That patience is a trade-off for potentially lower risk and/or a higher possible return. A sample aggressive portfolio asset allocation is 85% Stocks, 15% Bonds. One way you can actually lower your risk is by committing to holding your investments longer. The longer holding period gives you more time to ride out the ups and downs of the market. While the S&P 500 index has a great track record, those returns came over time, and over any short period, the index could be down substantially.

What Are Long-Term Investments?

The fund’s investment advisor, Geode Capital Management, employs a passive strategy, which helps to minimize its costs. Consequently, the fund has a turnover ratio of 4% and charges a low net expense ratio of 0.015%. The Fidelity Spartan 500 Index Investor Shares holds 505 stocks in its portfolio, which has total net assets of approximately $219.3 billion. Investors hold short-term investments for a much shorter period of time. Short-term investments are about getting a quick cash-out but often come with higher risk or lower potential return.

What are examples of long term investments?

Definition: Long-term investments are non-current assets that are not used in operating activities to generate revenues. In other words, LT investments are assets that are held for more than one year or accounting period and are used to create other income outside of the normal operations of the company.

Stock mutual funds, especially growth stock funds and aggressive growth stock funds. Many long-term investors also like to use index funds for their low-cost and their tendency to average good returns over long periods, such as ten years or more. A long-term investment is an account on the asset side of a company’s balance sheet that represents the company’s investments, including stocks, bonds, real estate, and cash. Long-term investments are assets that a company intends to hold for more than a year.

Rather, most companies choose to reinvest the cash in their business for continued growth. One of the inherent flaws in investor behavior is the tendency to be emotional. Many individuals claim to be long-term investors up until the stock market begins falling, which is when they tend to withdraw money for fear of additional losses.

The fund holds 124 bonds in its portfolio, which has total net assets of $8.2 billion. On average, this mutual fund’s portfolio of bonds has an average effective duration of 2.2 years, which indicates it carries a low degree of interest rate risk.

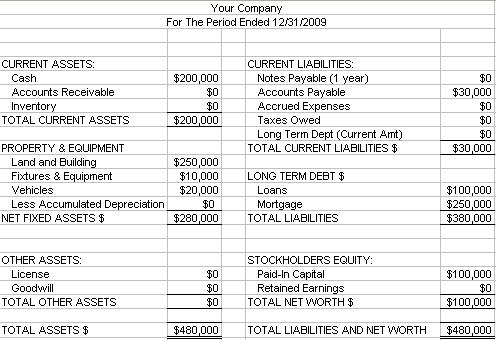

For example, you report stocks on the balance sheet at the current fair-market value rather than how much you paid for them. Short-term investments and long-term investments on the balance sheet are both assets, but they aren’t recorded together on the balance sheet. Investments can include stocks, bonds, real estate held for sale and part ownership of other businesses. Finding safe investments with high returns is one of the best ways to protect and grow your money to build lasting wealth.

Reading the Balance Sheet

Keep in mind that any type of investment in the stock market carries a certain level of risk. However, utilizing a professional should reduce the risk of buying a bad growth stock. These types of investments are also highly liquid, giving investors the flexibility to move their money in and out. Growth stocks are one portion of the stock market that has performed well long-term. Many tech companies that are growing fast offer growth stock options, but they rarely distribute cash to investors, like dividend stocks.

What Does Long Term Investments Mean?

Short-term investments are marked to market, and any declines in value are recognized as a loss. On the other hand, real estate investors who choose to invest in strong, growing markets, often overlooked for the glitz and glam of big market cities, minimize their risk exponentially. Although buying a rental property requires more cash upfront, you won’t lose your entire investment because it’s a physical asset with (hopefully) appreciating value. This helps make real estate a relatively low risk, high return investment. Keeping a property in your portfolio long-term can continually generate more and more passive income each year.

- The first investment type most people think about long-term investing in is stocks.

- Investing is similar to saving in that you’re putting away money for the future, but you’re looking to achieve a higher return in exchange for taking on more risk.

