Number of requisitions, quantity or value of material for each department. Floor area, cubic content, No. of electric points.

ABC is generally used as a tool for understanding product and customer cost and profitability based on the production or performing processes. As such, ABC has predominantly been used to support strategic decisions such as pricing, outsourcing, identification and measurement of process improvement initiatives. ABC provides cost driver rates and information on transaction volumes which are very useful to management for cost management and performance appraisal of responsibility centres. Cost driver rates can be used advantageously for the design of new products or existing products as they indicate overhead costs that are likely to be applied in costing the product. Overhead costs are indirect costs that are not part of manufacturing costs.

What is the direct method of cost allocation?

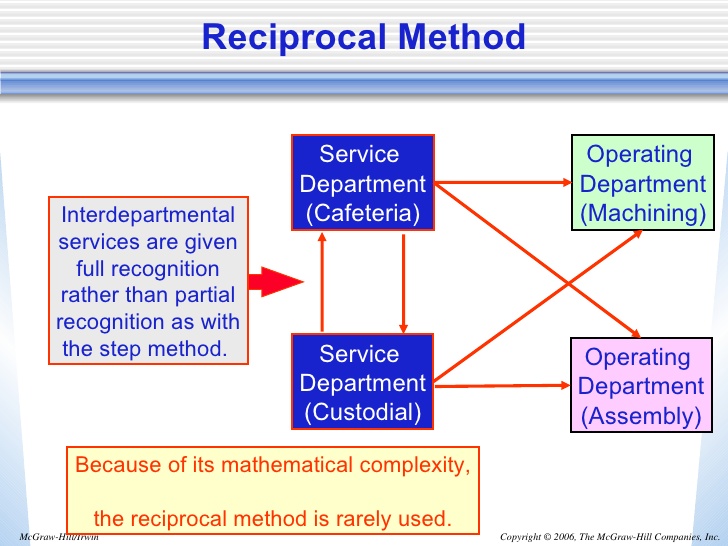

The reciprocal method uses simultaneous equations to allocate the costs incurred by service departments to other departments; allocations are also made between the service departments. This method results in an accurate distribution of costs.

Generally, time is the key factor, which determines the amount of indirect expenses. Hence, any recovery rate calculated on the basis of the hours of work shall give accurate result. In a manufacturing process, if handwork is the rule, the rate of overhead per direct labour hour is worked out and applied suitably. The following formula is used to calculate the rate. This method is the combination of both percentage of direct material cost method and percentage of direct labour cost method.

The differences are in the accuracy and complexity of the two methods. Traditional costing is more simplistic and less accurate than ABC, and typically assigns overheadcosts to products based on an arbitrary average rate. ABC is more complex and more accurate than traditional costing. This method first assigns indirect costs to activitiesand then assigns the costs to products based on the products’ usage of the activities.

The main costs and limitations of an ABC system are the measurements necessary to implement it. ABC systems require management to estimate costs of activity pools and to identify and measure cost drivers to serve as cost allocation bases. Even basic ABC systems require many calculations to determine costs of products and services. Activity cost rates also need to be updated regularly. This method is otherwise called as continued distribution and attrition method.

Cooper and Kaplan described ABC as an approach to solve the problems of traditional cost management systems. These traditional costing systems are often unable to determine accurately the actual costs of production and of the costs of related services. Consequently, managers were making decisions based on inaccurate data especially where there are multiple products.

Methodology

In the field of accounting, activity-based costing and traditional costingare two different methods for allocating indirect (overhead) costs to products. The formula for activity-based costing is the cost pool total divided by cost driver, which yields the cost driver rate. The cost driver rate is used in activity-based costing to calculate the amount of overhead and indirect costs related to a particular activity.

Under this method, the total costs of service departments are ascertained with the help of simultaneous equation. Then, the costs of service departments are apportioned on agreed percentage only among production departments. Under this method, the costs of one service department are apportioned only to the production departments ignoring the service rendered by one service department to another.

As an activity-based costing example, consider Company ABC that has a $50,000 per year electricity bill. The number of labor hours has a direct impact on the electric bill. For the year, there were 2,500 labor hours worked, which in this example is the cost driver.

Activity-based costing benefits the costing process by expanding the number of cost pools that can be used to analyze overhead costs and by making indirect costs traceable to certain activities. Robin Cooper and Robert S. Kaplan, proponents of the Balanced Scorecard, brought notice to these concepts in a number of articles published in Harvard Business Review beginning in 1988.

- Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services.

Rate of labour turnover or number of employees in each department. Maintenance and Repair shops, Planning & Progress, Tool room. Direct Labour Hours, machine hours, Direct labour or wages, Asset value X hours worked. Canteen and welfare, Hospital and Dispensary personnel Department, Timekeepin. Number of purchase orders or value of material purchased for each department.

Calculating the cost driver rate is done by dividing the $50,000 a year electric bill by the 2,500 hours, yielding a cost driver rate of $20. For Product XYZ, the company uses electricity for 10 hours. The overhead costs for the product are $200, or $20 times 10.

They are not related to the labor or material costs that are incurred in the production of goods or services. They support the production or selling processes of the goods or services.

The split of cost helps to identify cost drivers, if achieved. Direct labour and materials are relatively easy to trace directly to products, but it is more difficult to directly allocate indirect costs to products. Where products use common resources differently, some sort of weighting is needed in the cost allocation process. The cost driver is a factor that creates or drives the cost of the activity. For the activity of running machinery, the driver is likely to be machine operating hours, looking at labor, maintenance, and power cost during the period of machinery activity.

Appendix: Service Department Allocation

Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods. However, some indirect costs, such as management and office staff salaries, are difficult to assign to a product. Overhead cost is an indirect cost, providing common benefit to the production of different lines of products or rendering of a range of services. Both methods estimate overhead costsrelated to productionand then assign these costs to products based on a cost-driver rate.

Support Cost Allocation Using the Direct Method (Cost Accounting Tutorial #

Wattage, Horse power, Kwh, Horse Power X Machine hours, Kwh X machine hours. Crane hours worked or weight of material handled. Crane hours; Truck hours, Truck milage, Truck tonnage, Truck ton-hours, Tonnage handled, No. of packages of standard size. Activity-based costing (ABC) is a method of assigning overhead and indirect costs—such as salaries and utilities—to products and services.

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. This model assigns more indirect costs (overhead) into direct costs compared to conventional costing. No Services Department Basis for redistribution 1.

Managerial Accounting

The service department costs are distributed to other service departments and production departments on agreed percentage. In this way, this process is repeated till the costs of service department are too small. Then, the costs of service department are distributed only among production department. An activity cost driver is a component of a business process.

Activity cost drivers are used in activity-based costing, and they give a more accurate determination of the true cost of business activity by considering the indirect expenses. However, as the percentages of indirect or overhead costs rose, this technique became increasingly inaccurate, because indirect costs were not caused equally by all products. Consequently, when multiple products share common costs, there is a danger of one product subsidizing another. In a business organization, the ABC methodology assigns an organization’s resource costs through activities to the products and services provided to its customers.

Overhead costs are charged to the expense account, and they must be continually paid regardless of whether the company is selling any good or not. These levels include batch-level activity, unit-level activity, customer-level activity, organization-sustaining activity, and product-level activity.