The cost of setting up will be the same whether the printer produces one copy or 10,000. If the set-up cost is $55 and the printer produces 500 copies, each copy will carry 11 cents worth of the setup cost-;the fixed costs.

For example, a company may pay a sales person a monthly salary (a fixed cost) plus a percentage commission for every unit sold above a certain level (a variable cost). Business owners need to make big accounting decisions on how to handle their costs. When money is spent, it should be accounted for as either an expense or capitalize the cost.

When the roasting company spends $40,000 on a coffee roaster, the value is retained in the equipment as a company asset. The price of shipping and installing equipment is included as a capitalized cost on the company’s books. The costs of a shipping container, transportation from the farm to the warehouse, and taxes could also be considered part of the capitalized cost. These expenses were necessary to get the building set up for its intended use.

Birthday gifts, holiday presents and vacations are also variable expenses. To capitalize assets is an important piece of modern financial accounting and is necessary to run a business. Financial statements, however, can be manipulated—for instance, when a cost is expensed instead of capitalized.

Most experts suggest having enough in the bank for three to six months of living expenses. Fixed expenses are consistent and expected bills you pay each month, such as a mortgage or rent, a cellphone bill and a student loan payment. Car insurance, home insurance and life insurance are also fixed payments, along with your monthly electric and water bills. A digital subscription to a newspaper and monthly cable or streaming services are additional fixed costs.

For example, if a bicycle business had total fixed costs of $1,000 and only produced one bike, then the full $1,000 in fixed costs must be applied to that bike. On the other hand, if the same business produced 10 bikes, then the fixed costs per unit decline to $100. Total variable costs increase proportionately as volume increases, while variable costs per unit remain unchanged. For example, if the bicycle company incurred variable costs of $200 per unit, total variable costs would be $200 if only one bike was produced and $2,000 if 10 bikes were produced.

Determining your fixed and variable expenses is paramount to effectively building a budget. But while accounting for necessary costs is a simple and straightforward task, including discretionary expenses in your budget can present a challenge.

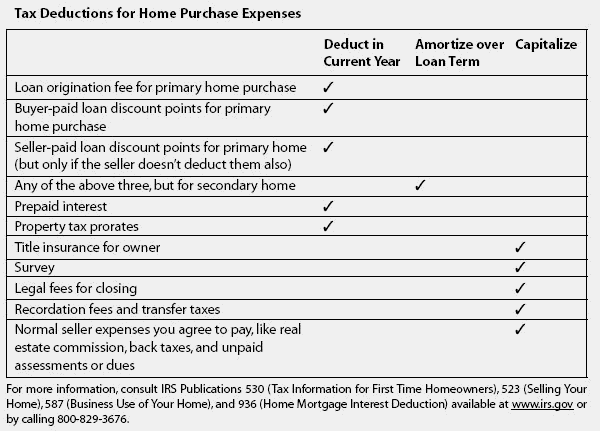

Examples include loan origination fees and interest on money borrowed. Economies of scale are another area of business that can only be understood within the framework of fixed and variable expenses. Economies of scale are possible because in most production operations the fixed costs are not related to production volume; variable costs are. Setting up the run requires burning a plate after a photographic process, mounting the plate on the printing press, adjusting ink flow, and running five or six pages to make sure everything is correctly set up.

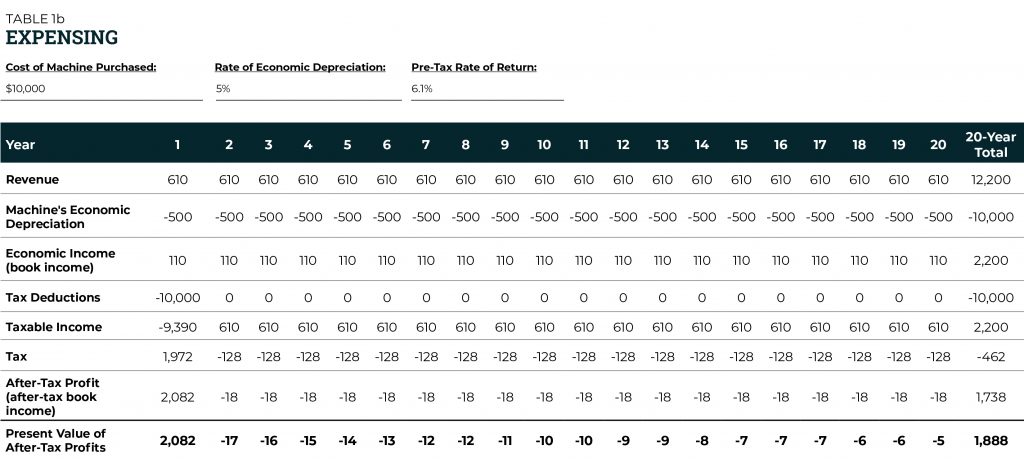

What does expensing something mean?

