What’s the Difference Between the Equity Market and the Stock Market?

What is difference between common and preferred stock?

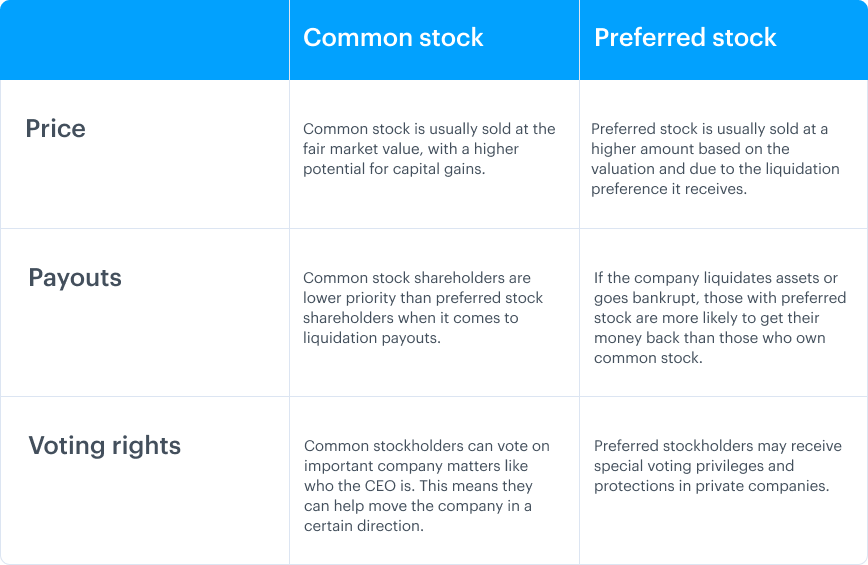

The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

The decision to pay the dividend is at the discretion of a company’s board of directors. In a liquidation, preferred stockholders have a greater claim to a company’s assets and earnings. This is true during the company’s good times when the company has excess cash and decides to distribute money to investors through dividends.

In fact, preferred stock often looks a lot more like a bond, as it typically has a set dollar amount that the company can pay preferred shareholders to redeem the shares. Most preferred stock pays dividends, and the amount tends to be higher than what common shareholders receive.

Preferred stock usually pays fixed dividends year in and year out, rather than seeing changes in payout amounts from quarter to quarter as common stock dividends are. Preferred stock derives its name from the fact that it carries a higher privilege by almost every measure in relation to a company’s common stock. Preferred stock owners are paid before common stock shareholders in the event of the company’s liquidation. Preferred stockholders enjoy a fixed dividend that, while not absolutely guaranteed, is nonetheless considered essentially an obligation the company must pay.

This is often based on the par value before a preferred stock is offered. It’s commonly calculated as a percentage of the current market price after it begins trading. This is different from common stock which has variable dividends that are declared by the board of directors and never guaranteed. In fact, many companies do not pay out dividends to common stock at all.

The Difference Between Class A Shares and Class B Shares

In fact, preferred stock functions similarly to bonds since with preferred shares, investors are usually guaranteed a fixed dividend in perpetuity. Thedividend yieldof a preferred stock is calculated as the dollar amount of a dividend divided by the price of the stock.

Both bonds and preferred stocks are considered fixed income securities because the amount of regular interest or dividend payments is a known factor. The market price of both bonds and preferred stocks is heavily influenced by movements in prevailing interest rates. Unlike bonds, which are debt instruments and don’t confer any ownership in the company, preferred stocks are equity instruments.

Like the common, the preferred has less security protection than the bond. However, the potential increase in the market price of the common (and its dividends, paid from future growth of the company) is lacking for the preferred. One advantage of the preferred to its issuer is that the preferred receives better equity credit at rating agencies than straight debt (since it is usually perpetual). Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit.

Unlike with bondholders, failing to pay a dividend to preferred shareholders does not mean a company is in default. Because preferred shareholders do not enjoy the same guarantees as creditors, the ratings on preferred shares are generally lower than the same issuer’s bonds, with the yields being accordingly higher. The nature of preferred stock provides another motive for companies to issue it.

The intention is to ameliorate the bad effects investors suffer from rampant shorting and dilutive efforts on the OTC markets. Companies also use preferred stocks to transfer corporate ownership to another company. For one thing, companies get a tax write-off on the dividend income of preferred stocks. They don’t have to pay taxes on the first 80 percent of income received from dividends.Individual investorsdon’t get the same tax advantage.