The Vanguard 500 Index Fund Investor Shares is one of the most cost-effective mutual funds that offers exposure to U.S. large-capitalization stocks. Issued on Aug. 31, 1976, it seeks to track the performance of the Standard & Poor’s 500 Index, its benchmark index. The fund seeks to achieve its investment goal by investing all, or a substantial portion, of its total net assets in stocks comprising its benchmark index.

Spotting Creative Accounting on the Balance Sheet

So investors who put money into the market should be able to keep it there for at least three to five years, and the longer the better. The balance sheet for your company shows your assets, your liabilities and the owners’ equity. Investments are listed as assets, but they’re not all clumped together. Long-term investments on a balance sheet, for instance, are listed separately from short-term investments.

Is long term investment a current asset?

A long-term investment is an account on the asset side of a company’s balance sheet that represents the company’s investments, including stocks, bonds, real estate, and cash. Long-term investments are assets that a company intends to hold for more than a year.

Accounting for Intercorporate Investments: What You Need to Know

You may want to keep most of your money into super safe investments, like high-yield savings accounts, CDs and US Treasury securities. But if you are looking to get better overall returns, start by investing small amounts of money in bonds, dividend-paying stocks, REITs, real estate or P2P lending. That way, you’ll enjoy higher returns offered by lower-risk investments. Investors today have many ways to invest their money and can choose the level of risk that they’re willing to take to meet their needs. You can opt for very safe options such as a certificate of deposit (CD) or dial up the risk – and the potential return!

Mutual funds allow investors to buy into different companies that fit under a set criteria. These companies may be in the tech industry or corporations offering high-paying dividends. Mutual funds let investors choose an investing niche to focus on, while spreading risk across multiple investments.

As of March 22, 2020, the Vanguard Short-Term Treasury Fund Investor Shares has generated an average annual return of 3.90% since its inception. Based on trailing 10-year data, this fund experiences a low degree of volatility and provides satisfactory returns on a risk-adjusted basis. The Vanguard Short-Term Treasury Fund Investor Shares aims to provide its investors with income with a limited degree of volatility. To achieve its investment goal, the fund invests 97.6% of its total net assets in U.S. short-term Treasury securities.

Looking back at stock market returns since the 1920s, individuals have never lost money investing in the S&P 500 for a 20-year time period. While past results are no guarantee of future returns, it does suggest that long-term investing in stocks generally yields positive results, if given enough time. In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk assets such as bonds have somewhat higher yields and high-risk stocks have still-higher returns.

Investors who want to generate a higher return will need to take on higher risk. The more your assets outweigh your liabilities, the larger your investors’ equity. It’s easy to inflate the value of assets by overestimating the value of your investments, so financial rules are strict on how to set their worth.

Investing is similar to saving in that you’re putting away money for the future, but you’re looking to achieve a higher return in exchange for taking on more risk. Typical investments include stocks, bonds, mutual funds and exchange-traded funds, or ETFs, and investors use a brokerage account to buy and sell them. The first investment type most people think about long-term investing in is stocks. This is because they have historically achieved higher average rates of return than other investing and saving vehicles, such as bonds and Certificates of Deposit (CDs).

The fund implements a passive indexing strategy, which minimizes its turnover ratio and expense ratio. As of March 22, 2020, it has a turnover rate of 3.9% and charges an expense ratio of 0.14%. A robo-adviser will often build a diversified portfolio so that you have a more stable series of annual returns but that comes at the cost of a somewhat lower overall return.

Traditionally, a classified balance sheet splits total non-current assets into long-term investments, plant assets or fixed assets, andintangible assets. This way investors can see how much the company is investing in its operations compared with other activities. Balanced funds are hybrid mutual funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. The Fidelity Spartan 500 Index Investor Shares is another mutual fund that provides low-cost exposure to the S&P 500 Index, its benchmark index. Issued on Feb. 17, 1988, by Fidelity, this fund seeks to achieve its investment objective by investing at least 80% of its total net assets in common stocks comprising the S&P 500 Index.