In accounts payable, a simple mistake can cause a large overpayment. An invoice may be temporarily misplaced or still in the approval status when the vendors calls to inquire into its payment status. After the AP staff member looks it up and finds it has not been paid, the vendor sends a duplicate invoice; meanwhile the original invoice shows up and gets paid.

To illustrate the difference between interest expense and interest payable, let’s assume that a company borrows $200,000 on November 1 at an annual interest rate of 6%. The company is required to pay each month’s interest on the 15th day of the following month. Therefore, the November interest of $1,000 ($200,000 x 6% x 1/12) is to be paid on December 15.

The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. The times interest earned (TIE) ratio is a measure of a company’s ability to meet its debt obligations based on its current income.

Definition of Interest Payable

Accounts receivablesare money owed to the company from its customers. As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. Accounts payableis the amount of short-term debt or money owed to suppliers and creditors by a company. Accounts payable are short-term credit obligations purchased by a company for products and services from their supplier.

What account is interest payable?

Interest payable is the amount of interest the company has incurred but has not yet paid as of the date of the balance sheet. Interest Payable is also the title of the current liability account that is used to record and report this amount.

Interest expense is a non-operating expense shown on the income statement. It represents interest payable on any borrowings – bonds, loans, convertible debt or lines of credit. It is essentially calculated as the interest rate times the outstanding principal amount of the debt. Interest expense on the income statement represents interest accrued during the period covered by the financial statements, and not the amount of interest paid over that period.

As an example of interest payable, a business owes $1,000,000 to a lender at a 6% interest rate, and pays interest to the lender every quarter. After one month, the company accrues interest expense of $5,000, which is a debit to the interest expense account and a credit to the interest payable account. After the second month, the company records the same entry, bringing the interest payable account balance to $10,000.

What is the difference between interest expense and interest payable?

Accounts receivable are similar to accounts payable in that they both offer terms which might be 30, 60, or 90 days. However, with receivables, the company will be paid by their customers, whereas accounts payables represent money owed by the company to its creditors or suppliers. Accounts payable are not to be confused with accounts receivable.

After the third month, the company again records this entry, bringing the total balance in the interest payable account to $15,000. It then pays the interest, which brings the balance in the interest payable account to zero.

This makes it impossible for an employee to add himself as a vendor and then cut a cheque to himself without colluding with another employee. It is the repository of all significant information about the company’s suppliers. It is the reference point for accounts payable when it comes to paying invoices.

Some even believe it to be an industry standard in the near future. According to a report done by the GXS team in 2013, Europe is adopting government legislation encouraging businesses to adopt electronic invoicing practices. The United States has no such legislation yet but does recognize the value of this technology. The US Treasury estimated that implementing e-invoicing across the entire federal government would reduce cost by 50% and save $450 million annually.

By applying end-to-end robotic process automation or RPA to their accounts payable department, organizations can accelerate invoice processing speed and accuracy while improving operational costs. Some companies also separate the functions of adding new vendors and entering vouchers.

- The accounts payable department’s main responsibility is to process and review transactions between the company and its suppliers.

- Accounts payable automation or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments.

Increasingly, large firms are using specialized Accounts Payable automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization’s invoices. An interest expense is the cost incurred by an entity for borrowed funds.

While interest expense is tax-deductible for companies, in an individual’s case, it depends on his or her jurisdiction and also on the loan’s purpose. Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company’s balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents. Interest expense refers to the costs of borrowing money, and includes a company’s interest payable on any bonds, loans, convertible debt, and lines of credit.

(US Bank, Scott Hesse, 2010) The invoices may be submitted in a number of ways, including EDI, CSV, or XML uploads, PDF files, or online invoice templates. Because E-invoicing includes so many different technologies and entry options, it is an umbrella category for any method by which an invoice is electronically presented to a customer for payment. Effective and efficient treatment of accounts payable impacts a company’s cash flow, credit rating, borrowing costs, and attractiveness to investors.

It does not include other fixed payments, such as dividends on common or preferred stock. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days. With the increasing availability of robotic solutions, businesses are driving process improvement in AP even further.

As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet. Many companies have interest-bearing assets, such as loans and investments, that generate a stream of income for the company. That interest can be categorized as either “interest receivable” or “interest revenue.” These accounting terms have slightly different meanings. As companies advance into the digital era, more and more are switching to electronic invoicing services to automate their accounts payable departments.

Accounts payable automation or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments. The accounts payable department’s main responsibility is to process and review transactions between the company and its suppliers.

Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses. Companies looking to increase profits want to increase their receivables by selling their goods or services. For example, the terms could stipulate that payment is due to the supplier in 30 days or 90 days.

The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt. Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. These applications are tied to databases which archive transaction information between trading partners.

Then the duplicate invoice arrives and inadvertently gets paid as well, perhaps under a slightly different invoice. A variety of checks against abuse are usually present to prevent embezzlement by accounts payable personnel. In countries where cheques payment are common nearly all companies have a junior employee process and print a cheque and a senior employee review and sign the cheque. The amount of accrued interest for the entity owing the payment is a debit to the interest expense account and a credit to the accrued liabilities account. The debit is rolled into the income statement and the credit into the balance sheet (as a short-term liability).

What does interest payable mean?

Interest payable is the interest expense that has been incurred (has already occurred) but has not been paid as of the date of the balance sheet. [Interest payable does not include the interest for periods after the date of the balance sheet.]

Definition of Interest Unpaid on Note Payable

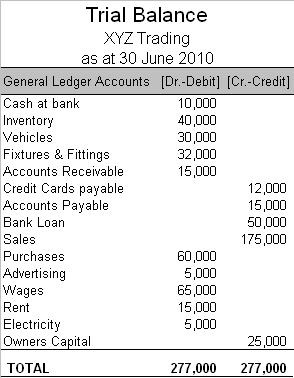

An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding, or open, liability because it has not been paid. Common examples of Expense Payables are advertising, travel, entertainment, office supplies and utilities. AP is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received. Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days.

For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is made within 30 days. Companies must maintain the timeliness and accuracy of their accounts payable process. Delayed accounts payable recording can under-represent the total liabilities. This has the effect of overstating net income in financial statements.

When you deposit money into a bank, the bank uses your money to give loans to other customers. Similarly, when you purchase something with a credit card, you pay the credit card company interest for using the money that paid for your purchase. In general, interest is money that a borrower pays a lender for the right to use the money.

The $1,000 of interest incurred during December is to be paid on January 15. Therefore, as of December 31, the company’s current liability account Interest Payable must report $1,000 for December’s interest. For the two-month period, the company will report Interest Expense of $2,000 (November’s and December’s interest of $1,000 each month). Interest receivable refers to the interest that has been earned by investments, loans, or overdue invoices but has not actually been paidyet. Put another way, interest receivable is the expected interest revenue a company will receive.

In other words, it is the accounts payable department’s job to make sure all outstanding invoices from their suppliers are approved, processed, and paid. Processing an invoice includes recording important data from the invoice and inputting it into the company’s financial, or bookkeeping, system. After this is accomplished, the invoices must go through the company’s respective business process in order to be paid. Householders usually track and pay on a monthly basis by hand using cheques, credit cards or internet banking.