Loan Amortization

Amortization is simply a way to pay back a loan. All loans come in three parts and the first two parts are principal and interest. The principal can be thought of as what goes towards the actual asset that you get to keep. Interest is what the bank charges you to actually use the money. It is usually represented as a percentage.

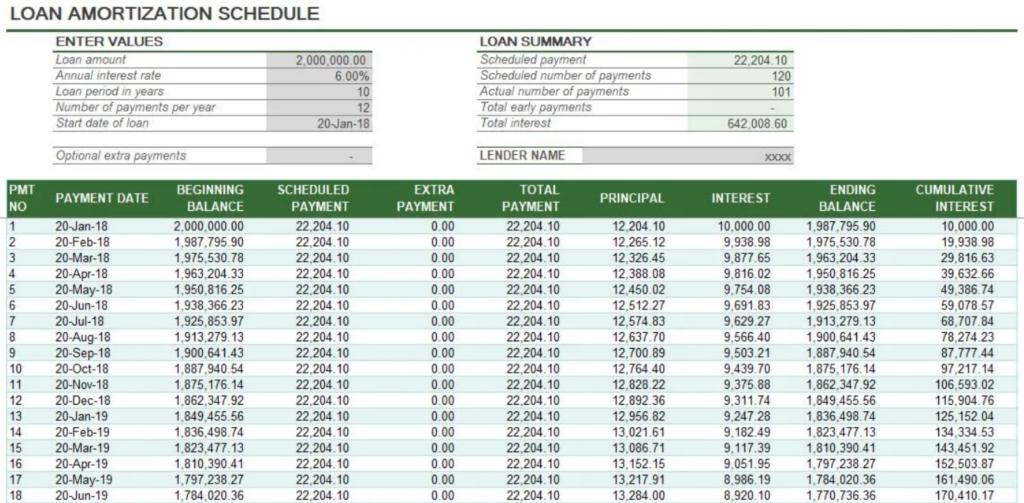

Since you are making monthly payments towards the loan, the loan itself is going to have a time span, which is typically 15 to 30 years. Amortization makes the loans scheduled, so in the beginning, 90% of your payments will be interest and the remaining will go towards the principal. This way, if you default on the loan, the bakers have already made their money. Towards the end, the principal portion will make up 90% of your payment and interest only 10%.

Amortization in Accounting

You will also come across the term amortization in accounting records. Here it is used similarly to depreciation. Amortization in accounting is an accounting process of allocating the cost of intangible assets to current expenses systematically and rationally when the company expects to benefit from the use of the asset. So, while tangible assets get depreciated, intangible assets get amortized.

We can name at least a few examples of assets that undergo amortization in accounting:

- Licenses

- Software

- Patents

- Capitalized R&D.

Amortization of intangible assets is calculated in accordance with accounting regulations (standards) or international financial reporting standards. The methods used in calculating amortization are provided for by these accounting regulations (standards).

Amortization in accounting is charged to profit or loss over the useful life. When determining the useful life, one should take into account the expected use of the asset by the enterprise, taking into account its expected obsolescence, legal or other restrictions regarding the terms of use of the asset, and other factors. Amortization in accounting starts from the month following the month in which the intangible asset was put into use and ends on the month following the month of its disposal.

The company chooses the method of amortization of an intangible asset independently. For example, the best method to amortize the cost of a license is to use the straight-line amortization method. Amortization of intangible fixed assets is carried out until the book value reaches its liquidation (residual) value. The residual value of amortizable intangible assets is defined as the difference between the original cost and amortization expense.

Amortization Journal Entry

Now that you know the definition of amortization, how do you account for it? Amortization in accounting is recorded using journal entries similarly to depreciation. For example, a company had acquired a patent for $69,000. Although the useful life might be longer, the company has to go with the legal life of a patent, which is 17 years, or less.

Let’s say the patent is amortized using straight-line amortization and its useful life is set to 15 years. If we do simple math, the amortization expense for this patent will be $4,600 per year. To record the amortization of this asset, you would create a journal entry where you will debit the Amortization expense in the Income statement and credit the Accumulated amortization (its contra account on the Balance sheet).

DR

CR

Amortization expense

$4,600

Accumulated amortization

$4,600

Note that the company can also just credit the Patent account for $4,600 instead of the Accumulated amortization account.