilities section. Accounts payable are debts that must be paid off within a given period to avoid default. At the corporate level, AP refers to short-term debt payments due to suppliers.

Although they cannot be converted into cash, they are the payments already made. Prepaid expenses could include payments to insurance companies or contractors. Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets.

In simple words, it is a balance sheet line item that represents all the short-term assets that are considered to be too insignificant to be recognized individually. Some intangible assets have an initial purchase price, such as a patent or license. Similar to fixed assets, intangible assets are initially recorded on the balance sheet as long-term assets. The quick ratiois the same formula as the current ratio, except it subtracts the value of total inventories beforehand. The quick ratio is a more conservative measure for liquidity since it only includes the current assets that can quickly be converted to cash to pay off current liabilities.

It is often deemed the most illiquid of all current assets – thus, it is excluded from the numerator in the quick ratio calculation. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash.

There may be a subtotal on the balance sheet for all current assets. This is especially useful when calculating the current ratio, which divides current assets by current liabilities. Current assets are located in the beginning of the assets section of the balance sheet.

The payable is essentially a short-term IOU from one business to another business or entity. The other party would record the transaction as an increase to its accounts receivable in the same amount.

Current liabilities are short-term liabilities of a company, typically less than 90 days. Examples of non-current assets include land, property, investments in other companies, machinery and equipment. Intangible assets such as branding, trademarks, intellectual property and goodwill would also be considered non-current assets.

Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment. Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivables, which is money owed by customers for sales.

Current assets are short-term economic resources that are expected to be converted into cash within one year. Current assets include cash and cash equivalents, accounts receivable, inventory, and various prepaid expenses.

Purchases of PP&E are a signal that management has faith in the long-term outlook and profitability of its company. The following ratios are commonly used to measure a company’s liquidity position. Each ratio uses a different number of current asset components against the current liabilities of a company. Thus, the technology leader’s total current assets were $167.07 billion. Prepaid expenses—which represent advance payments made by a company for goods and services to be received in the future—are considered current assets.

The list of current assets includes cash and cash equivalents, short term investments, accounts receivables, inventories, and prepaid revenue. The list of non-current assets includes long term investments, plant property and equipment, goodwill, accumulated depreciation and amortization and long term deferred taxes. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company.

Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet. Property, plant and equipment, intangible assets and long-term investments are the examples of noncurrent assets. Plant machinery and equipment are reported on the balance sheet at book value which generally the acquisition cost for that fixed asset. Companies also depreciate the plants and machinery either through the straight-line method or Double Declining method. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

- Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year.

Current assets represent all the assets of a company that are expected to be conveniently sold, consumed, used, or exhausted through standard business operations with one year. Current assets appear on a company’s balance sheet, one of the required financial statements that must be completed each year.

Petty Cash:

What are some examples of current assets?

What are Other Current Assets? Other current assets are the assets of the business that are not very common and significant like cash & cash equivalents, inventory, trade receivable, etc. and expect to be converted into cash within 12 months of the reporting date.

Accounts payable include all of the company’s short-term debts or obligations. A company may have many open payments due to vendors at any one time. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term lenders.

An example of a current liability is money owed to suppliers in the form of accounts payable. Noncurrent assets include property, plant and equipment (PP&E), intangible assets and long-term investments.

Other Current Assets

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales.

AccountingTools

Revenue represents the total income of a company before deducting expenses. Companies looking to increase profits want to increase their receivables by selling their goods or services.

This part of the balance sheet contains those assets most easily convertible into cash in the short-term. Each of the current asset line items is positioned on the balance sheet based on its comparative ability to be converted into cash (called the order of liquidity). Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated.

Current assets

Tangible assets form the backbone of a company’s business by providing the means to which companies produce their goods and services. Tangible assets can be damaged by naturally occurring incidence since they are physical assets. Intangible assets are the non-physical assets that add to a company’s future value or worth and can be far more valuable than tangible assets.

An asset is anything of monetary value owned by a person or business. The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets. It considers cash and equivalents, marketable securities, and accounts receivable (but not the inventory) against the current liabilities.