With its regular fixed dividend, preferred stock resembles bonds with regular interest payments. However, unlike bonds that are classified as a debt liability, preferred stock is considered an equity asset. Issuing preferred stock provides a company with a means of obtaining capital without increasing the company’s overall level of outstanding debt. This helps keep the company’s debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

If the company does well, the value of the preferred stock can appreciate independently of interest rate movements. Preferred shareholders have a prior claim on a company’s assets if it is liquidated, though they remain subordinate to bondholders. Preferred shares are equity, but in many ways, they are hybrid assets that lie between stock and bonds. They offer more predictable income than common stock and are rated by the major credit rating agencies.

- So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company.

- In fact, preferred stock functions similarly to bonds since with preferred shares, investors are usually guaranteed a fixed dividend in perpetuity.

- A main difference from common stock is that preferred stock comes with no voting rights.

But for individuals, a straight preferred stock, a hybrid between a bond and a stock, bears some disadvantages of each type of securities without enjoying the advantages of either. Like a bond, a straight preferred does not participate in future earnings and dividend growth of the company, or growth in the price of the common stock. However, a bond has greater security than the preferred and has a maturity date at which the principal is to be repaid.

Preferential tax treatment of dividend income (as opposed to interest income) may, in many cases, result in a greater after-tax return than might be achieved with bonds. Those attributes make preferred stock especially attractive for investors whose primary focus is on income.

The market prices of preferred stocks tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise. The yield generated by a preferred stock’s dividend payments becomes more attractive as interest rates fall, which causes investors to demand more of the stock and bid up its market value.

Typically, company founders and employees receive common stock, while venture capital investors receive preferred shares, often with a liquidation preference. The preferred shares are typically converted to common shares with the completion of an initial public offering or acquisition.

Preferred stockholders must be paid their due dividends before the company can distribute dividends to common stockholders. Preferred stock is sold at a par value and paid a regular dividend that is a percentage of par. Preferred stockholders do not typically have the voting rights that common stockholders do, but they may be granted special voting rights. Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly. These dividends can be fixed or set in terms of a benchmark interest rate like the LIBOR.

Preferred Stock

A big risk of owningpreferred stocks is that shares are often sensitive to changes in interest rates. Because preferred stocks often pay dividends at average fixed rates in the 5% to 6% range, share prices typically fall as prevailing interest rates increase. For example, if Treasury bond yields increase and approach a preferred stock’s dividend yield, demand for shares will likely decline, sending its share price lower.

This tends to happen until the yield of the preferred stock matches the market rate of interest for similar investments. A company raising Venture capital or other funding may undergo several rounds of financing, with each round receiving separate rights and having a separate class of preferred stock. Such a company might have “Series A Preferred”, “Series B Preferred”, “Series C Preferred”, and corresponding shares of common stock.

Second, companies can sell preferred stocks quicker than common stocks. It’s because the owners know they will be paid back before the owners of common stocks will. Some companies also issue preferred stock, and the features of preferred stock can differ greatly from common stock.

A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. The market value of a preferred stock is not used to calculate dividend payments, but rather represents the value of the stock in the marketplace. It’s possible for preferred stocks to appreciate in market value based on positive company valuation, although this is a less common result than with common stocks.

A main difference from common stock is that preferred stock comes with no voting rights. So when it comes time for a company to elect a board of directors or vote on any form of corporate policy, preferred shareholders have no voice in the future of the company.

Understanding Preferred Stocks

Convertible preferred stock—These are preferred issues which holders can exchange for a predetermined number of the company’s common-stock shares. This exchange may occur at any time the investor chooses, regardless of the market price of the common stock. It is a one-way deal; one cannot convert the common stock back to preferred stock. A variant of this is the anti-dilutive convertible preferred recently made popular by investment banker Stan Medley who structured several variants of these preferred for some forty plus public companies. In the variants used by Stan Medley the preferred share converts to either a percentage of the company’s common shares or a fixed dollar amount of common shares rather than a set number of shares of common.

Like bonds, preferred shares also have a par value which is affected by interest rates. When interest rates rise, the value of the preferred stock declines, and vice versa. Terms of the preferred stock are described in the issuing company’s articles of association or articles of incorporation.

The dividends for this type of stock are usually higher than those issued for common stock. Preferred stock also gets priority over common stock, so if a company misses a dividend payment, it must first pay any arrears to preferred shareholders before paying out common shareholders. Preferred shares represent a significant portion of Canadian capital markets, with over C$11.2 billion in new preferred shares issued in 2016. Many Canadian issuers are financial organizations which may count capital raised in the preferred-share market as Tier 1 capital (provided that the shares issued are perpetual). Investors in Canadian preferred shares are generally those who wish to hold fixed-income investments in a taxable portfolio.