Expensing involves wrapping expenditures in as operating costs rather than designating them as capital investments. As a result, these expenses are immediately deducted from income, rather than moving to the asset section of a balance sheet. Often, purchases below a certain dollar amount are counted as expenses.

A company’s spending can have a significant impact on its profitability and the balance sheet. If the company’s expenses are growing, expensing results in greater R&D expense. The expenditures are treated as operating costs rather than capital investments. Variable costs are unfixed, discretionary costs that include gas, clothing, entertainment, pet supplies and dining out at restaurants. Your electric bill is a variable expense, too, unless you’ve arranged to have even billing, where the payment doesn’t change from month to month.

When this happens, companies appear to be much more valuable than they actually are. Expenses on the income statement go way down, company value through valuation of assets goes up, and the yearly depreciation of assets is tax deductible. To prevent your variable costs from spiraling, Beverly Miller, a personal finance coach in Pittsburgh, suggests socking money away in case your variable expenses are higher than you predict. “Your emergency fund is there to catch truly unpredictable and necessary expenses,” Miller says.

However, variable costs applied per unit would be $200 for both the first and the tenth bike. The company’s total costs are a combination of the fixed and variable costs. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time.

The roasting facility’s packaging machine, roaster, and floor scales would be considered capitalized costs on the company’s books. The monetary value isn’t leaving the company with the purchase of these items.

- A capitalized cost is an expense that is added to the cost basis of a fixed asset on a company’s balance sheet.

What is expensing in accounting?

An expense in accounting is the money spent, or costs incurred, by a business in their effort to generate revenues. Essentially, accounts expenses represent the cost of doing business; they are the sum of all the activities that result in (hopefully) a profit.

Estimated taxes: How and when to pay them to the IRS

In general, capitalizing expenses is beneficial as companies acquiring new assets with long-term lifespans can amortize the costs. For example, expenses incurred during construction of a warehouse are not expensed immediately. The costs associated with building the warehouse, including labor costs and financing costs, can be added to the carrying value of the fixed asset on the balance sheet.

A capitalized cost is an expense that is added to the cost basis of a fixed asset on a company’s balance sheet. Capitalized costs are incurred when building or purchasing fixed assets. Capitalized costs are not expensed in the period they were incurred but recognized over a period of time via depreciation or amortization. Variable costs can change each month, and are based on the amount of gross profit that the business earns each month. Inventory expenses would be an example of variable costs if your business accounts for these types of costs on the expense portion of the income statement.

If this occurs, current income will be inflated at the expense of future periods over which additional depreciation will now be charged. To capitalize is to record a cost/expense on the balance sheet for the purposes of delaying full recognition of the expense.

Accounts Expenses

For example, the $40,000 coffee roaster from above may have a useful life of 7 years and a $5,000 salvage value at the end of that period. Depreciation expense related to the coffee roaster each year would be $5,000 (($40,000 historical cost – $5,000 salvage value) / 7 years).

But if 10,000 pages are printed, each page carries only 0.55 cents of set-up cost. It is very important for small business owners to understand how their various costs respond to changes in the volume of goods or services produced. The breakdown of a company’s underlying expenses determines the profitable price level for its products or services, as well as many aspects of its overall business strategy. Capitalized costs are originally recorded on the balance sheet as an asset at their historical cost. These capitalized costs move from the balance sheet to the income statement as they are expensed through either depreciation or amortization.

How long should you keep IRS tax records?

These capitalized costs will be expensed through depreciation in future periods, when revenues generated from the factory output are also recognized. These are costs incurred from borrowing or earning income from financial investments.

Insurance by state

Some fixed costs are incurred at the discretion of a company’s management, such as advertising and promotional expense, while others are not. It is important to remember that all non-discretionary fixed costs will be incurred even if production or sales volume falls to zero.

Fixed expenses, savings expenses, and variable costs are the three categories that make up your budget, and are vitally important when learning to manage your money properly. When you’ve committed to living on a budget, you must know how to put your plan into action.

While some variable costs are clear-cut wants, others are necessities. For instance, if you have children and pets, unexpected but essential costs might include doctor, dentist and vet visits, along with copays, prescriptions and preventative medicines and vaccines.

Promotion and mailing expenses are also considered variable expenses, because most businesses will do less of each when sales are down. In other words, variable costs are adjusted to the current profitability of a company, and variable expenditures are made when the business has the money and curtailed when it doesn’t. It is important to understand the behavior of the different types of expenses as production or sales volume increases. Total fixed costs remain unchanged as volume increases, while fixed costs per unit decline.